Investors who want to know how to invest in gold or silver bullion and who are wrangling over whether to invest in the metal itself, or gold and silver mining stocks, should realize that they are two entirely separate asset classes.

Gold bullion is money itself, a tangible asset with eternal value. You own it for insurance against a collapsing financial and monetary system. The profit – and there certainly have been some great gains in the past decade – is gravy.

You own gold and silver mining companies not for their eternal value (they could go bankrupt), not for insulation from the financial system (they are financial assets that are affected by credit conditions and general market volatility), but for their profit potential. You take on more risks in owning gold mining stocks or silver mining stocks in exchange for what should be a larger upside if business and market conditions prove favorable to them.

Contents

Do Gold Mining Stocks Outperform Gold Bullion Over Time?

Precious metals mining stocks collect their profits based on the spread between mining costs and the value of the metal being dug out of the ground. When the gold price rises by, say 50%, the profit per ounce of gold bullion produced accruing to a gold mining company might double or triple.

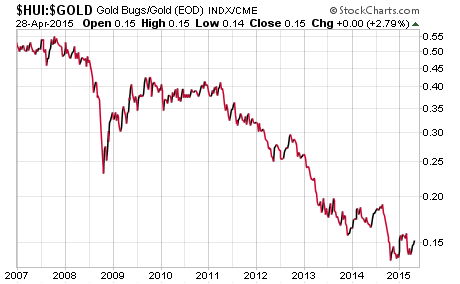

In the past few years, investors in gold bullion

have enjoyed outsized gains as compared

to investors in precious metals stocks.

The above ratio makes that clear.

Advocates of mining stocks often tout that gold stocks move with two to three times the magnitude of the price of gold. They note that if gold rises 10% over any given period of days, weeks, or months, the stocks can be expected to rise 20%-30% and the best gold stocks will do far better. At times – particularly good times – that's been the case. But it's certainly not the rule!

The mining sector has substantially lagged behind gold's performance in recent years. Stocks can lag due to:

- rising energy and labor costs

- political risk (including the threat of nationalization)

- wider economic/financial turmoil

- credit market tightness

- peculiarities affecting profitability in the industry

- investor sentiment/risk aversion

When times get tough, the action in the gold and silver mining stocks can get quite ugly. These stocks are typically the most volatile area of the entire stock market. They are not for the short-term risk averse. They are for those who believe the potential long-term rewards are worth the risk.

Bullion functions better than the mining sector as a portfolio diversifier (physical gold is less correlated with the stock and credit markets). Over the long term, gold bullion for sale also performs better on a risk-adjusted basis (similar expected returns with a fraction of the volatility), as measured by the Sharpe ratio.

When the $*!% Hits the Fan, the Safe Haven Will Be Gold Bullion

Owning mining stocks in 2008 was a gut-wrenching experience. Gold itself remained relatively strong during the panic, even managing to post a modest annual gain for 2008. But even the best gold stocks got clobbered. The benchmark HUI gold stocks index lost 27% of its value for the year (after having lost more than 70% of its value within the year).

Fortunately for those who avoided selling at washed-out levels and hung on for the ride, the HUI gained back in 2009-2011 all of what it gave up in 2008. But since 2012, mining stocks have again gotten crushed as compared to bullion.

Also, when gold and silver stocks are being clobbered mercilessly, premiums on many types of commonplace gold and silver bullion products (such as American Eagles) generally soar. In a true panic that incites a run on the physical retail market, physical gold and silver coins, bars, and rounds will be the direct beneficiaries, not mining stocks or ETFs.

Accumulate Physical Bullion First – Then Buy Mining Stocks

We're NOT against owning mining stocks per se. They can be a rewarding area in which to speculate during a precious metals bull market. But they are speculative! As such, they serve an entirely different purpose than the low-premium bullion products you can purchase through Money Metals Exchange.

As renowned precious metals mining stock analyst David Morgan, editor of the Money, Metals, and Mining newsletter, advises his subscribers,

Start with the physical bullion first. Build a solid foundation in the metals themselves before even considering the purchase of mining shares, which aren't suitable for all investors.

Everyone should have some physical gold and silver to their name. For more information on how to invest in gold or how to invest in silver, be sure to tour this website!

About the Author:

Stefan Gleason is CEO of Money Metals Exchange, the company recently named "Best Overall Online Precious Metals Dealer" by Investopedia. A graduate of the University of Florida, Gleason is a seasoned business leader, investor, political strategist, and grassroots activist. Gleason has frequently appeared on national television networks such as CNN, FoxNews, and CNBC and in hundreds of publications such as the Wall Street Journal, TheStreet, and Seeking Alpha.