Money Metals

columnist, David Smith

I'll bet you'd like to know upfront just what this "investment tool" really is. So that you could immediately put it to work in the markets to begin growing your investment nest egg.

Indeed, it is so powerful that if you become skilled in its use, you may one day find yourself at the pinnacle of financial success in relation to just about anyone else you know.

The "greens" on your portfolio can start outnumbering the "reds" several times over. You may even become an investing legend – writing a book about your success, standing the test of time, that people for generations will want to read. A few people like Jesse Livermore (Reminiscences of a Stock Operator), Sir John Templeton (Golden Nuggets), Charles Mackay (Extraordinary Popular Delusions and the Madness of Crowds), and Jim Rogers (Investment Biker: Around the World with Jim Rogers) have done just that.

On the other hand, what if you use this device carelessly, get overconfident, and let some "really good trades" make you think you've found the "perfect system" to outsmart Mr. Market? In reverse, it has the power to ruin your investment results and create enough stress to bend out of shape the really important things in your life.

This "secret investment tool" is explosive, both literally and figuratively. It's a concept similar to what Mike Tyson's trainer once said about fear: "It's like fire. It can cook for you. It can heat your house. Or it can burn you down!"

Given where we are now in the resource sector bull market mega-cycle, especially in relation to the "Precious Metals Four" – Gold, Silver, Platinum, and Palladium – the timing of getting this information into your hands to think about and perhaps act upon could not be more important.

Contents

The Secret Investment Tool Is…Your MIND

Believe it or not, how a person develops, controls, and uses their mind will be the biggest determinant in whether or not they ever become, let alone continue to be, a successful investor.

In this report you will learn some very important things involving the markets, the outside world, and what drives everything related to them – but most important, about yourself – and something about me as well.

You see, despite all the years I've been investing and trading the markets – futures, physical metals, mining stocks, the general stock market, real estate, and other forms of investments – I have not "perfected" the handling of this tool. And I never will!

But I've come a long way on my own personal journey. As a life-long learner, I will continue to shape, mold, and seek to control this tool to improve my investing success for as long as I choose to "play the game."

Understanding, reflecting upon, and applying certain skills will help you attain a much higher level of investing success than you now think is possible. In the process, you can start making better buy, hold – and sell decisions than most other investors in today's volatile markets.

Don't think for a minute when you take a position, whether it's in a mining stock, an Exchange Traded Fund (ETF), the physical precious metals, or another type of investment, that you are involved in some kind of playful activity with gentleman's rules where people "just get along." No, my friend, the truth is much, much different.

As the great trader and instructor, Dr. Alexander Elder states, "Trading means battling crowds of hostile people while paying for the privilege of entering the battle and leaving it, whether dead, wounded, or alive."

Avoid the King Midas Curse

This doesn't mean you must become a cutthroat trader, make money by deceitful means, or operate illegally like some kind of "Bernie Madoff wannabe" (if you don't know about "Big Bad Bernie" then stop right now and Google his name to read his story).

Don't let the idea of earning money become some kind of deity to which you bow in homage every day.

Tweet This

Nor does it mean that you have to spend all of your waking – and many sleeping hours trying to earn a huge profit on your position. Don't let the idea of earning money become some kind of deity to which you bow in homage every day. There's no need to withhold love and forgo quality time with your family – unfortunately, as some very "successful" investors have done over the years.

It certainly isn't necessary to turn yourself into a sort of Midas model, where piling up "investment gold" becomes such an obsession that you would be happy if the gods gave you the power to turn everything you touch into gold. Perhaps, like King Midas in the old tale – to the point where even the food he touched became metal – causing him to choke when he tried to swallow it!

Successful Investing Is a "Three-Legged Stool"

A successful investment plan has three essential elements.

First, cultivating a method based upon the study of fundamentals and technical analysis or (ideally) a combination of the two. Looking at the fundamentals – the supply/demand factors, gives you a sense of whether the item you're following seems to be in surplus or deficit, what factors might alter this relationship, and how pricing dynamics are likely to be reflected due to these changes.

A current example – likely to hold true for at least several more years, is palladium, and to a slightly lesser extent, platinum. The reported exhaustion of Russia's palladium reserves, as well as labor and social unrest in South Africa, the two countries where about 70% of the PGMs are mined, is beginning to squeeze supplies and cause an upward move in the price.

Palladium has seen increasing demand from industrial users, as well as from jewelers and investors – through their purchase of Exchange Traded Funds (ETFs), in addition to physical holdings of ingots and bullion coins. Given the extended lead times needed to increase production by way of new mining operations, the reliability of sufficient supply to meet these increasing demands is coming into question. This is causing greatly increased interest on the part of investors, not only in Asia but also in the U.S. and Canada, who now want to hold physical palladium and platinum (PGMs).

This dynamic has created a situation about which well-known investor Rick Rule comments, "Because of demand, palladium prices can rise. Because of supply, the price must rise." An investor who is aware of this evolving situation might choose to take a position in say an ETF, a mining stock (after suitable research on the company), simply purchase palladium ingots or choose from a variety of bullion coins, such as the .999 fine Canadian Palladium Maple Leaf shown here.

The Second element of a successful investing plan has to do with establishing and following a personal money management process – e.g. deciding how much to commit beforehand, using a stop loss on stock buys, not adding to a losing position (except when buying in tranches – see later), and even taking profits from time to time, perhaps when you've scored a double on your position – what Doug Casey (coined by Marin Katusa) calls the "Casey Free Ride." In this situation when your position has earned a 100% profit, you might sell one-half, taking out what was invested for your original stake.

Regarding stop losses, it is usually better to keep them "mental," perhaps activating them on a close-of-day basis, rather than placing them in the market with your broker. If your price is in a cluster with others, you may be "picked off" intraday on an engineered price plunge, only to have the market reverse and close much higher the same day.

The Third, and most critical, element of a successful investment plan, and for this report the primary focus, is having a firm grip on your mind – the "secret tool" – that virtually every successful investor has learned to control if not master.

Without exception, market participants are tossed about by two emotional elements – Fear and Greed. The predominance of one or the other is what drives wild swings in the price of just about every stock or commodity.

When one emotion rules for a considerable time, the price of an investment such as precious metals will move in a general direction – up or down – and this is said to be a trend. "Corrections" or counter-trend moves take place when for a shorter period, excess emotion in the direction of the primary trend is "bled off" – through profit-taking, overbought/oversold conditions, or a pause which awaits the entry of more buyers (if in an uptrend), or sellers (if a downtrend).

Market technicians sometimes call this situation, "the pause that refreshes." When an established trend takes a breather, it is more likely to portend a major move of long-standing in the same direction than if it simply went vertical (bull markets in coffee offer a good example) until the last buyer has entered, and then collapses, dropping almost as fast as it rose. When this happens, many buyers will be trapped on the long side, either through inertia, false optimism that the trend will shortly resume, or abject fear of doing anything other than holding on. Vertical markets are generally not ones the long-term investor should seek to follow.

When the market moves in a broad sideways range for quite a while, prices are said to be in "congestion." Since most people – in just about any activity – spend the majority of their time in a rather aimless state, the idea that prices would also frequently endure a broadly-defined sideways movement makes a lot of sense. This seesaw activity continues until one side or the other – bulls or bears – are strong enough to force the price out of the prevailing range.

"The bigger the base, the stronger the upside case."

Generally, the more time spent in congestion the more important a move out of that range is likely to be. About this, traders say "The bigger the base, the stronger the upside case."

For over four years, gold and silver have been in a broad, downward-biased trading range. A sustained move from these boundaries will offer strong proof that either (a) the downtrend is still in force or (b) that the intermediate cyclical bear phase has ended, and the larger, longer-lasting cyclical bull trend is in the process of recommencing (this writer's belief).

The Twin Dragons – Fear and Greed

Whereas the concept of Greed can be fairly well-defined and recognized, Fear is a considerably more complex phenomenon. This is because one can not only be afraid of a loss when the price of an investment is going down but also afraid of a loss if the price is going up!

Investors fear that the price will turn around and erase some or all of the previous gain. In addition, they may be afraid that the stake they hold is not large enough – that they could make a lot more if only they held a larger amount! Of course, there's a saying about this too – "When the price is going your way, your position is never large enough. When it's going against you, it's never small enough!"

Controlling these two conflicting elements, Fear and Greed (hint: You can't totally eliminate them – nor indeed should you try), is a critical element in keeping emotional and financial balance in the markets. There is good reason that Fear and Greed are referred to as the "twin dragons of investing."

No matter how certain you are about an investment, never go "all in."

This leads us to a critical aspect of "mind control" that savvy investors make a habit of practicing. No matter how certain they are about an investment, they never go "all in." They decide beforehand how much money they will commit to their Big Idea, and then over time take several partial positions.

No matter how well things look from your research, never forget that, especially in this day and age, ALL investments carry some degree of risk. At times, the stacks of information you have to plow through almost make you want to just keep your money in a savings account to be "safe." The problem is that the annual rate of inflation – generally understated by government reporting – is slowly but surely eating away at your purchasing power, year after year.

So whether you do something with your money, or just let it sit there – you are indeed experiencing risk. Since that's the case, doesn't it make sense to become an informed risk-taker?

Buy Several Portions – Preferably into Weakness

Before buying in tranches (portions) over time, preferably into weakness, an investor will have decided beforehand how much money to commit, and at what price levels to make an additional purchase if given the opportunity. (It should go without saying that the investor has done research beforehand, understanding that no one has a crystal ball offering a guarantee that the results will be profitable.) All the more reason that everything you do needs to be geared toward increasing the probability of success.

An effective approach is to buy, say 20 - 30% of the entire position in the current trading range of the stock or metal. Then, after looking at charts, place several new entries at lower levels, with "Limit/Good ‘til Cancelled" orders. These orders will only be filled if the price drops to the specified levels and price. If you are purchasing bullion from a trusted source at regular intervals, you might simply call to make another purchase when and if your price is reached.

It also helps to keep a certain amount of money in reserve, in case the opportunity comes along to buy at what Doug Casey and others have referred to as "stupid cheap" prices.

From a psychological perspective, the importance of initially buying a small position to start and adding to it if given the chance at lower levels is twofold.

If the price does move lower, and one or more of your limit orders gets filled, you will feel more relaxed about the matter, since you had already planned for this possibility.

First, you begin with part of what you eventually want, and if the price goes up before the lower orders are filled, you won't be tempted to chase the market, feeling you've completely missed the boat. Second, if the price does move lower, and one or more of your limit orders gets filled, you will feel more relaxed about the matter, since you had already planned for this possibility.

The 21st Century is still young, but we've already seen prices in the general stock market, as well as with individual groups like resource sector companies and the precious metals themselves, fall a lot farther than most people expected. Indeed, sometimes well below levels making fundamental sense. But each time, when investor sentiment changed, quality stocks and commodities bounced back, resuming their bull trends. Of course, it's difficult, even for the seasoned investor, to "hang in there" when it appears that the world is coming to an end. But here's what Eric Sprott, one of the most successful investors in the resource sector has to say about this kind of situation:

"If you believe you're right and the data says hold your ground – you hold your ground. Normally there's a pretty big payday at the end."

Before 2000, Eric was a millionaire – not too shabby. Now he is a billionaire. He did it in no small part because he was willing and able to take large, but calculated risks which few others had the courage and conviction to attempt. On a smaller, but relatively no less significant scale, we can do the same thing.

Respond -- Rather Than Try to Predict Market Changes

A variation of the concept of buying in tranches is that of "dollar cost averaging." You "leg into" a position, purchasing in regular amounts – committed either to a set dollar value per month or in the case of bullion, perhaps a specific number of ounces.

A major benefit of this approach is financial – over time you can "average out" the cost of your acquisition – buying more into declining prices, lowering the breakeven point. A person who bought American Silver Eagles each month over the last three years would have been able to acquire more silver most months since the intermediate cyclical bear trend (within the larger secular/global bull market trend) was down. The net result is that you would have a pretty good average price for your entire purchase. Yes, your cost might still be above today's spot price, but almost certainly it is a lot less than if you had gone "all in" at, say, $40 when you "just knew the bottom was in."

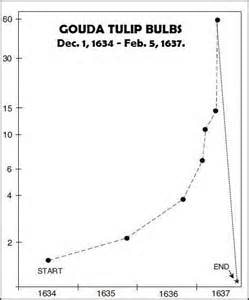

Dollar-cost averaging keeps your "Tulip Mania brain" under control.

A seldom-discussed advantage to dollar/share cost averaging is it makes it less likely that you'll buy too much at "the top." When the price goes vertical, it's easy to throw caution to the winds, because Fear and Greed just love to get into the emotional driver's seat and help each other out! Dollar-cost averaging keeps your "Tulip Mania brain" under control.

The philosophy related to dollar-cost averaging and its cousin, buying in tranches, is the surprisingly powerful idea of responding to market change, rather than trying to predict it. Newsletter writer Stewart Thomson believes that you should always buy "less than is rational." Just one more underappreciated yet powerful tactic to help control those twin dragons.

The wisdom of buying tranches into weakness, and responding to price changes rather than trying to predict them (making the mistake of buying ahead of where you think prices will go), significantly lowers your fear-greed quotient. Using the passenger train analogy, Stu sums it up nicely when he remarks,

"Don't try to drive the gold train. You're not that good, nor am I. Just act professionally at each station. Train goes backward, you pick up some passengers. Train goes forward, offload a few."

Buying in Tranches Is Not the Same as "Averaging Down"

The idea of buying portions or tranches into weakness is different from the questionable practice of "averaging down"! When averaging down, a person places a bet on a particular investment, expecting (of course!) that it will rise in price. If it does not and begins to fall, the investor is faced with a loss. Rather than sell out, he/she hopes the price will rise, and so out of fear, buys more.

The idea is that if the price rises just a bit, the position will get back to "break even," enabling the investor to sell without a loss. But too often the price keeps falling. Also too often, the investor continues to average down, buying more. At some stage, the investor panics and sells the entire position for a big loss, most likely right at an intermediate or long-term low.

Of all the trading techniques this writer has tried over the years, the idea of buying tranches into weakness with a pre-determined amount of money has done more than any other behavior to help reduce the market's emotional impact. Fear is reduced. Greed is reduced. You're more relaxed when the markets are open and after the day's session.

With the pace of today's trading, where markets, due to High-Frequency Trading by pre-programmed computers, can experience a "flash crash" within a matter of minutes and just as quickly recover, keeping calm gives you a powerful investment edge.

To Summarize: The components of a successful investment plan – understanding fundamental and technical analysis, using good money management, and cultivating the Mind as your "secret investment tool" – work together in an analogy resembling a three-legged stool. Each "leg" is so important that as Dr. Elder remarks, "Remove one, and the stool will fall, together with the person who sits on it."

Don't Be Afraid to "Fail"

"Winners are not afraid of losing. But losers are. Failure is part of the process of success. People who avoid failure also avoid success." (Robert Kiyosaki, author of Rich Dad, Poor Dad)

From Think and Grow Rich, Napoleon Hill:

"Before success comes in any person's life, they are sure to meet with much temporary defeat, and, perhaps, some failure. When defeat overtakes a person the easiest and most logical thing to do is to quit. That is exactly what the majority of people do.

"More than five hundred of the most successful men this country has ever known told the author their greatest success came just one step BEYOND the point at which defeat had overtaken them. Failure is a trickster with a keen sense of irony and cunning. It takes great delight in tripping one when success is almost within reach."

Move One Step Beyond "Defeat" – on the Way to Success

Napoleon Hill had a keen understanding of human nature, as well as how failure can be a "trickster" separating winners from losers – often during the last few steps of the final lap before the finish line. Try Googling people like Sir John Templeton, Robert Friedland, or Dr. Keith Barron to see what a person can accomplish when they don't stop "four feet from gold."

To be successful, you must be willing to discipline yourself and contradict your emotions, moving beyond "temporary defeat" to sit in the winners' circle.

"The winner acts in opposition to his own feelings."

Stewart Thomson, to whom I owe a great debt for the insights his writings have provided over the last few years, puts it this way – "Very few investors really buy or sell anything based on real analysis. They may do some analysis, but the buying and selling action is really based on a feeling they have. We all have those same feelings. The losers act on them. The winner acts in opposition to his own feelings."

So there you are.

In April of 2011, what was to become a multiple-year cyclical bear market in the precious metals and resource sector stocks got underway. Few people – certainly not this writer – expected the downdraft to last so long or go so deep. But I have persevered in my investments and study of the markets. I have been willing to buy, in tranches, deeply-discounted mining stocks and metals. I sincerely believe that over the next few years, a renewed metals' bull market will drive gold and silver into new all-time highs – to levels few people today believe are possible.

Unlike the last secular bull market ending during the spring of 1980, this one will be a global phenomenon involving the majority of the world's population centers. Like Eric Sprott, I intend to "hold my ground," choose the best investment vehicles, and be around for "a pretty big payday at the end."

What's interesting about these plays is that it generally doesn't take a lifetime to realize outsized gains. Sprott Asset Management's Rick Rule has been through this cycle several times – during each cycle increasing his return on capital by 5 – 10 times the initial entry. With that kind of track record, it might be worth your time to pay attention. Rick says, "I would suggest to you that the gold mining industry today is reasonably priced. And the last time that was the case was in 1992. "In 1996 I paid more in capital gains tax than my net worth was in 1992."

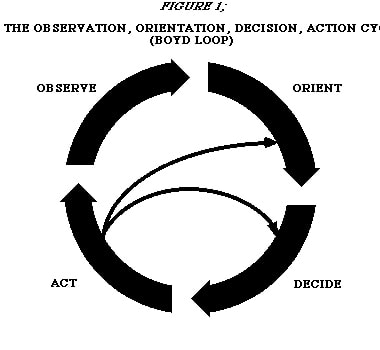

Sync Your Mind and Behavior to the Boyd Cycle

During several decades of trading and market study, I've run into quite a few "systems" and "approaches" that claim to help investors make significant money. I've even bought a few!

But the most valuable Big Picture insights I gained came from studying and applying the teachings of a man who, as far as I know, never spent much time in the investment world. His name is John Richard Boyd.

Boyd was an Air Force fighter pilot and consultant to the Pentagon whose ideas revolutionized the military theory and presented the rest of us with an invaluable strategy for trading the markets and dealing with life in general. His theory, developed from observing air combat between opposing jet fighters over Korea, concluded that the critical factor in responding to an event was time.

In what so often becomes a survival of the fittest situation – in markets as well as in life – Boyd noted that "The pilot who goes through the OODA cycle in the shortest time prevails because his opponent is caught responding to situations that have already changed."

His cycle – constantly resetting itself – consists of four overlapping procedures: Observe, Orient, Decide, and Act. The pilot on either side who was able to move through this process with the greatest precision and the most speed, won.

It's simple, straightforward, and repeatable. Apply this concept directly to your investments. Indeed, as you come to understand and can use it, you will almost certainly find that its application extends to just about every facet of your life. To illustrate an investment example, let's look at silver (or you can substitute another metal).

Observe – Get the Big Picture: Research what's going on politically, economically, and socially in terms of supply-demand factors, and how changes in them might significantly move the price of silver in your favor over the next few years.

Orient – Ask yourself, "How do I fit into this picture? Do my financial goals, ability to invest, belief structure, willingness to keep learning about silver, and ability to deal with risk (temperament) mesh with the volatile nature of this market?"

Decide – Lay out your plan. Ideally, begin with physical silver. Start a dollar-cost averaging buy plan? Purchase a certain amount of silver, regardless of the price - monthly/quarterly? Research/choose a few high-quality producers for your main investment portfolio, and maybe one or two explorers to buy with a small amount of "casino money?"

Act – Once you've concluded the decision-making part of the cycle, get your program going. (A valuable Chinese saying goes "To know and not act is the same as not knowing.") Carefully choose a legitimate bullion dealer with a proven track record, as well as a lot of satisfied customers, and embark on your purchase schedule. Focus on what you're doing and don't let uninformed opinions or nay-sayers divert you from your course of action. And never forget how powerful and indispensable the role of the secret investment tool – your mind, will be for your investment success. As "Mr. Gold" Jim Sinclair says, "Technique without a mindset is like a race car without fuel!"

You MUST Preserve Your Psychological Capital!

Most of us think there's just one kind of capital in our investment account. There's a second one – arguably as important as the funds listed in your brokerage statement. It is your Psychological Capital – the mental ability to keep trading the markets in a sustainable, optimistic way. Draw down your emotional capital below a certain point – and you may be finished as an investor.

Don't ignore this very important caveat – that to do well, you must truly believe in the premise underlying your investing actions. If you are convinced – as is this writer – that precious metals are in the middle stages of what will likely become a historic price rise over the next few years, and that in addition, gold, silver (and yes, platinum and palladium) as tried and true forms of "physical reality" offer insurance against loss in the value of the rest of your assets, then your investment actions will back up that opinion. If not, causing your behavior to run counter to your belief – success will be much more difficult for you to achieve.

In this report, we've discussed several ways to keep a good "mental balance," in addition to the growing the dollar value in your account. Don't overtrade. Use a stop loss to limit your risk. Research your "targets" fully before taking a position. And when you do, never go all in at one price point – no matter how "certain" you are that you've found the next moon shot investment.

The pace of market trading – due to the speed by which information (and rumors) are spread on the Internet – has become more frenetic than ever, so it's critical that the individual investor lower the tone of his/her emotions in any way possible. High-Frequency Trading (HFT) – where pre-programmed computers make large split-second trades, rather than real people executing reasoned real-life trading decisions, now comprises about 70% of the daily volume of the broad U.S. stock exchanges. These computers buy and sell based upon information relayed to them, sometimes a fraction of a second before the rest of us in the public space get to hear about it!

Tamp down fear and greed to a manageable – and sustainable level. And keep it there!

Tamp down fear and greed to a manageable – and sustainable level. And keep it there! When you buy physical precious metals or a mining stock – the dollar cost average monthly, or buy in tranches at pre-set price points. If the price drops lower as you buy, celebrate that fact, because you will be getting more metal – real money – as you pick up a larger position for your dollars while the price undergoes a short-term decline.

How to Hold onto Market Earnings

Over the last few years, the exhaustive studies I've made about historically successful investors, and the writings of Stuart Thomson at Graceland Updates, (as well as my association with David Morgan and his philosophy of living and investing) have had a profound effect on the thinking – and emotions this writer employs when approaching the markets.

Having traded the metals/futures/mining stocks since 1974, I can truthfully say that had I not listened to and applied to my circumstances, the wisdom of these teachers and a few select others, I might not have survived – either emotionally or financially – the travails of the 2008-2009 meltdown, let alone the even more difficult and lengthy 2011-2015 cyclical precious metals' bear market.

Think deeply concerning what Stu has to say about investment success – in markets that are now, and which will continue to be, some of the most treacherous (but also potentially profitable!) of our lifetime. Said he:

"It's a long process. No champion is built by opening up a crackerjack box and pulling out a U.S. debt clock prize that says, ‘Free gold parabola for you!' Wealth-building is a mindset. It's a mindset that takes years to build. (But) Once built, it's unbreakable."

If you're willing to pay the price in terms of study, personal reflection, and application to keep your emotional and financial ship upright, the potential rewards may turn out to be much greater than you think possible. When your success ship comes in, because of the consistent work you've done to make it happen, your "earnings" will include something even more powerful than the dollar signs listed in an account statement. You will have arrived at this place because you developed an understanding of how to effectively apply time-tested principles in relation to both the markets and yourself.

The Sixth Century Chinese general, military strategist, and writer, Sun Tzu, in The Art of War, one of the greatest books on strategy (and markets!) ever written, had this to say:

"If you know yourself and your (marketplace) enemies, you will be victorious in 100 battles."

"If you know only yourself, the odds are even."

"If you know neither, there is great danger in 100 battles."

For well into the second decade now, I have been writing reports and commentary for David Morgan's The Morgan Report, available on his site at www.themorganreport.com, I often close my essays with the following, which I believe is equally relevant to the report you have just read:

Do the research.

Do the math.

The decision must be yours.

Bonne Chance!

About the Author:

David H. Smith is the Senior Analyst for TheMorganReport.com, a regular contributor to MoneyMetals.com as well as the LODE digital Gold and Silver Project. He has investigated precious metals mines and exploration sites in Argentina, Chile, Peru, Mexico, Bolivia, China, Canada, and the U.S. He shares resource sector observations with readers, the media, and North American investment conference attendees.