Counter-party risk. That's the biggest threat to anyone who owns a paper-only investment portfolio. The evidence of this truth is mounting – especially for those who hold paper-backed precious metals instruments and not enough of the real thing.

Last month's PFGBest fraud and last year's MF Global debacle lay bare the risks of owning precious metals (or financialized proxies) through financial institutions. Customers of the failed firms, many of whom held precious metals positions, got a surprise notice. A portion of their assets was stolen and the remainder was frozen, pending lengthy and expensive legal action.

Credible new warnings from insiders suggest more fleecings of unwitting precious metals investors lie ahead. Now is the time to make absolutely sure your chosen methods of precious metals ownership are safe from counterparty risk.

Understand the Problems and Advantages of Physical Storage

Using a third-party storage company can make sense if you already have a sizeable stash of precious metals in your immediate possession. Certain precious metals vaulting companies offer a private, safe, and secure option for those worried about keeping too many valuables in their home. Bullion storage through third-party facilities should only be done on an allocated or (better yet) segregated basis – meaning your metal will be physically separated from the metal held by the vault's other clients.

Minimums usually apply and storage rates will vary, but generally speaking vaulting companies will charge anywhere from 50 to 80 basis points (0.5% - 0.8%) annually for fully segregated storage of your physical precious metals.

There are a number of reputable private storage companies, several of which have been vetted by Money Metals Exchange. For instance, a typical yearly vaulting fee on $100,000 worth of precious metals would be somewhere between $500 ($100,000 x 0.005) to $800 ($100,000 x 0.008). For information on this and other storage options, call Money Metals Exchange at 1-800-800-1865.

Bullion Unallocated Is Bullion Unowned

You may be able to save a small amount on fees by opting for an unallocated or "pooled" account, but you assume much greater risk by doing so. In an unallocated account, the gold you "buy" is actually owned by the firm. It just issues you an IOU. If the firm goes bankrupt, your gold claim may be worthless.

Institutions offering unallocated accounts sometimes practice "fractional reserve" bullion – meaning they may have ten times (or more) as many claims on ounces of gold as actual ounces of gold held in storage.

Jeff Christian of the CPM Group warned in a recent Financial Sense Newshour interview that unallocated metal "is owned by the bank. The bank can hypothecate it. They can lend against it. They can use it as collateral for other lending." Christian is no "gold bug"; he's normally sanguine about paper precious metals and even denies that the markets are manipulated. But even he now concludes that unallocated accounts offered by bullion banks are high-risk. According to Christian, " Some people don't know that they have unallocated gold. They think they have allocated gold, but they don't."

Allocated accounts are in theory much safer, since the gold isn't on the balance sheet of the institution and instead legally belongs to you, the client. However, some institutions that claim to offer allocated storage cheat. In 2007, Morgan Stanley settled a class-action lawsuit for $4.4 million. The investment bank failed to buy and store precious metals for clients as promised, but charged clients for the service anyway. Last year, UBS Financial Services got hit with a lawsuit over similar alleged misrepresentations.

"Even the allocated gold in the banking system has probably been loaned out. Many of these customers will wake up one day and realize they entrusted their gold to the wrong people," warns John Embry, Chief Investment Strategist of Sprott Asset Management. Matterhorn Asset Management's Egon von Greyerz recently relayed an experience of " a client moving a substantial amount (of gold) from a Swiss bank to our vaults, and we found out the bank didn't have the gold. This was supposed to be allocated gold, but the bank didn't have it."

Von Greyerz advises as follows:

"We are stressing to investors to take their gold out of the banking system, not only because there are runs on banks that will continue, but the risk of being in the banking system is major. So you should take the additional step of not just owning physical gold, but also owning it outside of the banking system."

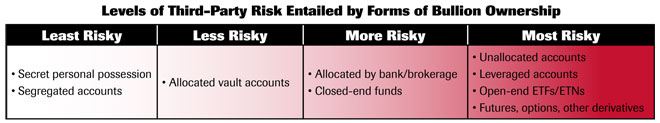

Here's a Guide to Assessing Real-Time Risk

Of course, the most secure, most private way to own precious metals is to have them in your actual possession (and not telling your neighbors!). When opting for indirect ownership through third parties, make sure you avoid the riskiest methods unless you intend to speculate – and then do so only with funds you can afford to lose.

About the Author:

Clint Siegner is a Director at Money Metals Exchange, a precious metals dealer recently named "Best in the USA" by an independent global ratings group. A graduate of Linfield College in Oregon, Siegner puts his experience in business management along with his passion for personal liberty, limited government, and honest money into the development of Money Metals' brand and reach. This includes writing extensively on the bullion markets and their intersection with policy and world affairs.