Gold and silver spot prices rallied during the first two trading days of the New Year and may look forward to a few more days of support from portfolio rebalancing. Investors and money managers are paring back on stocks and other outperforming assets of 2013 and buying underperformers -- including precious metals.

A few more days of strength in prices will make for some better-looking charts -- something the metals need to attract traders on the long side. Gold and silver regained some important levels over the past two weeks, with silver solidly above $20.00/oz and gold back above $1,200.

The bullion markets were quiet during the holidays. Activity often picks up during the first weeks of January as investors place orders for bullion coins dated with the new year. Although premiums will be elevated, the 2014 Silver American Eagles should start becoming available for delivery within two weeks, while this year's Gold Maple Leafs, Silver Maple Leafs, and Gold Kangaroos are already in stock.

Silver bars and rounds are currently available at MUCH lower per-ounce prices. As a result, these low-premium and fast-delivery forms of silver continue to gain in popularity.

Some Macro Events to Watch For in 2014

Predicting market events is difficult. It is one of the reasons we advocate investors focus more on the fundamentals and try not to get hung up on market timing. Humans are notoriously bad at picking tops and bottoms.

But there are a few things we believe have a high probability of occurring in the coming year…

1) A 20% (or Greater) Correction in U.S. Equity Prices

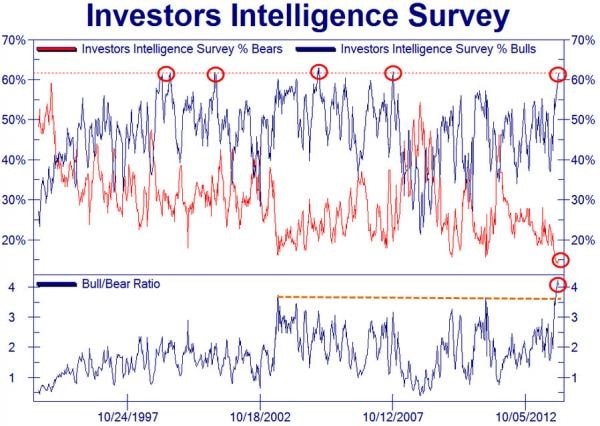

General bullishness toward the stock market reached a historic extreme toward the end of 2013. The ratio of bulls to bears now exceeds 4 to 1, something unseen even during the dot com bubble of the late 1990s. Valuations based on actual earnings are also at high levels. This is not likely to end well.

The Fed has created trillions of new dollars in recent years, and we certainly expected to see some of this inflation manifest in the stock market. We also expect to see volatility accompanying the higher prices. As demonstrated by the above chart, when the number of bulls reaches today's high levels, the market usually punishes them.

If investors exit the stock market looking for a safer place, but low-yielding bonds and no-yielding cash look like trouble, gold and silver stand to benefit greatly.

2) Fed Stimulus Reaches New Record

With the Fed supposedly tapering back stimulus, it's harder to persuade folks that more easy money is coming. But it's even tougher to find a replacement for the Fed as the buyer of last resort for U.S. bonds and mortgage securities.

If we get a major correction in stock prices and/or long-term interest rates continue to rise, investors should expect new Federal Reserve Chair Janet Yellen to come to the rescue. As staggeringly large as the Fed's stimulus has been, we don't think the world has seen anything yet.

3.) Bullion Coin Premiums Remain Elevated

Silver bars are WAY less expensive

than bullion coins.

Demand for bullion coins drove premiums higher in 2013. Higher metal spot prices could take some of the pressure off by enticing more holders of coins, bars, and rounds to sell. But likely not enough. During the last big run-up in prices, far more investors were buying physical bullion than were selling.3) Bullion Coin Premiums Remain Elevated

The tide of people uncomfortable with fiat currency and paper assets continues to swell, driving worldwide physical demand higher -- regardless of what is happening with spot prices. Precious metals refiners and mints – particularly unreliable government mints -- remain ill-equipped to handle the sort of demand we are now seeing.

Investors should expect under-supplied bullion products such as Silver American Eagles to continue commanding elevated premiums over paper (spot) prices. Low-priced silver bars and rounds will attract more investor dollars.

Potential Market-Moving News This Week

- Wednesday, Jan. 8th – FOMC Minutes. Investors will get a look at the minutes of the December meeting. We'll hear more about the decision to “taper.” The minutes will not address the recent jump in yield for the 10-year note and what that means for the prospects of more tapering.

- Thursday, Jan. 9th – European Central Bank. The ECB's Governing Council meets. It is not expected to announce any new measures after surprising markets with a rate cut last November, but its language could move currency markets.

- Friday, Jan. 10th – Employment Situation. Consensus is calling for another anemic job report with about 200,000 new jobs being created. The “official” unemployment rate is expected to remain at 7%. Of course, we may get more “good” news: hordes of people no longer eligible for unemployment benefits fall off the rolls and no longer get counted – making the official rate even lower.

We Buy Back Too!

This week's Market Update was authored by Money Metals Director Clint Siegner.

About the Author:

Clint Siegner is a Director at Money Metals Exchange, a precious metals dealer recently named "Best in the USA" by an independent global ratings group. A graduate of Linfield College in Oregon, Siegner puts his experience in business management along with his passion for personal liberty, limited government, and honest money into the development of Money Metals' brand and reach. This includes writing extensively on the bullion markets and their intersection with policy and world affairs.