Precious metals prices are benefiting nicely from the weakness in the dollar and the ongoing potential for conflict in Ukraine.

The U.S. Dollar Index has been trending lower since last July. On this St. Patrick's Day, the greenback sits just above its key support level of 79. And investors appear to finally be remembering the go-to safe-haven alternative to the dollar: gold.

Precious metals are also getting a boost by a virtuous cycle. Gold and silver are among the best-performing asset classes of the year. Gold is up nearly 15% with its price currently sitting at 6-month highs.

Meanwhile, U.S. equities are losing some of their shine. The S&P 500 is virtually flat for the year. Gold and silver ETFs, which had been liquidating inventories, are accumulating once again.

Investors should keep an eye on the bond market. U.S. Treasuries, which also traditionally benefit from safe-haven buying, have been generally stronger since the first of the year. Investors appear unconvinced the Fed will continue reducing its stimulus measures, and turmoil in Ukraine, and the surrounding geopolitics, are adding a new element for investors to consider. More on that below...

Currency Wars Heating Up

Unfolding events in Ukraine have created a major foreign policy challenge for State Department officials and the President. The Obama Administration reportedly sent several billion dollars to organizations in Ukraine before pro-European Union forces staged their coup, but Russia appears to be undeterred in reclaiming the Crimea region.

The ongoing turmoil in Ukraine, Iraq, Afghanistan, Libya, and Syria all suggest the U.S. is losing influence. An increasing number of Americans are growing tired of paying for conflicts around the globe, and political support for new military adventures is waning.

But there is another consideration with implications for metals investors. The U.S. government's borrowing needs make it financially dependent on nations such as Russia and China, who buy and hold massive amounts of Treasuries.

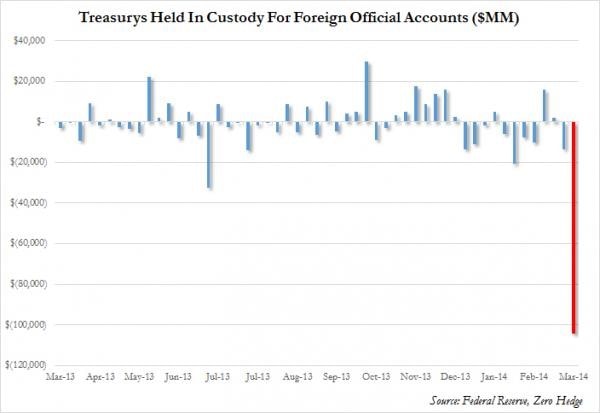

Russian President Vladimir Putin and the Chinese have been warning the U.S. to butt out of Ukraine and not impose sanctions. Perhaps in anticipation of actions by the Obama Administration to lock down Russian assets on deposit at the Federal Reserve and other banks, Russia has been shedding its holdings in recent weeks. The chart below is a shot across the bow:

The U.S. finds itself in a tough spot. The Fed's posture is to “taper” -- to wind down its purchases of U.S. debt. But the Administration's stance in Ukraine risks antagonizing some of the largest outside buyers of Treasuries.

Geopolitical developments like these could lead to carnage in the bond and currency markets, sparking buying of precious metals.

Potential Market-Moving News This Week

- Monday, March 17th - Consumer Price Index. Recent data on price inflation shows prices rising slowly -- below the Fed's stated target. A muted CPI figure may give Fed officials cause to reverse course on tapering.

- Wednesday, March 19th - FOMC Meeting Announcement. There is no doubt the Fed will leave short-term interest rates at essentially zero. Investors will be parsing Yellen's statement carefully for hints on the direction of QE.

- Thursday, March 20th - Philadelphia Fed Survey. The February report on economic activity in the Philadelphia region was a surprise negative 6.3. Consensus is calling for a return to positive growth of 3.0 in this week's report, but with continually harsh winter weather and recent reports showing weakness, another downside surprise is possible.

About the Author:

Clint Siegner is a Director at Money Metals Exchange, a precious metals dealer recently named "Best in the USA" by an independent global ratings group. A graduate of Linfield College in Oregon, Siegner puts his experience in business management along with his passion for personal liberty, limited government, and honest money into the development of Money Metals' brand and reach. This includes writing extensively on the bullion markets and their intersection with policy and world affairs.