Money Metals recently published my article on the growing threat to gold and silver owners from armed thugs committing home invasion crimes. We reminded our readers who keep gold and silver close by that it's best to keep your mouth shut about what you own and where you store it.

But how do you stop criminals from stealing other forms of wealth?

It turns out, that's a lot harder than protecting a stack of silver from armed robbers. Every cent of wealth ever created is at risk of being stolen or lost every minute of the day, no matter what form that wealth takes.

And it has always been that way.

And it has always been that way.

There is a long list of illegal and legal ways of stealing your money, ranging from fraud to mismanagement, to hiking your taxes, to destroying your purchasing power through deliberate inflation. Those thefts cannot happen to you without a counterparty, who is simply the other guy in the deal.

Anyone you contract with -- from your employer, to your lender, to your investment firm, to the guy who sells you a car -- is your counterparty. You put your wealth at risk whenever you take on a counterparty. You protect yourself by wisely choosing whom that counterparty should be, or whether to even have a counterparty in the first place.

It's best that you read all the fine print.

Putting money in a bank savings account makes the bank your counterparty. You contract to be paid interest while the bank takes control of your money. And under the law not widely understood, it now legally owns what used to be your money. You become an “unsecured creditor” of the bank, a legal status for depositors upheld by many courts for many years.

You Are an Unsecured Creditor Standing at the End of the Line

“Unsecured creditor” means just what it says -- if the bank goes bust, you are the first to lose. Your cash on deposit will be the money that “secured” creditors legally get to dip into to recover their losses.

FDIC insurance is supposed to protect you, but only up to a certain amount and only so long as FDIC itself is financially sound. Government can change FDIC protections any time it wishes, meaning anytime abnormal economic pressures arise.

The same counterparty concerns apply to stock accounts, mutual funds, insurance policies, and your deadbeat brother-in-law. You assume the risk of losing it all when you entrust your wealth to a counterparty.

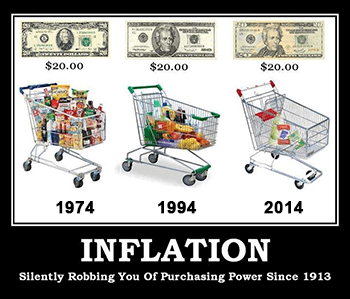

Uncle Sam Is Robbing Dollar Holders through Deliberate Inflation

Even if you keep your dollar in your pocket, it's destined for theft from the largest counterparty in existence, the U.S. government. Its banker, the Federal Reserve, issues those dollars, and Uncle Sam forces you to use them by law. The theft comes in the form of deliberate inflation which seriously erodes your dollar's purchasing power year after year.

This planned inflation has been underway since 1913 when the Federal Reserve was established as the central bank. The erosion of more than 97% of the dollar’s purchasing power since 1913 is no accident. It’s the result of an insidious plan to cheat Americans while no one notices.

The government profits from inflation simply by having money whenever it wants to pay for whatever it wants, such as wars and welfare programs. As more money is printed, a process which is also known as currency debasement, those dollars flow into the economy, resulting in higher prices as more dollars chase the same number of goods and services. You finance this theft by paying higher prices. If prices get too expensive for the government, it merely prints more money, which means you are that much poorer. Even if your income rises in nominal terms, the buying power of your wealth evaporates.

The government profits from inflation simply by having money whenever it wants to pay for whatever it wants, such as wars and welfare programs. As more money is printed, a process which is also known as currency debasement, those dollars flow into the economy, resulting in higher prices as more dollars chase the same number of goods and services. You finance this theft by paying higher prices. If prices get too expensive for the government, it merely prints more money, which means you are that much poorer. Even if your income rises in nominal terms, the buying power of your wealth evaporates.

Currency debasement has been used by dishonest governments for centuries. The U.S. Federal Reserve did not invent currency debasement. It only perfected it.

Today's dollar will buy only what three cents bought in 1913, give or take a fraction. Yet, for the first 135 years of our nation's history, inflation barely existed in the United States.

The word “inflation” was not part of the American vocabulary until the 20th century, because, before then, prices were linked to a gold standard. It also happens that for the best ninety of those years, there wasn’t even a central bank.

Your Property Taxes Are Tantamount to Rent Paid to the Government

Closely following inflation on our list is the property tax. You might think you own your home, but you don't. In truth, no one in America owns a home. Whether your mortgage is paid or not, you rent your home from the government (your counterparty) thanks to property taxes.

If you don't pay your rent to the government, it will seize your home. Your counterparty will send men with guns to throw you out. Resist, and men with guns will lock you away. Somehow, that doesn't square with my understanding of ownership!

You protect yourself from the ravages of inflation and higher taxes with precious metals. Gold and silver have served as stores of wealth for centuries because they have proven to hold their purchasing power throughout all of written history.

Here's the kicker in the case of storing your wealth in precious metals: they have no counterparty. They offer the choice to hold wealth with no counterparty.

Physical Precious Metals You Hold Have No counterparty Risk

Although dollar values of gold and silver often act as investments, metals are truly best utilized as stores of wealth, as savings. With your savings held in gold and silver, you don't have to worry about being paid or re-paid by any counterparty. Your gold or silver in your control is your pay.

Precious metals don't erode with inflation, don't go bankrupt, and come with only one sentence of fine print: Gold and silver have been unanimously voted by every civilization on Earth as the best representation of money through every war and every government collapse since antiquity, all with no counterparty risk.

About the Author:

A great communicator who connected with his readers, the late Guy Christopher lived on the Gulf Coast. Writing for MoneyMetals.com as a retired investigative journalist published author, and former stockbroker, Christopher previously taught college as an adjunct professor and was a veteran of the 101st Airborne in Vietnam.