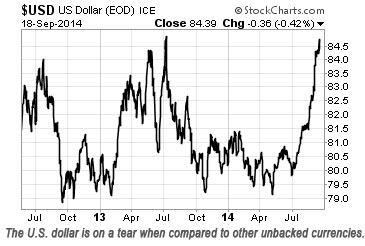

Opportunistically minded retail customers swooped in and bought large quantities of gold and silver coins, rounds, and bars last week, as precious metals spot prices accelerated to the downside. Traders reacted to poor technicals and a stronger U.S. dollar.

Silver prices, in particular, got clobbered. The white metal fell to its lowest levels since 2010 and finished the week below $18.00/oz. From a technical standpoint, more selling in silver is possible as the strong support level established around the $18.20 mark failed on Friday. Gold, however, has not violated its 2013 lows around $1,180.

Silver prices, in particular, got clobbered. The white metal fell to its lowest levels since 2010 and finished the week below $18.00/oz. From a technical standpoint, more selling in silver is possible as the strong support level established around the $18.20 mark failed on Friday. Gold, however, has not violated its 2013 lows around $1,180.

Meanwhile, Bloomberg reports the dollar wrapped up its 10th straight weekly gain, its longest rally since at least March 1967. It’s a remarkable performance in light of recent actions taken by Russia, China, and other BRIC nations designed to reduce their dependence upon the dollar.

Commodity prices are falling along with the precious metals, and yields edged downward slightly on the 10-year Treasury bond. It seems as if deflation fears are starting to take hold of investors; however, stock prices powered higher once again last week.

Precious Metals at Beaten-Down Prices Attract Value-Oriented Buyers

No investor likes to be wrong. We expected metals prices to move higher over the past 2 years. What we got was the opposite. There are a lot of shell-shocked precious metals bulls scratching their heads. Although gold, unlike silver, has not fallen below its 2013 lows, last week’s sell-off in silver inflicted damage to the technical charts in a fashion that could drive silver prices lower in the futures market.

Tough markets make for lots of soul-searching. It is easy to fear precious metals right now given the price action. During the last couple of years, just about any asset class performed much better.

If you had decided to rotate out of financial assets and into precious metals 7 years ago when the stock market was trading at elevated levels, you’re experiencing no regrets today. Yes, the Dow Jones has now fully recovered from its bear market, showing a net gain of 25%. But gold is up 65% over the past 7 years, despite its recent weakness. Battered silver is still up 31%.

If you had decided to rotate out of financial assets and into precious metals 7 years ago when the stock market was trading at elevated levels, you’re experiencing no regrets today. Yes, the Dow Jones has now fully recovered from its bear market, showing a net gain of 25%. But gold is up 65% over the past 7 years, despite its recent weakness. Battered silver is still up 31%.

If the secular trend of gold and silver outperformance is still intact, then this latest selloff represents an opportunity to accumulate more ounces at what will, in time, be seen as impossibly cheap prices.

Money Metals Exchange customers are BUYING, not selling. Physical gold and silver owners by and large aren’t dumping metals to buy stocks and bonds or to accumulate cash. Those assets may look attractive in the rearview mirror, but not necessarily through the windshield. The road ahead may not be so smooth for financial assets. At some point, it will turn in favor of hard assets.

The flip side of deciding to sell is the decision to buy an investment that is likely to perform better -- even if it is just cash held in a savings account. Again, almost none of our clients are selling. The percentage of our inventory that comes from our customers remains well under 5% -- with the balance coming from mints, refiners, and wholesalers. However, be aware that we are eager to buy precious metals from our customers, and we offer some of the best prices out there.

About the Author:

Clint Siegner is a Director at Money Metals Exchange, a precious metals dealer recently named "Best in the USA" by an independent global ratings group. A graduate of Linfield College in Oregon, Siegner puts his experience in business management along with his passion for personal liberty, limited government, and honest money into the development of Money Metals' brand and reach. This includes writing extensively on the bullion markets and their intersection with policy and world affairs.