There was a time when U.S. dollars didn’t fold, they clinked. Americans carried gold coins in their pockets, and price inflation was virtually non-existent. For more than a century, citizens could walk into a shop, slide a $10 gold “Eagle” across the counter, and walk out with roughly the same large stack of merchandise. Grandparents could spend decades filling a jar with a stash of beautiful coins and pass them to their grandchildren, confident the value of what they saved would not diminish over time.

That is the nature of honest money. Unfortunately governments prefer the dishonest kind.

Franklin Roosevelt infamously outlawed gold ownership in 1933, and the U.S. Mint halted production of the iconic coins. Wise people ignored the official assurances that the new dollars would carry the same stable value and hid the gold coins away.

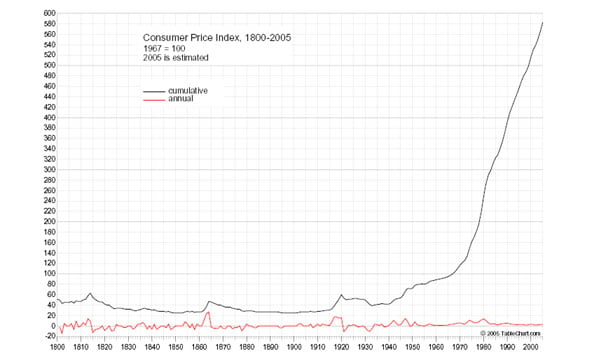

Irredeemable paper dollars became the standard, and a new era of perpetual inflation began. Just look at what has happened to the dollar’s purchasing power since Roosevelt made his proclamation and ordered the Treasury to stop redeeming dollars for gold:

President Nixon slammed shut the “gold window” in 1971, officially ending the gold standard. President Ford made private ownership of gold legal once again in 1974. Today investors can openly buy and sell the same coins that served earlier Americans so well -- still beautiful and still promising enduring value.

One note of caution to investors; these historic U.S. coins are valuable because of their gold content, not because age has made them collectible.

Are Gold Coins a Good Investment?

Unethical dealers often prey upon the misconception that these coins must be rare given they haven’t circulated for close to 100 years. A relative few are prized by collectors, but most are not. Unless you are an expert on the numismatic coin market, you won’t be able to tell the difference.

Money Metals Exchange does not carry “slabbed” or graded coins, and we don’t have commissioned salespeople making dubious claims about why collectibles are the way to go. We think it’s important for people to simply invest in gold. If done right, the cost over the spot price will only be a few percent.

The bullion market is extraordinarily competitive. Speculating in “rare” coins, when the entire business model of many prominent dealers is to capitalize on customers’ inexperience, is not an investment in gold. It is a prescription for pain.

Slabbed and graded coins are

exploited by unscrupulous numismatic

coin dealers to trick inexperienced

investors to overpay.

The U.S. Mint produced lots of these coins over decades. There is simply no need to pay big mark-ups.

Money Metals Exchange offers Pre-1933 gold coinage at premiums competitive with other bullion products. If we can’t secure inventory cheap enough to resell at low premium making it a good value for our customers, we won’t offer it at all. But we usually have something available. Both the price a customer pays to buy and the price a customer receives to sell are published live on our website product pages for each coin. No worries about being ripped off; you know exactly what a coin is currently worth if you were to sell before you buy.

The U.S. Mint issued gold coins in 4 denominations primarily; the $2.50 “Quarter Eagle,” the $5 “Half Eagle,” the $10 “Eagle,” and the $20 “Double Eagle.” Actual gold content ranges from .1209 to .9675 troy ounces of gold alloyed with 10% copper to improve wear. Investors may find Liberty Head, Indian Head, and St. Gaudens designs available. Each coin is a piece of American history -- honest money.

We have a good supply of $20 Liberty and St. Gaudens in stock now, and at premiums that are lower than we’ve ever been able to offer. Order yours either online or by calling 1-800-800-1865. If you are a beginner making your first investment in gold, we have friendly Specialists standing by to provide straight-forward answers. Experienced investors will find some of the lowest premiums around. And everyone can order without hassle or pressure and get prompt, discreet delivery. We look forward to hearing from you today!

About the Author:

Clint Siegner is a Director at Money Metals Exchange, a precious metals dealer recently named "Best in the USA" by an independent global ratings group. A graduate of Linfield College in Oregon, Siegner puts his experience in business management along with his passion for personal liberty, limited government, and honest money into the development of Money Metals' brand and reach. This includes writing extensively on the bullion markets and their intersection with policy and world affairs.