Precious metals bulls question why metals prices keep falling in the face of what appears to be strong demand and great fundamental reasons for prices to move higher instead.

The bears have some answers of course. You can't eat gold, it's basically a pet rock and modern financial systems are doing just fine without anything as antiquated as bullion gumming up the works.

The bears are declaring victory and saying the market has spoken. They ought to look a bit deeper into recent developments.

Outside of the price action, there is very little to support claims that gold and silver are relics of the past.

"Just one ounce of registered gold now backs nearly 300 ounces in COMEX contracts."

Lately, the real answer to the bulls' question about why prices are headed lower isn't the stuff of a lengthy philosophical debate. These days, the answer seems to be a lot simpler; huge demand for physical metal hidden behind an enormous glut in paper supply. And the actual physical metals are shifting into new hands.

Without looking, you would never know that exchange inventories are falling – a combination of demand for physical bars and a dearth of sellers willing to furnish actual metals at the current price.

The natural dynamic is for prices to move higher, but the market has been completely overwhelmed by a huge increase in leverage. Unfortunately, there is no end to the supply of paper gold and silver contracts the trading exchanges will stack atop a shrinking layer of physical bars in their vaults.

The amount of paper gold has tripled...

Relative to “registered” stocks available for actual delivery. This has happened in just the past few months. Just one ounce of registered gold now backs nearly 300 ounces in COMEX contracts (as depicted in a chart we re-published last week from Zerohedge.com).

Stated another way, that's razor-thin coverage of just 0.0033. Trouble is brewing. About 1% of contract holders have been standing for delivery in recent years. So we could see requests to deliver 3 times more gold than is currently in the registered category in Exchange vaults.

To avoid default, the exchanges are going to need more registered gold. Luckily, there is another category of physical inventory available to draw against.

The vaults also hold “eligible” gold which can easily be converted to registered, provided the owners are willing. Bullion banks often move bars from the “eligible” category to “registered.” That is what they have been doing recently.

The problem is stocks of eligible gold are collapsing as well. TFMetalsReport.com reports that combined eligible and registered gold in the COMEX has fallen nearly 50% during the past 5 years.

It's a lot worse for JPMorgan Chase and Scotia Mocatta, two of the largest bullion banks. Since March the amount of eligible and registered gold in their vaults has fallen from 3,732,915 ounces to 1,515,825 ounces. That's a 59% drop in just the past few months. And December is historically the biggest month of the year when it comes to requests for physical delivery.

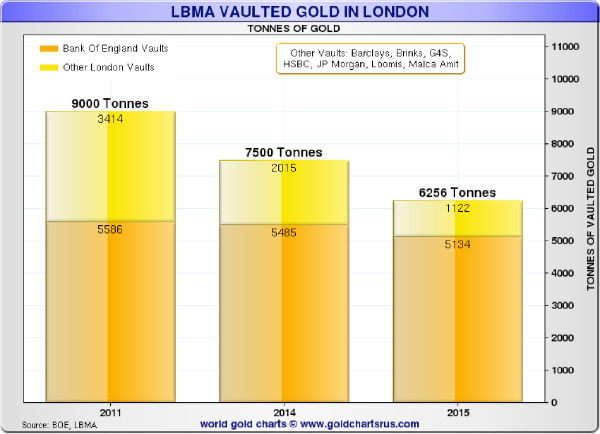

The drop in physical inventory isn't limited to COMEX vaults. Trouble is brewing in London's LBMA market – the world's largest exchange – as well. Ronan Manly authored a report estimating that LBMA stocks outside the Bank of England vaults have fallen by 67% since 2011.

However, the report estimates that ETFs hold 1,116 of the 1,122 tonnes remaining, leaving only 6 tonnes – roughly 200,000 ounces – really in play for delivery.

Consider that LBMA banks often trade 1,000 times that amount – 200,000,000 ounces – in paper gold per day, and you find the same completely untenable scenario.

The price is falling because exchanges around the world are happy to let traders and banks sell more and more metal they don't have and almost certainly can't get. On the other side are folks busily buying the paper gold and ignoring the metastasizing counterparty risk. And behind-the-scenes inventories are vanishing as players with greater concern take delivery of bars and head for the exit.

There is no telling how this scenario will end. It could end if spot prices rise to the point that sellers with actual bars show up to sell. Or we may see exchanges engulfed and destroyed by a massive wave of delivery defaults. Who knows?

However, given the explosion in leverage over the past few months, the question of when it will end may be easier to answer. The reckoning for metals markets may not be far ahead.

Are you interested in purchasing silver and gold? Check out our most popular coin, silver, and gold bullion American Eagle coins.

About the Author:

Clint Siegner is a Director at Money Metals Exchange, a precious metals dealer recently named "Best in the USA" by an independent global ratings group. A graduate of Linfield College in Oregon, Siegner puts his experience in business management along with his passion for personal liberty, limited government, and honest money into the development of Money Metals' brand and reach. This includes writing extensively on the bullion markets and their intersection with policy and world affairs.