One of the most powerful movies ever made – which eventually became a trilogy – Is The Lord of the Rings. In books and on the big screen, audiences flocked to the adventures of the Hobbits as they journeyed to the land of Mordor in an effort to destroy the One Ring before its power – in the wrong hands – could enslave Middle Earth. Of course, Bilbo Baggins himself was far from immune to the power of the ring, as it sought to "bend" his morality toward the dark side.

Based upon a three-volume work by J.R.R. Tolkien, the themes of bravery in the face of adversity, allegiance to duty, honor, and personal growth, resonates with audiences around the world to the extent that it has become the 40th-highest-grossing film of all time.

What's fascinating is that the idea of such a ring, which allows its wearer to become invisible, dates back to The Ring of Gyges, from Book II of Plato's Republic.

In the telling of this tale, the issue was one of whether or not a man who possesses the ring would be able to act in a just way... when he knew that he could behave however he chose and not face a consequence. Plato argued that the man who abuses the power of the ring would become a slave to his appetites, whereas the person who did not, would remain content and in control of himself.

One can see the significance of this argument because it looks at how people either constructively use or abuse great wealth and power – and what a challenge it tends to be, even for those of us with the most self-control!

Putting aside a discussion on the morality of finance – gold, silver, or any other object does not in and of itself possess an ethical quality – because being either "good" or "bad" ultimately depends solely upon how that "object" is put to use.

Today, I'd like you to consider a variation of the concept – a ring formed by the union of gold and silver into The One (Monetary) Ring, which would underlie and unite all other forms of financial exchange. Indeed, their price movements are over 90% correlated.

Gold-and-Silver: "One-Ring to Rule Them All"

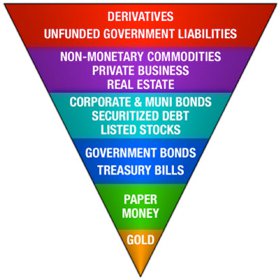

John Exter, in his inverted pyramid (see Rock, Paper, Scissors: Why Gold and Silver will Always Prevail here ), defined gold – and by implication silver – as the sole item upon which all other variations of financial instruments rested.

Exter's Inverted Financial Pyramid

Precious metals have no claim upon them other than by those who hold these metals at any given time. They can be exchanged for other goods and services, but their intrinsic value does not evolve from something else. In this light, ALL other instruments – paper currencies, corporate and government bonds, stocks, unfunded government liabilities and derivatives, even real estate – are simply by-products of what Exter called "Power Money" – gold (and silver).

Nowadays, in Japan, the countries of the European Union, China, and especially in the U.S., underfunded government programs, pension funds, and bond holdings have created a debt overhang that any rational person must admit can never be paid back in a normal manner. Instead, debtors will either "whittle down" the real value via inflation, or simply default on the debts themselves.

Add derivative contracts written on many of these debt categories – the notational value of which has soared into trillions of dollars – and it's apparent just how far out of whack the global financial pyramid has become. Now do you see why Money Metals Exchange and David Morgan of TheMorganReport.com have so often – and so correctly – referred to gold and silver as "honest money" – and to virtually all the un-backed derivations resting above it as "paper promises"?

“Gold is the universal prize in all countries, all cultures, and in all ages.”

- Physicist and polymath, Jacob Bronowski, Ascent of Man

As it dawns on enough people that the sea of debt we've generated can never be repaid without hyperinflation or outright debt repudiation, it's almost a given that gold and silver will be looked upon as the one underlying asset class which can restore fiscal responsibility and confidence to a financial system gravely distorted by mismanagement, short-sighted "decision-making," and simple greed.

Would this be a new concept? Of course not! Such an outcome has been seen many times throughout history, as virtually EVERY "experiment" with fiat currencies has failed due to the behavior of those who have corrupted them, in due time reducing the value of each sea of "paper promises" to no more than the ink and paper upon which they were printed – in effect – to zero.

J.R.R. Tolkien's words ring out strongly to us today as we seek to undo what decades of financial chicanery and an ignorance of history have foisted upon us. Fill in the blank below for your favorite municipality, state, or country.)

One Ring to rule them all, One Ring to find them,

One Ring to bring them all and in the darkness bind them

In the Land of (______) Mordor where the Shadows lie.

In 2011, for the first time in 20 years, European central banks became net buyers of gold, even as they continue to dismiss its utility in today's financial arena. Gee, I wonder why. You can wait to find out the obvious answer or make a decision now to hold your supply of precious metals. Then sooner or later, just like the money-lenders themselves, you too will be able to "laugh all the way to the bank."

About the Author:

David H. Smith is the Senior Analyst for TheMorganReport.com, a regular contributor to MoneyMetals.com as well as the LODE digital Gold and Silver Project. He has investigated precious metals mines and exploration sites in Argentina, Chile, Peru, Mexico, Bolivia, China, Canada, and the U.S. He shares resource sector observations with readers, the media, and North American investment conference attendees.