Investors bought some gold last week as they fled the stock market. It was the worst performance ever for stocks in an opening week for any year on record. Unfortunately for stock market bulls, the selloff carries big implications for the rest of the year. According to WSJ Market Data Group, the performance of the S&P 500 during the first 5 trading days of the year foretells the direction of U.S. markets for the balance of the year 68% of the time.

What drove last week’s selling? One catalyst was the jobs report, which significantly beat expectations. Yet again, the good news is bad news.

Stimulus-addicted markets anticipate more rate hikes and they are having withdrawals.

One reality of today’s perverse markets is that equity investors find themselves having to root for higher unemployment. It seems stock prices have more riding on continued easy money from the Fed than on whether or not companies are hiring.

The devastation in stocks began in China and spread around the globe. World markets lost $2.3 trillion in value collectively. Gold and silver fared much better. Gold rose 4% for the week. Not too shabby compared to the 6% drop in U.S. stocks. Silver did not perform as well -- finishing just a hair above flat for the week.

Supply Outlook Worsens after Worst Year for Mining Since 1986

Stock investors read Friday’s employment report and reacted to the much better-than-expected headline data on job creation by dumping shares. The U.S. economy added an estimated 292,000 jobs, but they weren’t impressed. In part because some concluded the Fed is more likely to hike rates again, as mentioned above. Others looked deeper into the report and found little to like.

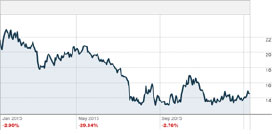

Market Vectors® Gold Miners ETF

The report caps the worst year for U.S. miners since 1986. The December report details the 12th consecutive month of job losses according to Mining.com. Producers slashed 129,000 jobs last year, and 2015 is the first year since 2009 that employment in the sector shrank.

Look past the headline number of 292,000 jobs and you’ll find the vast majority of them were created via “seasonal adjustment.” BLS officials counted 11,000 actual jobs, then tossed in 281,000 more, for good measure.

Bureaucrats prefer theory to facts. They want you to believe it is appropriate to add all of these theoretical jobs because 1) they couldn’t count actual jobs. Lots of people take holiday vacations. Or 2) the economy would have created jobs if it weren’t for cold weather. December is usually colder than November.

David Stockman, who served as director of the Office of Management and Budget under Ronald Reagan, does a good job of dissecting Friday’s report. Bureaucrats aren’t letting facts get in the way of a good story. Never mind that December was warmer than usual or that employment associated with bricks and mortar retail, particularly around the pivotal holiday season, is in decline as more and more consumers shop online.

David Stockman, who served as director of the Office of Management and Budget under Ronald Reagan, does a good job of dissecting Friday’s report. Bureaucrats aren’t letting facts get in the way of a good story. Never mind that December was warmer than usual or that employment associated with bricks and mortar retail, particularly around the pivotal holiday season, is in decline as more and more consumers shop online.

The report provides additional confirmation that the supply of anything miners produce is likely to fall significantly in 2016.

That certainly isn’t good news for the U.S. economy, but it is likely to support higher prices for coal and base metals as well as gold and silver.

Precious metals prices can benefit in two ways. Falling supply should support prices directly. And, if we see higher prices for mined commodities, those markets will be signaling inflation rather than deflation, which ought to encourage investors to position accordingly.

About the Author:

Clint Siegner is a Director at Money Metals Exchange, a precious metals dealer recently named "Best in the USA" by an independent global ratings group. A graduate of Linfield College in Oregon, Siegner puts his experience in business management along with his passion for personal liberty, limited government, and honest money into the development of Money Metals' brand and reach. This includes writing extensively on the bullion markets and their intersection with policy and world affairs.