There has been a lot of discussion on the remaining global supply of certain precious metals in the alternative media. I continue to read articles that state there are only ten years' worth of silver remaining. Unfortunately, many of these figures are inaccurate. So, I thought I would provide an update based on recent USGS – United States Geological Survey data and information.

For example, some analysts continue to say there are only ten years worth of silver reserves remaining. This was true back in 2009 before the USGS updated their figures. Unfortunately, the USGS had not updated their silver reserve figures for quite some time and the higher silver price (including higher prices for metals associated with by-product silver production) was an additional factor that led to much higher silver reserve estimates in the following years.

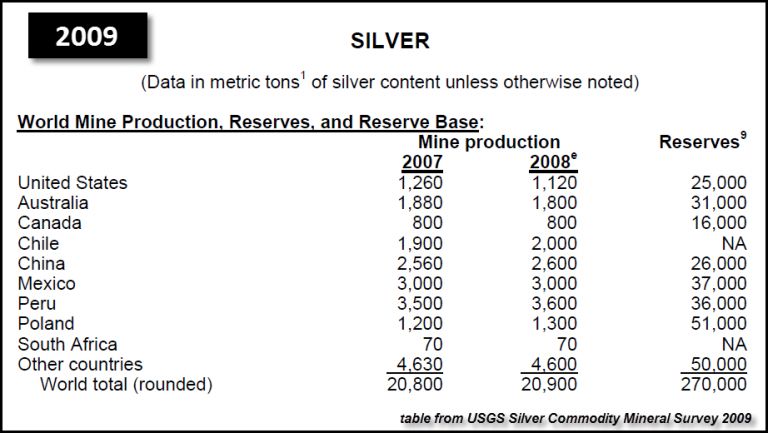

Here is a table from the USGS Silver Commodity Mineral Survey in 2009:

Silver Reserves

If we take the estimated silver reserves (2009) of 270,000 metric tons (mt) and divide them by the annual production of 20,900 mt in 2008, that would equal 12.9 years' worth of remaining reserves. Again, this is where many in the precious metals community state that there are only ten years (close enough) worth of silver remaining.

However, the USGS started revising their silver reserve figures in the following years and also replaced the “NA” information in the table above with actual reserves. Basically, the low silver price in the early 2000s did not motivate governments to revise their silver reserves. But, as the price of silver started to skyrocket after 2009, well then, it was time to put some REAL VALUE into these silver reserves.

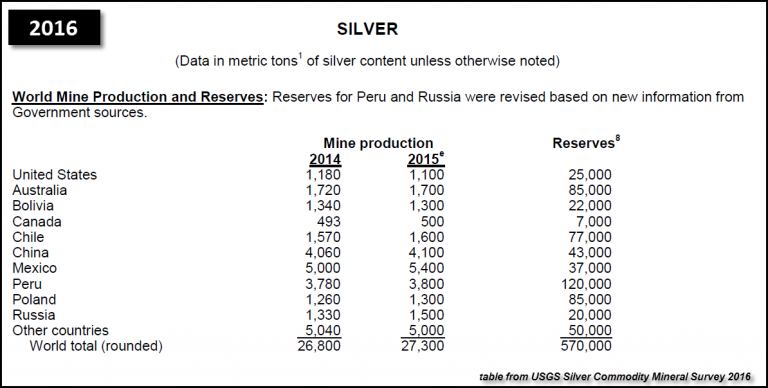

Here is the most recent table by the USGS, of global silver reserves:

According to the USGS, total global silver reserves are now 570,000 mt. Thus, if we divide the 2015 production of 27,300 mt, we end up with 20 years' worth of global silver reserves remaining... at current rates of annual production. You will notice, that Chile now has silver reserves of 77,000 mt for 2015. However, the USGS had a “NA” next to Chile’s silver reserves in its 2009 Silver Commodity Summary.

Furthermore, the top three countries (Peru, Australia & Poland) account for 51% of the total world silver reserves at 290,000 mt.

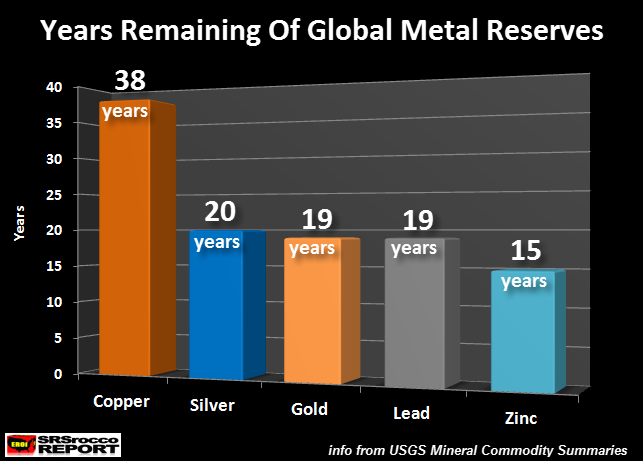

That being said, here is a chart showing the years remaining of the top global precious and base metals:

According to the USGS, copper has the largest amount of reserves remaining at 38 years compared to silver (20 years), gold (19 years), lead (19 years), and zinc (15 years). Of the five metals shown in the chart above, silver has the second highest amount of reserves, based on years worth of supply remaining.

Interestingly, zinc has the least amount of metal reserves, at only 15 years of supply. Regardless, these official estimates are based upon business as usual continuing in the global economy for the next 30-40 years. While these reserve estimates provide an “official gauge” as to how many years' worth of supply of each metal is remaining, I doubt they will last that long.

This will be due to the peak and decline of global oil production as well as the continued collapse of net energy from oil supplied to the market. That being said, silver reserves will likely fall the most as 70% of silver production comes as a by-product of base metal and gold production.

Once the global oil industry disintegrates under the weight of falling prices as costs continue to rise, the decline of base metal and gold production will impact silver the greatest. Not only will silver reserves plummet to a greater degree versus the other metal reserves but so will its annual production rate.

These two factors will make the future supply of silver more vulnerable than most other metals... even gold.

About the Author:

Independent researcher Steve St. Angelo started to invest in precious metals in 2002. In 2008, he began researching areas of the gold and silver market that the majority of the precious metal analyst community has left unexplored. These areas include how energy and the falling EROI – Energy Returned On Invested – stand to impact the mining industry, precious metals, paper assets, and the overall economy.