Answering the Most Common and Current Objections

Gold attracts its fair share of detractors. But the most common objections to gold as money, and as a safe-haven asset within an investment portfolio, are misplaced. Anti-gold myths are ubiquitous.

Mega billionaire Warren Buffett remarked derisively of gold that it “gets dug out of the ground in Africa, or someplace. Then we melt it down, dig another hole, bury it again, and pay people to stand around guarding it. It has no utility.”

That brings us to the first thing precious metals naysayers get wrong…

Myth #1: “Gold has no utility.”

Warren Buffett is without question one of the world’s greatest investors. But he is not without biases.

Buffett’s primary business interests are in banking and insurance.

He has made fortunes off the fiat monetary regime. He took part in (and benefited from) the government bailouts of the financial system. He (along with most other Wall Street and banking titans) supported Hillary Clinton for president.

So maybe, just maybe, Buffett’s hostility to gold has something to do with his deep, symbiotic connections to the political, banking, and monetary establishments!

In any event, the claim that gold has no utility is false. It's been chosen by the market as money because of its many useful features, including fungibility, divisibility, durability, and rarity. Gold also functions as a store of value precisely because it, unlike Federal Reserve notes, has uses beyond that of a currency.

Even if gold weren’t hoarded in vaults, people would still dig it out of the ground at great cost for its uses in electronics, jewelry, art, and architecture. In an economic sense, $50,000 in physical gold is just as useful as a $50,000 sports car – as determined by the market.

Myth #2. “Gold is the money of the past. Digital cryptocurrencies are the money of the future.”

Every generation comes up with some new reason to regard gold as a “barbarous relic.” Previously it was the advent of paper money. Then the creation of the Federal Reserve. Now the rise of internet-based cryptocurrencies is hailed by some as a technology that will render gold obsolete as money.

The reality is that no paper or electronic currencies ever have or ever could replicate the unique monetary properties of gold. Central banks continue to accumulate it. And new cryptocurrencies backed by gold and silver are in the works.

A cryptocurrency that combines the convenience of digital transactions with the security of metal backing could ultimately knock Bitcoin off its perch – and be a source of billions of dollars in new demand for gold and/or silver.

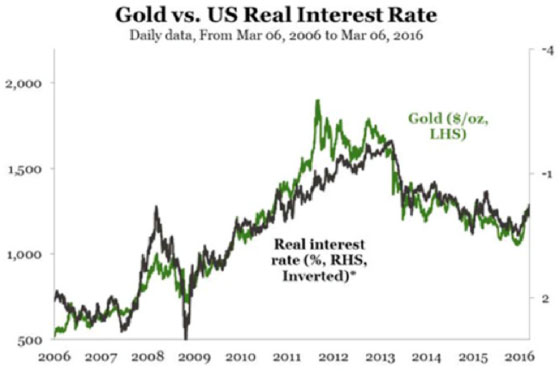

Myth #3. “Precious metals markets can’t go up while the Fed is raising interest rates.”

The persistence of this myth is surprising given how often in market history it has been dispelled. Gold prices hit a major bottom in December 2015 just as the Fed initiated its first interest rate hike. Gold and silver rallied big during the rate hiking campaign from 2014 to 2016. Back in the late 1970s as interest rates rose dramatically into the double digits, gold prices rose in tandem – until, finally, nominal interest rates exceeded the inflation rate by 1980.

The direction of the gold price is keyed into real interest rates, not nominal rates. When real rates are negative or inflation expectations are rising, that tends to be bullish for precious metals.

Myth #4. “If the economy crashes, then so will gold.”

Gold is one of the least economically sensitive assets you can hold as an investor. The yellow metal exhibits virtually no long-term correlation with the stock, bond, or housing markets – and a relatively low correlation with industrial commodities such as oil and copper.

When every sector of the stock market including mining stocks crashed in 2008, gold itself managed to eke out a positive gain for the year. Gold isn’t impervious to economic shocks that may affect things like demand for jewelry, but safe-haven buying by investors is often more than enough to pick up the slack.

Myth #5. “Ordinary investors can’t win in gold and silver markets that are manipulated.”

A distinction needs to be made between physical metals markets and manipulated paper markets. Most of the manipulation that occurs in futures (paper) markets is done for short-term technical purposes – to game a few cents on bid/ask spreads, break resistance levels, force options to expire worthless, etc.

Ordinary investors absolutely should not try to trade the paper markets. They won’t beat the big banks and other institutional traders at their own game.

To the extent that paper prices are artificially suppressed, however, that’s an advantage for buyers of physical metal.

They can obtain it at a discount.

Meanwhile, artificially low prices serve as a disincentive to new mining production, which makes the long-term supply/demand fundamentals for gold and silver even more favorable.

Myth #6. “Gold pays no interest so it’s therefore a poor investment.”

Warren Buffett’s Berkshire Hathaway shares pay no interest or dividends. Venezuelan junk bonds yield more than 50%. Which is the better investment?

Obviously, the size of the nominal yield doesn’t in itself tell you whether a financial asset is a good investment. Even the “safe” yield provided by U.S. Treasury securities isn’t safe from inflation. Or from taxation.

Since physical precious metals aren’t debt instruments and therefore pay no interest, their inflationary upside potential is all tax-deferred growth. You owe no taxes until you sell (or take distributions from a traditional IRA).

About the Author:

Stefan Gleason is CEO of Money Metals Exchange, the company recently named "Best Overall Online Precious Metals Dealer" by Investopedia. A graduate of the University of Florida, Gleason is a seasoned business leader, investor, political strategist, and grassroots activist. Gleason has frequently appeared on national television networks such as CNN, FoxNews, and CNBC and in hundreds of publications such as the Wall Street Journal, TheStreet, and Seeking Alpha.