Silver currently sells for around $16, which would be sensible if the U.S. national debt was much less than its current $20 trillion.

Given the massive national debt and 100 years of experience, silver prices could easily be double or triple their current prices, and far higher in a panic.

WHY?

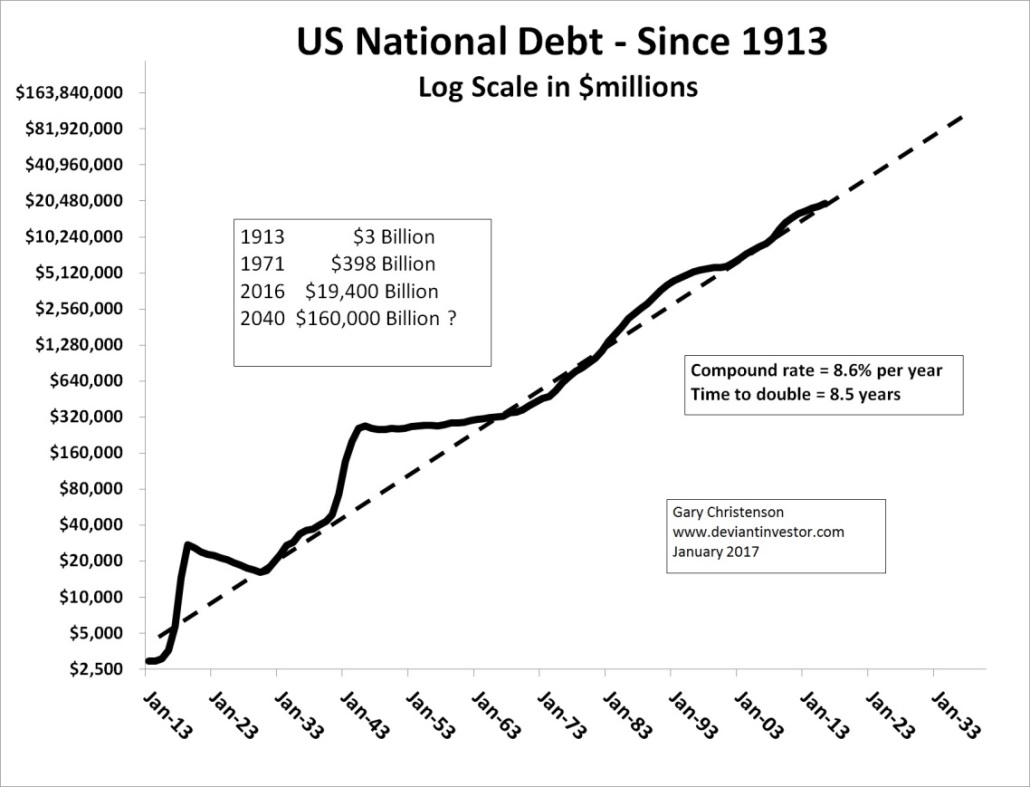

Examine over a century of official national debt data graphed on a log scale. Official debt in 1913 was $3 billion. Since then it has risen 8% to 9% every year to reach $20 trillion or $20,000 billion. Debt will continue rising as long as politicians spend and bankers lend.

Proof: Name the Senators, Representatives, Presidents, military contractors, pharmaceutical companies, and Medicare recipients who wish to see the government reduce expenses.

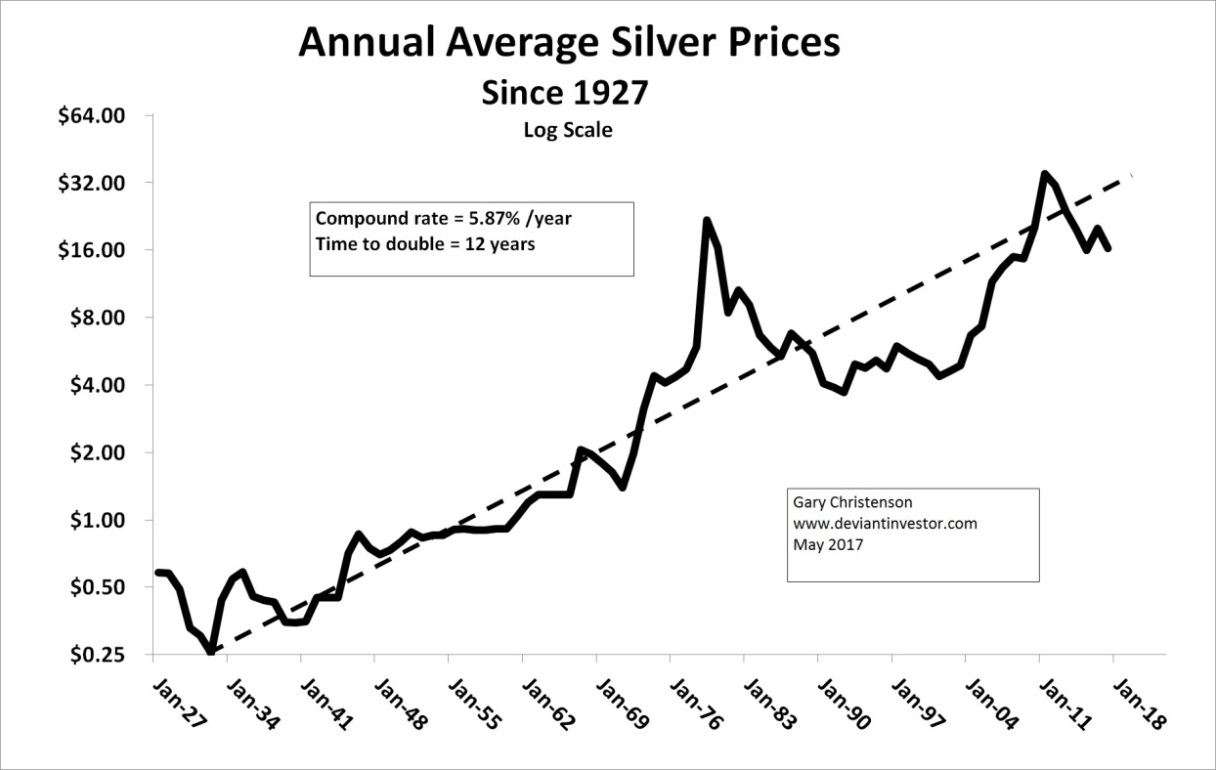

Silver prices have increased, but more slowly than the national debt, as dollars have been devalued for over a century.

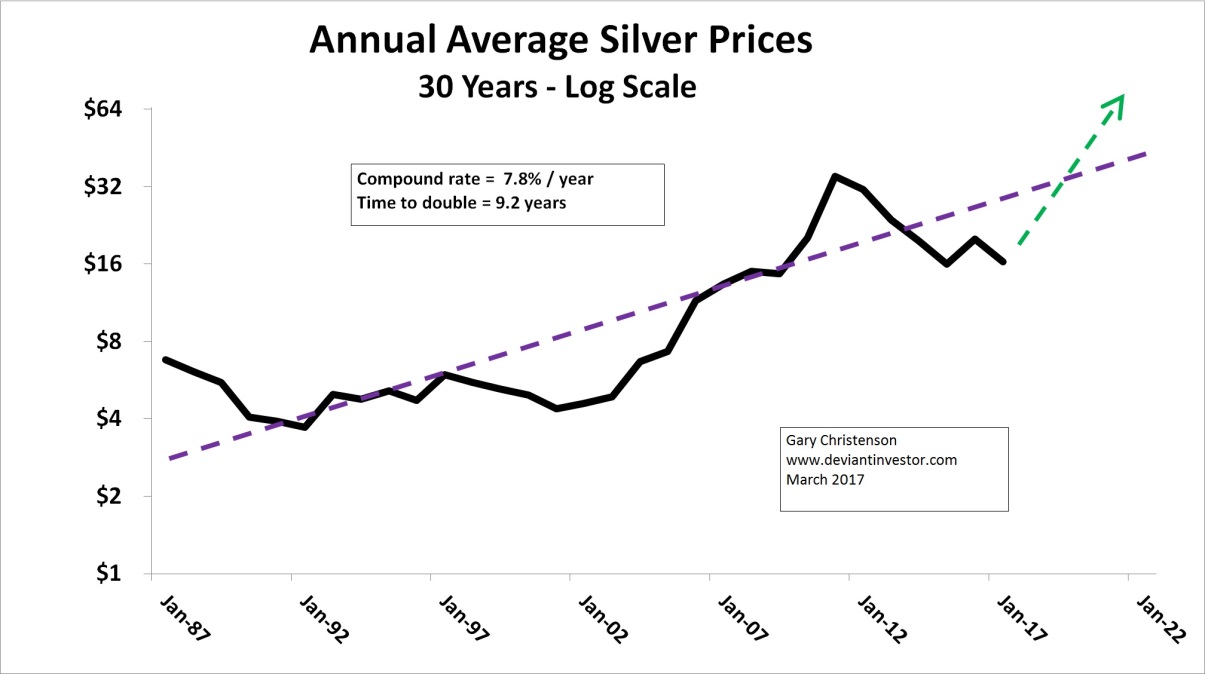

Silver prices, after the 1980 bubble and crash, have increased erratically since their low in 1993 at $3.51. The exponential trend line, as drawn, indicates that silver prices in mid-2017 are well below their long-term trend. Daily silver prices exceeded $48 in April 2011 before crashing back to $13.60 in late 2015.

Silver prices are, in the big picture, too low and will rise above their exponential trend.

CONSIDER RATIOS:

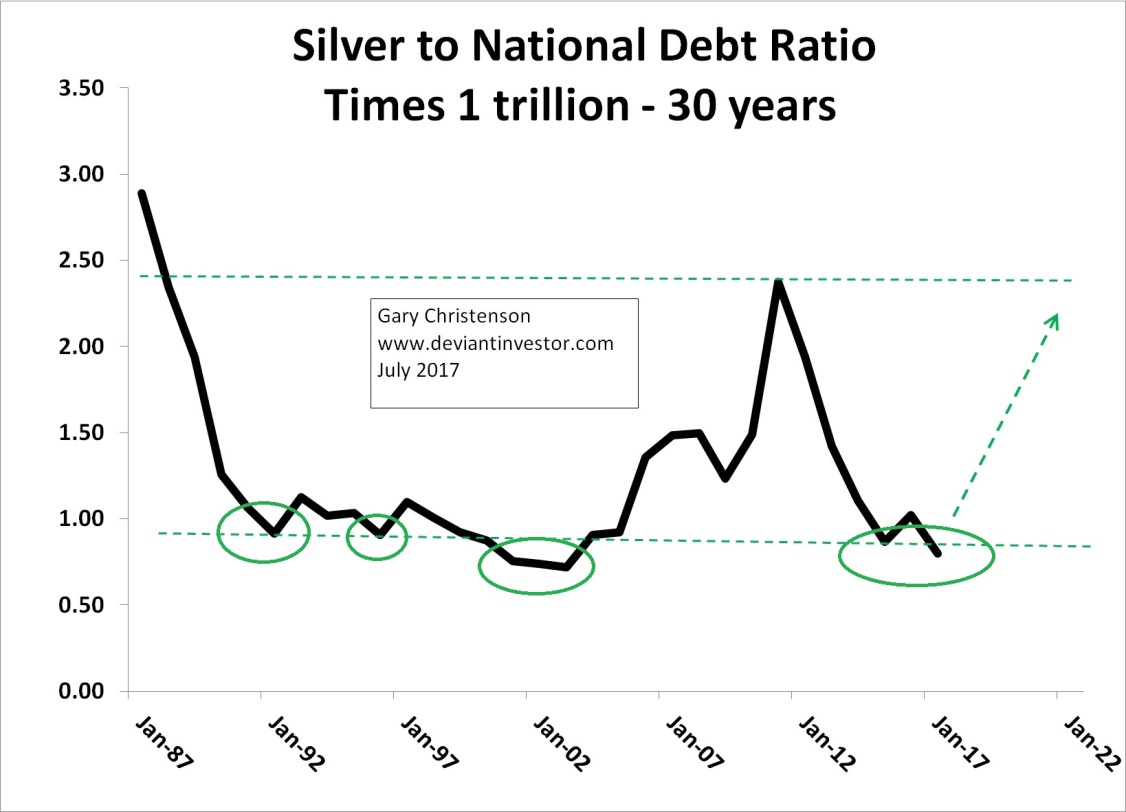

Multiply average annual silver prices by one trillion and divide by the ever-increasing national debt. For the past 30 years, the ratio has ranged between 0.7 and 2.9. The ratio is currently very low at about 0.8. Someday silver prices will rally substantially and force the ratio toward 3 and higher. For comparison the ratio, using average annual silver prices, reached 26 in 1980, and surpassed 50 using the daily prices for silver.

SUMMARY:

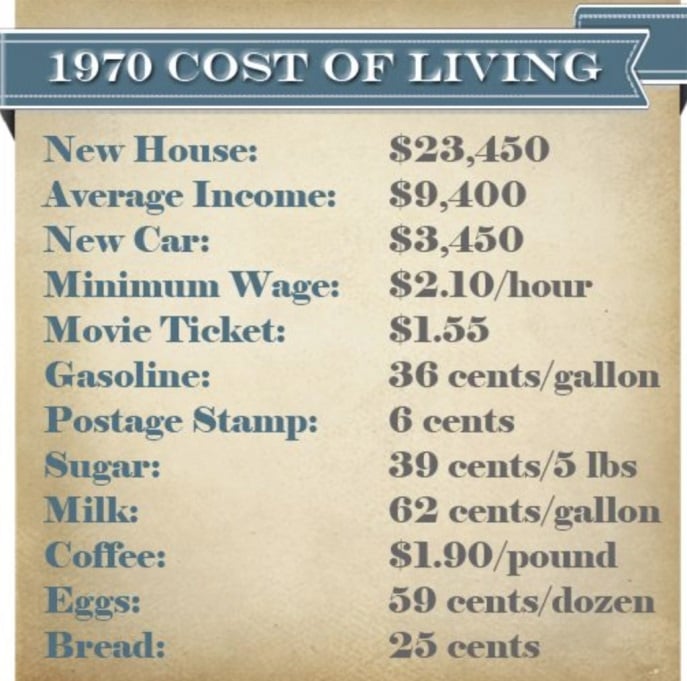

- Politicians spend and bankers lend. Debt increases, total dollars in circulation increase, and dollars purchase less. Prices for stocks, commodities, food, energy, gold, silver, beer, and many others rise.

- Silver prices have risen erratically but inevitably, along with debt and most consumer prices, for decades. As of July 2017 silver prices, compared to the national debt, are too low and will rise.

- The next rally in silver bullion sales should be huge based on the prospects for expanded war, financial chaos, and central bank “printing” that will devalue all currencies.

Silver will sell for $100 per ounce! Impossible? Look at price increases for Amazon ($6 to $1,000 in 16 years), Bitcoin, and many others. Yes, $100 silver (and higher) seems likely within a few years.

About the Author:

Gary Christenson is the owner and writer for the popular and contrarian investment site Deviant Investor and the author of several books, including Fort Knox Down! and Gold Value and Gold Prices 1971 – 2021. He is a retired accountant and business manager with 30 years of experience studying markets, investing, and trading. He writes about investing, gold, silver, the economy, and central banking.