Global stock and bond markets: Watch out below!

I discussed over-priced markets here and here and here.

2017 was an outstanding year in many markets.

- DOW is up 24.7%

- NASDAQ 100 is up 31% (Wow!)

- Nikkei is up 19%

- DAX is up 12%

- Gold is up 13.6%

- Silver is up 7.1%

- XAU (gold mining stocks) Index is up 8%

- Dollar Index is DOWN 10%

We can be certain of the following:

- Death, Taxes, and Politics.

- When markets move too far and too fast in either direction, they correct.

- Bubbles crash!

So What?

We live with the inevitability of death, and the predations of taxes and politics. Stock markets rise as the dollar inevitably devalues, and as investors become optimistic (higher P/E ratios). Stock prices fall when investors lose faith in the narrative that things are good, central banks are in control, this time is different… whatever. P/E ratios fall as investors lose confidence or earnings weaken.

Where are stock prices now?

Examine the 26-year chart of the DOW.

- Prices accelerated into a near-vertical (unsustainable) rise and corrected.

- The monthly and weekly RSI (Relative Strength—one of many timing indicators) reached all-time highs (over 116 years). The DOW moved too far and too fast, and then, as always, corrected.

- A high RSI (like late January 2018) shows high risk. It does NOT guarantee a turndown. Bubble markets often move from crazy (December 2017) to even more crazy (January 2018). And then they correct or crash!

Examine the 26-year chart of the NASDAQ 100.

- Same as the DOW – a near vertical rise and up over 30% in 2017.

- RSI reached high-risk and unsustainable levels.

- The NASDAQ (including Apple, Amazon, Facebook, Netflix, and others) in January 2018 reminded me of 1999 when people were glued to CNBC watching their “internet stocks” rise to the sky. The consequences were ugly and the NASDAQ 100 fell 84%.

Examine the German DAX. This market is correcting. The peak was January 23. We shall see if central bankers can manufacture another rally, or not.

Conclusions and Actions:

Stock Indices have moved too far, too fast, were over-bought at the end of January, and are ready to correct. The daily peaks, so far, have been:

Bitcoin December 2017

DAX January 23, 2018

Nikkei January 23, 2018

DOW January 26, 2018

NASDAQ January 26, 2018

Action: Stock market risk is high while the potential reward is low. Don’t expect the correction to finish soon. Expect wild volatility, up and down! Consider moving profits and capital into something with less risk and more safety. Silver, gold, platinum, and cash come to mind.

What Others Think:

From the always brilliant John Hussman, Ph.D.: Three Delusions: Paper Wealth, a Booming Economy, and Bitcoin

“So even given the level of interest rates, we expect a market loss of about -65% to complete the current speculative market cycle.”

“At present, U.S. investors are under the delusion that the $37.3 trillion of paper wealth in their equity portfolios represents durable purchasing power. Unfortunately, as in 2000 and 2007, they are likely to observe an evaporation of this paper wealth. Nobody will ‘get’ that wealth. It will simply vanish.”

Note to readers: If you cash out paper wealth from overvalued stock markets (and bonds and Bitcoin) and place that capital into gold and preferably silver, the wealth and purchasing power will NOT vanish.

“Warren Buffett’s Favorite Indicator Just Flashed Warning”

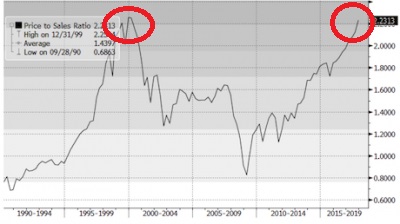

The stock market capitalization ratio to GDP (Buffett Indicator – not shown) is too high. The price-sales ratio is at all-time highs. These indicate bubble valuations and high stock market risk.

From David Stockman in December 2017: Gold and Silver Only Safe Asset Left

“Stock prices are going to collapse big time when the underlying predicate of cheap debt, massive stock buybacks and M&A deals and everything else supporting the market today finally reverses. So, we are going to have deflation in the canyons of Wall Street, and that will not be a happy day.”

From Wolf Richter in late December 2017: Peak Good Times? Stock Market Risk Spikes to New High

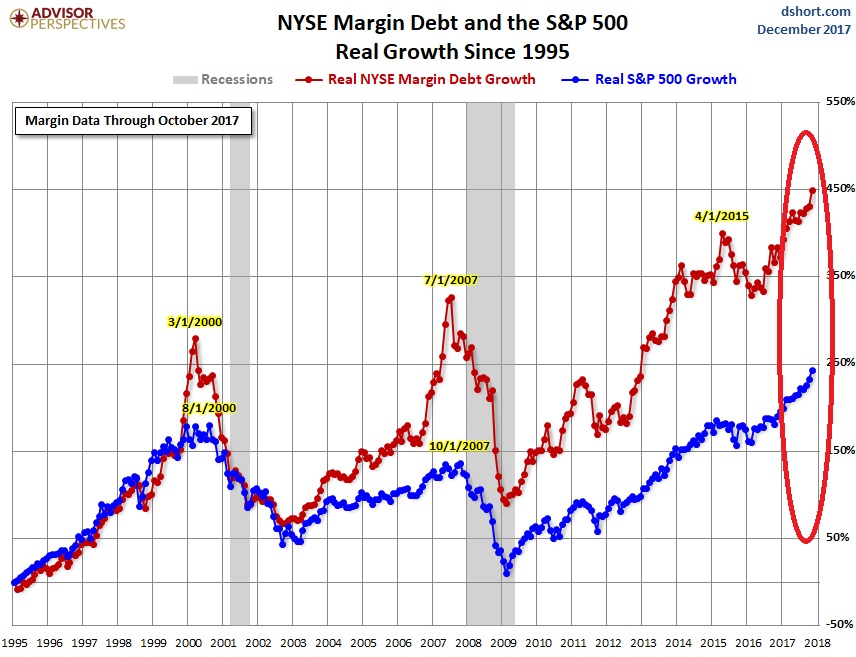

“The growth in margin debt has far outpaced the growth of the S&P 500 Index in recent years. The chart below (by Advisor Perspectives) shows the percentage growth of margin debt and the S&P 500 index, both adjusted for inflation:

“In other words, the stock market is far more leveraged than it has ever been before.”

BONDS: They Move Opposite to Yields

Martin Armstrong in December 2017: We Are In the Biggest Bond Bubble In History

A declining or crashing bond market means much higher interest rates. After 35 years of declining yields, most people have no memory of higher rates.

From Armstrong: “Our computers are showing that interest rates are going to go up faster than anybody has ever seen in history.”

How long can central banks maintain near zero rates (U.S.) or negative rates (Europe)? Such craziness cannot continue forever without massive and destructive consequences.

Graham Summers sees “The Everything Bubble,” a breakout higher in the yields on 10 Year Notes, and higher consumer price inflation.

“When the Bond Bubble bursts, the EVERYTHING bubble follows.”

Bonds have risen in a bull market from the early 1980s until 2016. But yields are now rising from mid-2016 lows. However, other astute individuals believe yields must fall again, partially because over-indebted global governments will demand suppressed yields so they can spend less on interest expenses. We’ll see.

With yields so low (negative in several European countries), how much lower can they go? Bonds look like a high-risk and minimal-reward investment during 2018 for most investors. Consider moving capital out of the debt markets and into something real.

Ask Yourself:

How sensible is buying dodgy debt paper from insolvent governments – yielding peanuts – when those governments have assured you they will repay (if they do) with devalued currencies? Argentina sold 100-year bonds to “yield-starved” investors. Insanity!

Conclusions:

Stock Markets: Prices and valuations, even after the losses from the past two weeks, are too high. John Hussman, Ph.D. expects a drop of 65% or more. Do your due diligence, but consider moving capital to safer investments, such as silver bullion and coins.

Bonds: The 35-year bull market looks tired or dead. Yields are negative in much of Europe. Pension plans are increasingly insolvent (Look at CalPERS) thanks to the central bank and government-created low yields on dodgy debt. The bubble in sovereign debt could implode in 2018 with ugly consequences for currencies, bonds, economies, governments, and central bankers. Gold and silver prices will rise.

Convert over-valued stocks, idle cash, devaluing currencies, corporate debt, and dodgy sovereign debt to something real.

About the Author:

Gary Christenson is the owner and writer for the popular and contrarian investment site Deviant Investor and the author of several books, including Fort Knox Down! and Gold Value and Gold Prices 1971 – 2021. He is a retired accountant and business manager with 30 years of experience studying markets, investing, and trading. He writes about investing, gold, silver, the economy, and central banking.