The Silver Market is setting up for one heck of a move higher as investors are waiting for the signal to start buying. While the silver price has shot up due recently, it still isn’t clear if this is the beginning of a longer-term uptrend. The reason for the quick spike in silver was likely due to a small short-covering rally by the Large Speculators trading on the Comex.

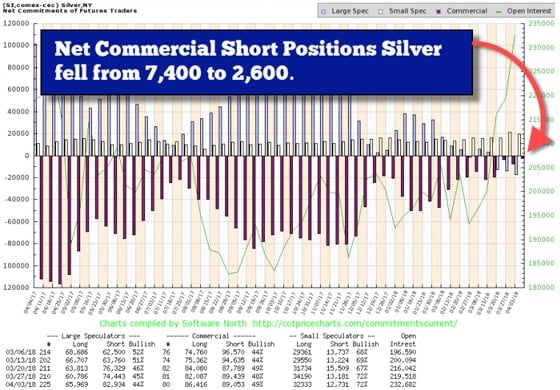

For the first time in quite a while, the Large Speculators (Specs) were net short silver. For example, the Large Specs were net long by more than 100,000 contracts last year when the silver price was $18.50. However, the last COT Report showed that the Large Specs were net short silver by 17,000 contracts:

The Large Specs are shown in the Light Blue bars. Typically, the Large Specs are long, not short silver. You can see the Large Specs going short three weeks ago as their light blue bars turned down. On the other hand, the Commercials (in Red) are usually net short. However, the Commercials had the lowest net short position in years. So, to see the price of silver shoot by nearly $1.00 in a few days isn’t surprising when I have seen this setup for a few weeks.

However, it’s difficult to know if this is the start of a long uptrend in the silver price. It’s coming, but I just don’t know if this is it yet. We will know when the Silver price is making a big move when it finally gets above $20 as the broader markets crash. Now, many silver investors might be a bit frustrated because silver sentiment and investment demand dropped to a low last year.

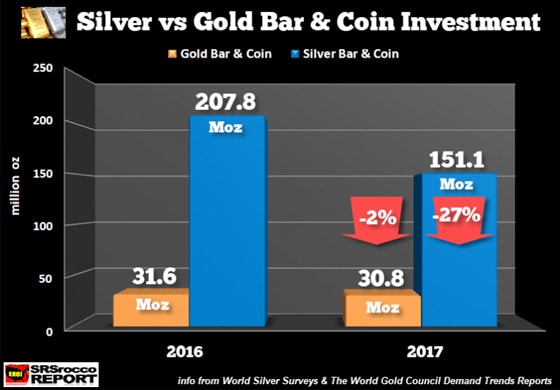

In 2017, demand for silver declined as investors were lured into the stock and crypto market bubbles. According to the data put out by the 2018 World Silver Survey, total Global Silver Bar & Coin demand declined from 207.8 million oz (Moz) in 2016 to 151.1 Moz last year. As we can see in the chart below, global silver bar and coin demand fell by 27% compared to 2% for physical gold investment:

The World Gold Council reports that global gold bar and coin demand fell to 30.8 Moz last year versus 31.6 Moz in 2016. However, the decline in physical gold investment would have been even more substantial if it wasn’t for gains from China, Turkey, and the Middle East to offset significant reductions in the United States. Gold bar and coin demand fell by 58% in the United States last year. And we saw the same trend take place in the silver market.

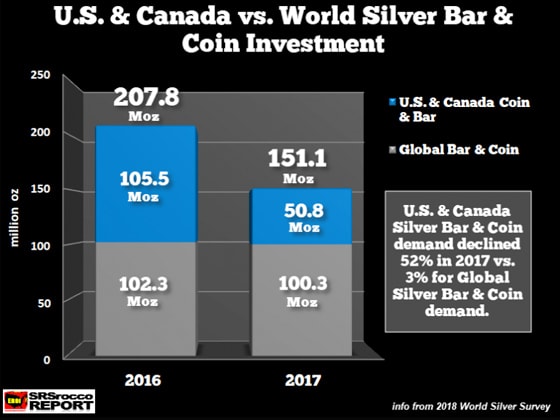

The majority of the decline in silver bullion bar and coin demand took place in the U.S. and Canadian markets. As the chart below shows, U.S. and Canadian silver bar and coin demand fell by 52% from 105.5 Moz in 2016 to 50.8 Moz last year. However, global physical silver investment only declined by two million ounces:

While silver investment demand decreased significantly in the West, India’s Silver bullion imports increased by 17% in 2017. So, silver investment demand wasn’t down across all countries or regions. However, the majority of the decline in the West was due to the 36 Moz decrease in U.S. silver bar and coin demand (2018 World Silver Survey).

According to my analysis, demand for physical silver and gold investment declined last year in the United States due to three reasons:

- Election of Trump as President changed the psychology of the Alt-Media community in that there was less motivation to purchase precious metals, prepping-survival goods, firearms, and ammo.

- The continued bubbly rally in the broader equity markets and tech stocks

- The massive increase in Bitcoin and Crypto-currencies in 2017.

Unfortunately, 99% of investors continue to pile into extremely overvalued and highly leveraged-margined assets in history. The value of stocks, bonds, and real estate are at the highest levels ever while the world’s oil industry is coming under a great deal of pressure that few are aware of.

The U.S. Shale Oil and Gas Industry is a $250+ billion Ponzi Scheme that Bernie Madoff would be jealous of. So, the BIG MOVE in silver is likely to occur right when the broader markets and the oil price collapse in unison.

About the Author:

Independent researcher Steve St. Angelo started to invest in precious metals in 2002. In 2008, he began researching areas of the gold and silver market that the majority of the precious metal analyst community has left unexplored. These areas include how energy and the falling EROI – Energy Returned On Invested – stand to impact the mining industry, precious metals, paper assets, and the overall economy.