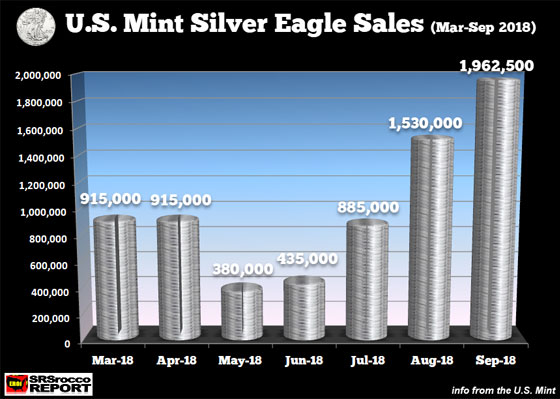

The sales of Silver Eagles surged in September as the U.S. Mint removed its temporary supply restriction. As the silver price continued to trend to new lows at the beginning of the month, several large purchases of Silver Eagles by Authorized Dealers wiped out the inventory at the U.S. Mint. The U.S. Mint had cut back on its monthly supply due to the falling demand.

However, now that the U.S. Mint has resumed sales of Silver Eagles, they have reached over 1.9 million, up 28% compared to August, and there are still ten days remaining in the month. Silver Eagle sales so far in September are the highest all year, except for the usual spike in January when the Authorized Dealers are stocking up on the newly released coin.

As we can see in the chart below, Silver Eagle sales have jumped in August and September due to the lower silver spot price:

According to the figures released by the U.S. Mint, Silver Eagle sales fell to a low of only 380,000 in May. However, sales started to pick up in July and have continued to increase each month. Interestingly, Silver Eagle sales in the two months of August and September are about the same for the previous five months.

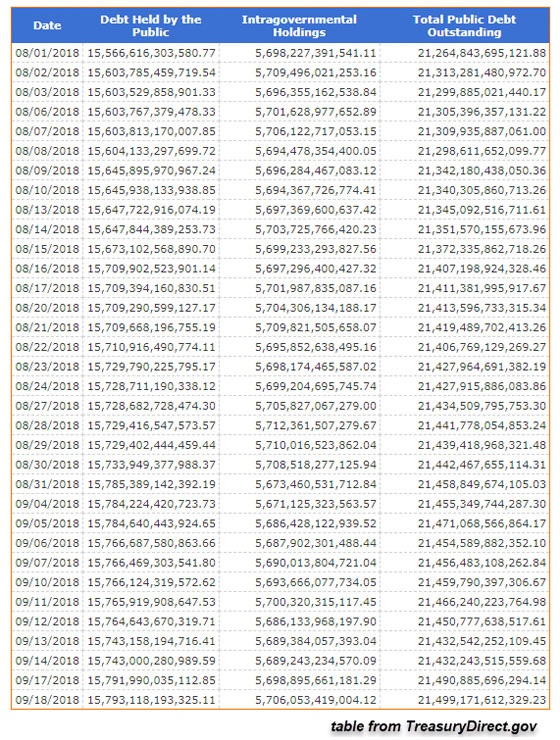

Total sales of Silver Eagles to date in 2018 are 11.2 million. The total cost to purchase these 11.2 million Silver Eagles at $20, would equal $224 million. Now, I just used a round $20 figure; the actual cost is likely a bit less. However, I wanted to compare the Silver Eagle market to the increase in U.S. public debt since August 1st.

In just the past seven weeks, the U.S. Debt has increased by a stunning $235 billion:

On August 1st, the U.S. debt was $21.26 trillion, and as of yesterday, it rose to nearly $21.5 trillion. So, how many Silver Eagles could be purchased with $235 billion??? How about 11.7 billion Silver Eagles… LOL. That’s a lot of Silver Eagles.

The U.S. Mint has sold a total of 515 million Silver Eagles since it started the program in 1986. So, going by the 515 million oz of Silver Eagles sold since 1986, how many years would it take the U.S. Mint to sell 11.7 billion of the official silver coin at the same rate? How about 750 years?

Americans have no idea how completely insane the state of the financial system is. It is built on an extreme level of leverage and debt. While leverage and debt can go up longer than most realize, it still has an EXPIRATION DATE.

I believe when the markets finally roll over, and we experience another crash similar to 2008-2009, we are likely going to see demand for physical precious metals like we have never seen before.

About the Author:

Independent researcher Steve St. Angelo started to invest in precious metals in 2002. In 2008, he began researching areas of the gold and silver market that the majority of the precious metal analyst community has left unexplored. These areas include how energy and the falling EROI – Energy Returned On Invested – stand to impact the mining industry, precious metals, paper assets, and the overall economy.