Gold is the metal of kings, the ultimate money, an eternal store of value, an untarnishable embodiment of beauty. Gold is also a precious metal like silver, platinum, and palladium. But gold is not the most valuable metal you can own on a cost-per-ounce basis, for the long-term.

Platinum, though visually similar to gold, holds greater value. Its rarity, higher density, and purity contribute to its higher price. When comparing platinum to gold, platinum's superior qualities consistently make it the more expensive choice.

Often, platinum commands a higher price than gold. Lately, platinum has traded at an abnormally large discount to the yellow metal. There are many reasons for their differences in price, even though many investors might argue that platinum is naturally more valuable than gold. This battle between gold and platinum has been ongoing for at least the past 20 years while tending to credit gold with greater value and the market's metal investment of choice. This current market preference does not mean it will last permanently.

Metals investors who want to hold the most concentrated wealth in a single-ounce bullion product should opt not for gold or platinum - the other white metal - but for a different platinum group metal called rhodium.

Rhodium is scarce and thinly traded. Frankly, it’s a little-known metal even among metals investors. Other than the fact that it is extremely valuable, it is quite the opposite of more base metals like copper, zinc, or nickel. Rhodium and palladium were discovered in 1803 by William Hyde Wollaston. Rhodium looks a lot like silver or platinum, and it is a part of the platinum group of metals (PGMs). They are similar in appearance, color, hue, shine, density, weight, purity, durability, strength, and rarity. To make white gold, jewelers use an alloy of gold with palladium, nickel, and/or other metals, and plated with either platinum or rhodium. Unplated white gold tends to be around 14-18 karats, while plated tends to be 18+ karat.

When platinum is mined, other minerals and metals are extracted in the process. At least six metals are extracted in the platinum mining process, and these are the specific PGMs: Platinum, Iridium, Ruthenium, Palladium, Osmium, and Rhodium.

Like platinum and palladium, the primary application for rhodium is catalytic converters for cars and trucks. It is alloyed with platinum and palladium to enhance corrosion resistance. Rhodium is also used in some types of jewelry, including men's engagement rings, engagement ring with or without a diamond or diamonds, earrings, necklaces with stones of particular rarity, and more. Jewelers use rhodium for various processes in white gold, rhodium plating, and other jewelry products. Other common applications include coating optic fibres, for crucibles, and to thermocouple elements and headlight reflectors.

Rhodium has quietly been in a raging bull market over the past couple of years. Prices bottomed out in 2016 at around $600/oz. In March of 2021, rhodium broke a record and reached a spot price of $29,800 /oz. That price eventually came down, but no one knows what price it will return to - high or low. In 2023, rhodium has maintained $4100 /oz and already rising past $5500 /oz.

From 2004 to 2008, rhodium launched from $500 to as high as $10,000/oz. At its current value of $5,600/oz, the niche metal still has lots of room to run.

Of course, the trade-off associated with rhodium’s explosive price potential is that it also carries significant downside risk. This metal isn’t for the faint of heart.

Folks just getting started in precious metals investing should first build up core holdings in gold and silver. But more seasoned hard assets investors who want to add a high-risk/high-reward speculative component to their precious metals portfolio might consider rhodium.

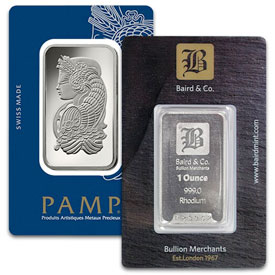

The high-flying metal is currently available to investors in the form of one-ounce bullion bars. They come sealed and authenticated by either of the reputable mints, Baird & Company, or PAMP Suisse.

More options are available for the more popular catalytic metals, platinum, and palladium. Bars, privately minted rounds, and even some sovereign coins are available to investors.

A Contrarian Bet on a Platinum Comeback

Platinum currently sells at a discount of more than $1000 less than gold and a higher price of nearly $200 more compared to palladium.

Platinum’s large discount incentivizes industrial users of palladium (mainly automakers) to begin substituting for platinum content where feasible. Platinum has generally been favored by diesel engine manufacturers, while palladium has increasingly been preferred for conventional gasoline vehicles.

Auto manufacturers use these PGMs (platinum, palladium, and rhodium) for catalytic converters because when vehicles emit nitrogen oxides, carbon monoxide, hydrocarbons, and other toxic gases, these metals draw nitrogen out of these toxic oxides and allow free nitrogen and oxygen molecules to form nitrogen gas and oxygen gas.

Ever since the Volkswagen diesel emissions cheating scandal, diesel car manufacturing has been in a bear market – bringing down demand for platinum as a side effect. Whether platinum prices have finally bottomed out remains to be seen.

Platinum won’t stay down forever, though. Its next bull market could be driven by a comeback for diesel, substitution by palladium users, a supply shortfall, or some combination of these fundamentals.

Most platinum comes from South Africa, a country now ruled by a land-grabbing, asset-seizing government. Some platinum also comes from other countries around the world, including Russia, Canada, the United States, Zimbabwe, and Australia.

Due in part to political risk and in part to adverse market conditions, many South African mines have scaled down operations or closed over recent years.

The total annual platinum supply of 7.224 million ounces still meets demand, but that dynamic could change by next year.

In the months ahead, supply destruction could lead to a deficit in the platinum market. Given the dire situation in the South African mining industry, supply will be difficult to ramp up again when it’s needed.

Contrarian metals investors are positioning themselves in platinum at current levels with the expectation that when the market turns, prices could run higher for years to come.

At the very least, a bet on platinum again becoming more expensive than palladium... and again more expensive than gold, seems likely to pay off eventually. It always has before whenever platinum got anywhere near as depressed as it is today. Consider rhodium, palladium, and platinum for your collections and investments.

When you are ready to purchase platinum, palladium, or rhodium, it is important to buy from a reputable dealer while also knowing the current spot prices. It is good to know the difference each metal brings for your best investment and cost ratio, as well as return on investment. Conduct plenty of market research and plan accordingly.

Money Metals Exchange has been in business since 2010 while receiving an A+ rating from the Better Business Bureau (BBB), and thousands of 5-star reviews from satisfied customers all over the United States. Money Metals has a fantastic reputation and has been voted as the Best Overall Precious Metals Dealer in the United States by Investopedia.

Be sure to sign up for the Money Metals Newsletter to stay informed with the latest precious metals news, product updates, product reviews, market perspectives, investing insights, geopolitics, the economy, and more!

If you have any questions about platinum, palladium, rhodium, gold, silver investment pieces, or others, or you'd like information about a particular piece, to place an order, returns, or something else, give our customer service representatives a call at our phone number: 1-800-800-1865

About the Author:

Stefan Gleason is CEO of Money Metals Exchange, the company recently named "Best Overall Online Precious Metals Dealer" by Investopedia. A graduate of the University of Florida, Gleason is a seasoned business leader, investor, political strategist, and grassroots activist. Gleason has frequently appeared on national television networks such as CNN, FoxNews, and CNBC and in hundreds of publications such as the Wall Street Journal, TheStreet, and Seeking Alpha.