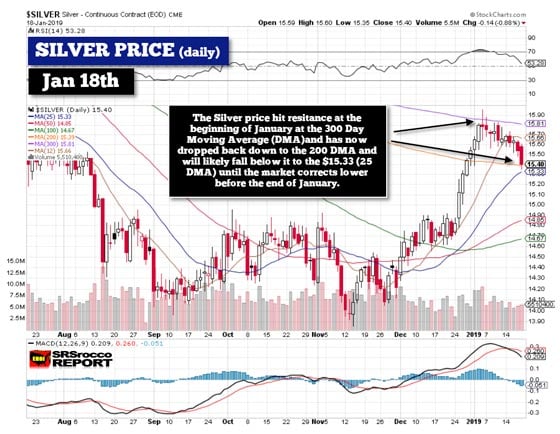

The silver price trended lower last week after hitting a high of nearly $16 the prior week. So, what’s in store for silver and the broader markets this week? If we look at the moving averages and what is taking place in the broader markets, we may find some clues. It seems as if the silver price over the past two weeks has been moving in the opposite direction of the Dow Jones Index and the broader markets.

As the Dow Jones increased 1,800 points since January 4th, the silver price fell more than 50 cents to $15.40 on the close of Friday. If we look at the Silver Daily chart versus the Dow Jones Index (Black line) we can also see that the silver price has been trading between two moving averages:

The silver price peaked right when the Dow Jones started the second stage of its correction higher on January 4th. On the close of Friday, when the Dow Jones Index added another 336 points, the silver price fell more than $0.20 to $15.40. So, it seems as if the silver price will continue to be weak as the broader markets move higher.

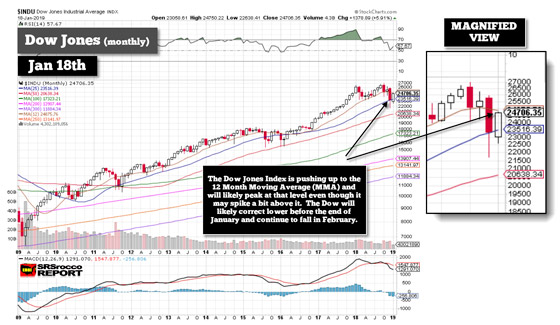

But, I do believe we are going to see a peak in the Dow Jones Index and broader markets very soon, likely this week. As I mentioned in a previous video update, the Dow Jones will probably hit resistance at the 12 Month moving average (MMA) of 24,875 before the end of January and will head down by the end of the month and continue the same trend lower in February:

So, if I am correct that the broader markets will begin to sell off, then the gold and silver prices will start moving back higher. Of course, there are no 100% guarantees with technical analysis, but we can check the markets and see how the price actions traded over the next two weeks.

Now, the Silver Daily chart suggests there is a good support level at $15.33 (25 DMA-Blue line):

However, the silver price could fall below that $15.33 level to $14.85 (50 DMA-Red lines) before reversing when the broader markets peak and decline sometime in the next week or so. Because the broader markets are becoming extremely overbought and now a high risk, shown in the Sentiment Trader Report I receive daily, a reversal lower is soon to take place:

When the broader markets begin to sell off once again, in what I believe is an ongoing BEAR MARKET (unless Central Banks step in with trillions of new QE), the precious metals prices will continue to disconnect and move higher. Thus, I believe silver will show a reversal sometime this week or next week at the latest and start moving higher to the $16.40 range shown in the monthly chart below:

Interestingly, the silver price in the monthly chart is right up against the 12 Month moving average (12 MMA –Brown line). In December the silver price went right up to it (large white candlestick) and is attempting to push above it.

If my analysis is correct, then I do believe the silver price will push above the 12 MMA by the end of January and then start trading above it in February as it continues up to the convergence of the three moving averages (25, 50 & 200 MMA), at the $16.40 range.

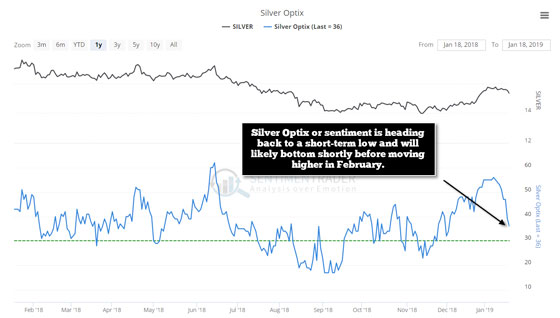

Lastly, due to the Federal Government shutdown, we haven’t had an update on the COT Report for a month now. So, we have no idea of the level of Commercial Short positions. However, I do believe the Commercials liquidated some short positions as the silver price has fallen over the past two weeks. If we look at the Sentiment Trader Silver Optix, or sentiment chart, we can see that sentiment is still heading lower, but will probably bottom soon and move back higher with the price.

I will do an update at the end of January to see how the markets and silver prices traded so we can see if my analysis of the moving averages was correct. If my analysis on a short-term basis is accurate, then we will be able to understand how the precious metals prices will move higher over the longer term.

About the Author:

Independent researcher Steve St. Angelo started to invest in precious metals in 2002. In 2008, he began researching areas of the gold and silver market that the majority of the precious metal analyst community has left unexplored. These areas include how energy and the falling EROI – Energy Returned On Invested – stand to impact the mining industry, precious metals, paper assets, and the overall economy.