After Columbus discovered the New World in 1492 and the Spanish began to extract vast amounts of gold and silver from Mexico and South America during the 16th Century, the global production of precious metals would grow considerably over the following centuries. However, the rise of gold production during this period still pales in comparison to what is taking place in the modern gold mining industry today.

Before Spain discovered the New World (as history suggests), most of the gold production in the world took place in Europe and Africa. Yes, there was also some gold production in India and Asia, but the majority came from Europe and Africa. And, of the total gold production in Europe, 80% came from the Austria-Hungary region. So, it’s no surprise that the rise of the infamous Habsburg Empire of Europe began in and around the Austria-Hungary area.

Furthermore, when Spain conquered Mexico and South America (including Central America), the riches they received from the discovery and production of gold and silver gave them the power to lead the Habsburg Empire of Europe for the 16th and 17th Centuries. Thus, there was no coincidence that Spain became a World Super Power for centuries due to the huge discovery of new gold and silver mines (and gold looting) in Mexico and South America.

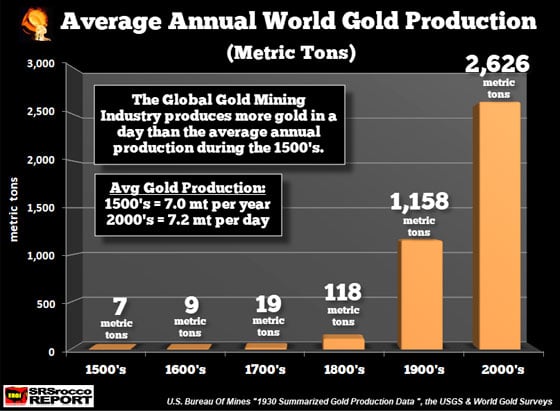

According to several sources, the world was producing approximately 7 metric tons (mt) of gold per year during the 1500s (16th Century). From 1493-1600, total world gold production was estimated to be 22.9 million oz (Moz), or a little more than 200,000 oz per year. However, gold production in 2018 was 3,332 mt or 107 Moz. So, what it took to produce 7 metric tons in one year during the 16th Century, the current gold mining industry can supply that in a day:

Here we can see that global gold production increased exponentially in the 1800-1900s. While part of the reason for the massive increase in global gold production during this period was due to new large gold deposits found in the United States, Australia, and South Africa, another factor was the introduction of fossil fuels as a much higher power source, including advanced extraction and processing technology.

The gold mining industry transitioned from human and animal labor digging up and transporting gold from narrow high-ore grade veins to massive open-pit low-grade mines using liquid petroleum as an energy source powering enormous haul trucks that can remove 300-400 tons of ore in a single trip while utilizing coal and natural gas generated electricity for processing.

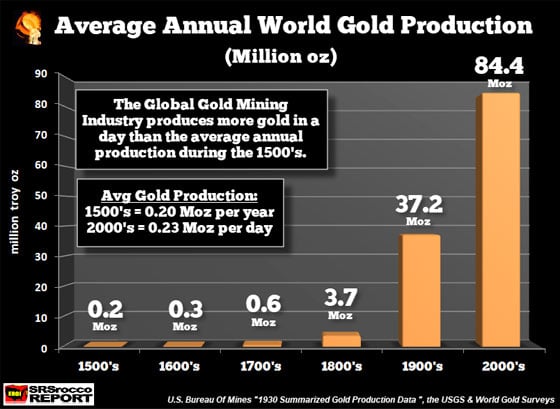

Here is the same chart above, but shown in a million troy ozs:

If we divide the average of 84.4 Moz of annual gold production during the 2000s by 365 days, it equals 231,000 oz per day or 0.23 Moz versus 0.2 Moz a year during the 1500s. However, this is the average for the past 18 years. If we considered the 107 Moz of gold production last year, the global gold mining industry produced nearly 300,000 oz of gold per day in 2018.

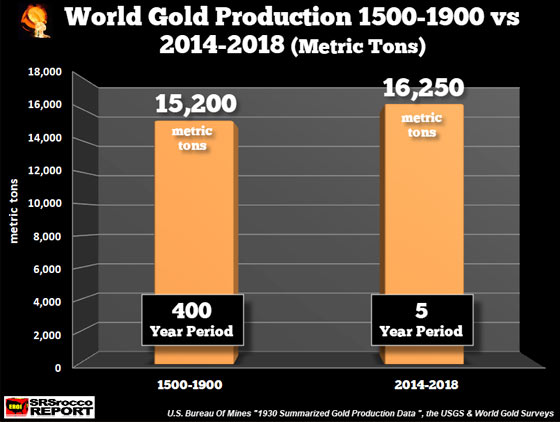

While this is a fascinating statistic, let’s look at the next chart. In just the past five years, the gold mining industry produced more gold than what the world mines supplied for 400 years, from 1500-1900:

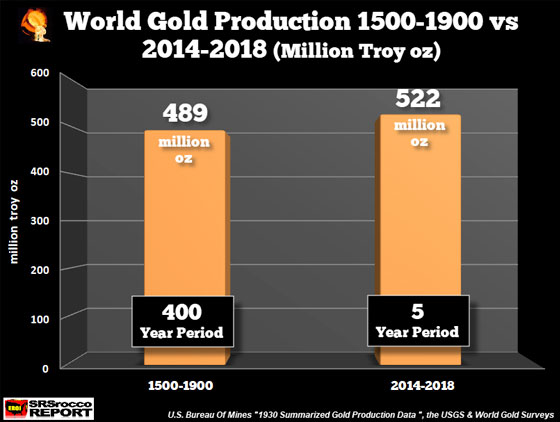

And in a million troy ozs:

Thus, the world was producing an average of 1.2 Moz per year from 1500-1900 (489 Moz divided by 400 years) versus 104 Moz per year (522 Moz divided by 5) for the past five years. It’s truly amazing the amount of condensed energy that fossil fuels provide, especially oil. As I have mentioned in previous articles, the energy content in one barrel of oil equals 10,000-20,000 hours of human labor. If we take the average of 15,000 human labor hours per barrel of oil, that would also equal the manpower of 150 mine employees working 10 hours a day for two weeks (10 work days).

So, with just one barrel of oil, the modern mining industry has replaced the energy labor of 150 workers for two weeks of work. Just think about the immense amount of oil the top gold miners consume each year. According to Newmont and Barrick (the two largest gold miners) Sustainability Reports, their combined diesel and heavy oil consumption in 2017 was a stunning 80 million barrels of oil equivalent.

Now, let’s convert the human energy content into 80 million barrels of oil equivalent:

80 million barrels X 15,000 human labor hours = 1.2 trillion human labor hours.

1.2 trillion human labor hours divided by 365 days = 3.3 billion human labor hours per day

3.3 billion human labor hours per day divided by 24 hours = 137 million workers per year

By Newmont and Barrick consuming 80 million barrels of oil to produce gold in 2017, they utilized the manpower of 137 million laborers working 24 hours a day for 365 days a year. We must remember, most of these gold mines are running 24 hours a day. However, if we look at the employee data from Newmont and Barrick Sustainability Reports, their total global workforce was only 48,700 in 2017.

Gold mining analysts and precious metals investors seemingly have no clue about the tremendous amount of energy that comes from a barrel of oil. We have taken for granted, the energy that oil provides the foundation for our high-tech world today. When oil production peaks and declines, gold production will be negatively impacted. It will no longer be economically feasible to extract gold in large open pit mines with ore grades in the 1-2 gram per ton range (or even higher).

Lastly, if we have to return to mining high-quality narrow-vein gold, then global production will drop like a rock. Investors will then be forced to buy mostly the only above-ground inventories of gold. At that point, physical gold buying will destroy the Paper Comex manipulation policy controlled by the Fed and member Bullion Banks.

So… it’s extremely wise for precious metals investors to PAY ATTENTION to what happens to GLOBAL OIL PRODUCTION.

About the Author:

Independent researcher Steve St. Angelo started to invest in precious metals in 2002. In 2008, he began researching areas of the gold and silver market that the majority of the precious metal analyst community has left unexplored. These areas include how energy and the falling EROI – Energy Returned On Invested – stand to impact the mining industry, precious metals, paper assets, and the overall economy.