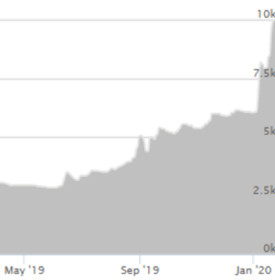

Rhodium prices have surged along with palladium. Price discovery in rhodium works differently than for other precious metals, so investors need to be especially careful.

The “spot” price for rhodium surged to $9,985 last week. However, that price does not come from a market where regular trading produces live, real-time prices.

Rather, the rhodium ask price is simply declared by major refiners. Johnson Matthey is one of the firms which publishes a price.

Rhodium 2-Year Chart

The price is generally updated twice per day during the trading week.

Lately, the published ask prices jumped dramatically higher. Bid prices, on the other hand, have not kept up.

The bid/ask spread in the thinly traded rhodium market has always been wider than in other precious metals, but it’s wider now than ever. Current bids are roughly $2,000 below the published ask price.

If there are industrial users paying the refiners’ $10,000 ask price for physical rhodium, it is quite an opportunity for arbitrage. Traders could theoretically purchase bars at the bid price and sell them at a very healthy profit to anyone paying the asking price.

That isn’t happening, at least as far as we can determine. Someone may have published a $10,000 ask price, but we can’t locate anyone paying that sum for rhodium bars.

Despite what the surging “spot” price for rhodium may imply, the bid for physical rhodium remains weak.

Money Metals has taken dozens of calls per day from sellers trying to cash in on spot prices near $10,000/oz. Many are disappointed to find actual prices are far lower which is a result of wholesalers dropping their bids. We believe one major rhodium buyer will cease further buying soon.

The rhodium market is tiny and illiquid. Price discrepancies like the one we are seeing are common. Our advice to clients would be not to put much credence in the “spot” price they see published until the spread is much tighter than it currently is.

The true price of rhodium, like all assets, is based on what real buyers are paying. That is currently closer to $8,000/oz, not $10,000/oz.

About the Author:

Clint Siegner is a Director at Money Metals Exchange, a precious metals dealer recently named "Best in the USA" by an independent global ratings group. A graduate of Linfield College in Oregon, Siegner puts his experience in business management along with his passion for personal liberty, limited government, and honest money into the development of Money Metals' brand and reach. This includes writing extensively on the bullion markets and their intersection with policy and world affairs.