The leading primary silver mining companies have experienced significant stock rallies from their lows in March. Some of the primary silver miners’ stock prices outperformed the competitors. Why? Could the silver miners with better stock performance be tied to their financials? Good question.

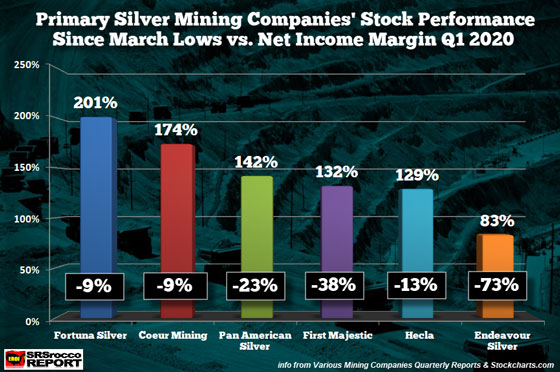

In the past, I looked at some comparisons to see why certain primary silver miners outperformed their competitors. In the chart below, I posted the stock performance of six of the leading primary silver miners since their lows in March this year versus the net income margin to total revenues.

As we can see, Fortuna Silver enjoyed the best stock performance in the group by increasing 201% from its lows in March. On the other end of the spectrum, Endeavour Silver suffered the worst performance at only 83%, and this is likely due to the closing of its El Cubo Mine and horrible Q1 2020 financial results. I wrote about Endeavour Silver in my previous article and also on my SRSrocco Report Twitter Feed:

CHART OF THE WEEK: Primary #Silver Miners REAL COST Higher Than Published All-In-Sustaining Cost

— SRSrocco Report (@SRSroccoReport) May 16, 2020

Endeavour Silver gets the TAKE ME OUT TO THE WOODSHED AWARD as it's losing money hand-over-fist.https://t.co/ZYDCfYbSs6 pic.twitter.com/n0J14R1GeC

Because Endeavour Silver lost a stunning $15.9 million in net income versus only $21.9 million in total revenues, that resulted in a net income margin of a NEGATIVE 73%. No wonder Endeavour Silver’s stock performance is DEAD LAST. Furthermore, the silver miners that enjoyed the best stock performance, Fortuna Silver and Coeur Mining, also had the lowest net income margin losses compared to the other four in the group.

Pan American Silver was the largest silver producer in the group at nearly 26 million oz in 2019. Half of that silver came from just two mines, the La Colorada and Dolores Mines (13.3 Moz). Pan American Silver’s stock price hit a low of $10.59 on Mar 16th and reached a high of $25.68 in early trading today (Monday). Thus, Pan American Silver’s stock performance increased by 142% over the past month:

However, Pan American Silver seems to be overbought in the short term as its RSI is now at 72. Its last high was $26.09 on Feb 24th. It will be interesting to see if Pan American Silver will form a DOUBLE-TOP at that level before correcting lower.

Ultimately, I see the primary silver mining stock prices outperforming the market as investors move into GOLD & SILVER ASSETS and out of STOCKS, BONDS, & REAL ESTATE.

About the Author:

Independent researcher Steve St. Angelo started to invest in precious metals in 2002. In 2008, he began researching areas of the gold and silver market that the majority of the precious metal analyst community has left unexplored. These areas include how energy and the falling EROI – Energy Returned On Invested – stand to impact the mining industry, precious metals, paper assets, and the overall economy.