A $10 bill today doesn’t buy as much as it used to. Yes, indeed… the $10 Federal Reserve Note today would only buy a little more than a half-ounce of silver. However, back in 1934, a $10 Silver Certificate would purchase 18.5 ounces of silver. Try doing that today.

According to Kitco.com, the price of silver in 1934 was 54 cents an ounce. That was a pretty good price for silver because it more than doubled from its low of 25 cents an ounce two years earlier in 1932. When silver was trading at 54 cents an ounce in 1934, the U.S. Treasury issued $10 Silver Certificates:

From the data at OldCurrencyValues.com, the U.S. Treasury printed over 75 million of these 1934 $10 Silver Certificates (Series A, B, C, & D). Thus, the total face value of these $10 Silver Certificates was $750 million, backed by nearly 1.4 billion oz of silver at the Treasury.

75 million $10 Silver Certificates (1934) X 10 = $750,000,000/ 54 cents (silver troy oz) = 1.39 billion oz.

According to the 1935 Annual Report of The Secretary of the Treasury, a total of $810 million of Silver Certificates were issued in 1934 and 1935. Americans during these years could take their $10 Silver Certificates and receive equal value in bullion or silver granules at the U.S. Treasury. The Treasury reported that $91 million in Silver Certificates were redeemed in 1934 alone.

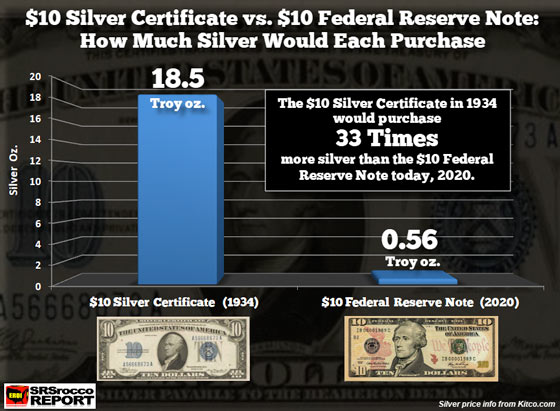

The following chart shows how much silver a $10 Silver Certificate would purchase in 1934 versus a $10 Federal Reserve Note today:

An American would receive approximately 18.5 ounces of silver for redeeming a $10 certificate in 1934. However, if U.S. citizens wanted to purchase silver on the open market with a $10 Federal Reserve Note, they would only receive 0.56 ounces of silver.

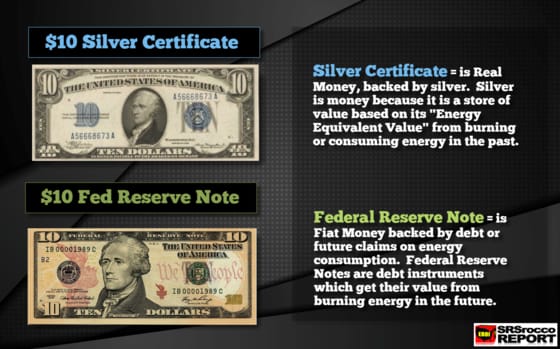

Furthermore, if we take that 18.5 troy ounces of silver that a $10 Silver Certificate would be worth in 1934 and sell it today, it would fetch $333. We must remember, Silver Certificates were backed by real money, SILVER. A $10 Federal Reserve Note is not backed by real money, but rather, $26.3 trillion of total Public Debt.

Since the global contagion hit the United States in mid-March, total U.S. Public Debt has increased a stunning $3 trillion. So, in a little more than three months, the U.S. Public debt increased by more than $2.7 trillion for 2018 and 2019 combined.

While the paper gold and silver prices may decline along with the broader stock markets temporarily, I believe we are going to see PHYSICAL INVESTMENT DEMAND as we have never seen before. At some point, physical investment demand will be the leading driver of the silver price.

I caution investors who are putting most of their funds in paper silver assets (not including mining stocks). Silver ETFs and Futures on the Exchanges should only be used (by professionals) to “TRADE” silver, not to STORE WEALTH.

About the Author:

Independent researcher Steve St. Angelo started to invest in precious metals in 2002. In 2008, he began researching areas of the gold and silver market that the majority of the precious metal analyst community has left unexplored. These areas include how energy and the falling EROI – Energy Returned On Invested – stand to impact the mining industry, precious metals, paper assets, and the overall economy.