The Federal Reserve Note “dollar” may be moving higher versus other fiat currencies, but foreign exchange markets seem to be another example of trading completely decoupled from reality.

Recent news has been full of ominous developments for the dollar.

Russia and China have already established trade without the need for U.S. dollars. The two nations signed a treaty in 2019 that provides for using their national currencies in trade.

U.S. sanctions on Russian exports will only serve to increase non-dollar trade between those Eastern powers.

In addition, the Russians have been building an alternative to the SWIFT system for making international payments. Vladimir Putin certainly anticipated U.S. sanctions when he decided to invade Ukraine. It is safe to assume he no longer feels subject to U.S. dollar hegemony.

Now India is exploring the possibility of trading rupees for rubles. If China, India, and Russia all implement workarounds, the greenback will become far less useful to a huge portion of the world population.

The dollar’s privilege as the currency required to buy Middle Eastern oil may also be slipping.

The concept of the “petro-dollar” emerged when Saudi Arabia agreed to sell its oil exclusively for U.S. dollars in the 1970s. The extraordinary demand for U.S. dollars from nations needing it to pay for Mid-East oil provided major support for the dollar ever since.

Last week it was widely reported the Saudi crown prince, Mohammed bin Salman, would not return Resident Biden’s call when Biden tried to reach him to discuss Ukraine and surging oil prices.

It may be only a matter of time before Saudi Arabia draws lessons from the sanctions imposed on Iran and Russia and seeks to diversify away from dependence on the Federal Reserve Note.

It’s easy to imagine future historians concluding it was a huge miscalculation for U.S. officials to weaponize the dollar and force nations to adopt alternatives.

Russia and China negotiated the deal to trade without dollars after watching the Fed pursue a decade of “extraordinary” monetary policy. When the answer to every problem is to print money and suppress interest rates, holding U.S. currency and dollar-denominated debt began looking like a very bad bet.

Perhaps Fed officials and federal politicians thought they would get away with abandoning all restraint in fiscal and monetary policy. But gold bugs and many of our trading partners around the world have been preparing for the inevitable reckoning.

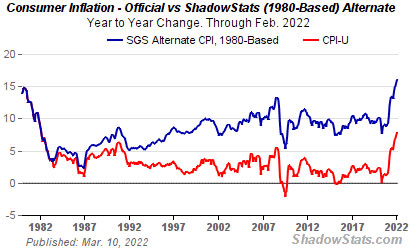

It took a while, but price inflation as measured by the old Consumer Price Index formulation just blew past the 1980 all-time high and there is no end in sight.

Some argue the hegemony of the dollar will persist because it is ultimately backed by the military might of the United States. They expect the U.S. will ultimately go to war to defend the dollar and the nation’s status as the world’s leading economic power.

Set aside the ethics involved in a currency that is supported by the threat of war. Failing confidence also changes this calculus.

Americans have very little appetite left for war. Polling shows Americans do not support sending troops into Ukraine. A portion of the country questions whether the Commander in Chief was legitimately elected. On top of that comes last summer’s humiliating and tragic withdrawal from Afghanistan – a bitter end to the 20-year war.

The trillions of dollars and thousands of lives spent in the Middle East, with almost nothing to show for it, are fresh in the memory of Americans across the political spectrum.

Unfortunately for the Fed and politicians, it will be hard, if not impossible, to fix issues like that. The decline in the dollar’s purchasing power has perhaps already morphed into a mass psychology event.

About the Author:

Clint Siegner is a Director at Money Metals Exchange, a precious metals dealer recently named "Best in the USA" by an independent global ratings group. A graduate of Linfield College in Oregon, Siegner puts his experience in business management along with his passion for personal liberty, limited government, and honest money into the development of Money Metals' brand and reach. This includes writing extensively on the bullion markets and their intersection with policy and world affairs.