In 1715, France was on the verge of collapsing. Taxes were raised to unprecedented levels to pay for war losses. France began defaulting on its outstanding debt. The French feared for the future and fled to gold and silver for shelter.

While the French people turned to gold and silver, the French government turned to John Law to solve its problems. Law was a Scottish exile after killing a man in a duel.

John Law knew he couldn't just steal everyone's gold, so he devised a perfect scheme.

He convinced the French government that the finite supply of gold and silver slowed their economy. And he advocated switching to paper notes by forming a bank and "The Mississippi Company" that took silver and gold deposits but allowed withdrawals in paper notes.

People wanted gold and silver when they took profits, but John Law limited redemption in gold and silver to avoid depleting his reserves.

This removed France's paper currency from the gold and silver standard and put it on the Mississippi Company share price standard.

The amount of paper currency afloat was now many times the actual reserves of gold and silver, and hyperinflation ensued. The paper currency became worthless, and Law was in exile once again.

The situation today is not unlike John Law's Mississippi bubble.

When you and I write a check, there must be sufficient funds to cover that check. However, when the Federal Reserve writes a check, it creates funds out of thin air.

Banks are not required to hold much in the way of cash reserves for deposits. This means they can loan money into existence just like the Federal Reserve does.

Gold and silver are kryptonite for bankers and governments.

Gold makes governments operate like a business focusing on efficiency and sound spending.

Fiat allows governments to create debt and run like a zombie company.

At its core, our current debt-based system allows the government to continuously spend more than it collects in taxes, financing budget shortfalls using debt.

If the Federal Reserve note was redeemable in gold and silver, the proliferation in debt and currency issuance would be halted. The politicians’ extravagant spending – both foreign and domestic – would be kept in check.

Here are five simple facts to remember:

- Central banks and governments gain the power to control human behavior by making laws over the use of fiat. It's harder to do with a commodity like gold.

- Legal tender laws requiring fiat currency to be tendered and accepted create “value” through government forces rather than the free market.

- Fiat decreases in value with unrestrained issuance, but the purchasing power of gold remains steady over time.

- You cannot print gold to bail out companies, industries, or governments.

- Gold competes with the Federal Reserve note as a reserve currency.

Government bureaucrats have tried to suppress the prices of gold and silver. They have also gone so far as to make gold ownership illegal in the United States for 40 years.

What's even more insidious and effective than overt confiscation is the covert gold/silver derivative market.

Large financial institutions trade paper representations of gold to smash down the price of the underlying metal. For example, when we look at futures market trading volume, a year's worth of mining activity can be traded in two or three days.

The futures market is a way to suppress the prices of – and demand for – precious metals.

The U.S. gold futures market was created in December 1974 in part to facilitate volatility in gold prices -- and thereby discourage gold ownership.

A State Department cable was obtained by Wikileaks. The cable reads:

The major impact of private U.S. ownership, according to the dealers' expectations, will be the formation of a sizable gold futures market. Each dealer believed that the futures market would be of significant proportion and physical trading would be minuscule by comparison.

“Also expressed was the expectation that large-volume futures dealing would create a highly volatile market. In turn, the volatile price movements would diminish the initial demand for physical holding and most likely negate long-term hoarding by U.S. citizens.

Moreover, the CFTC has this on its site:

The truth is gold and other precious metals are highly volatile. Past performance is not a good predictor of future returns... and they could set you up for fraud.

Physical gold and silver are money. Therefore, anything paper-based is a debt instrument.

Gold and silver futures trading entails trillions of paper transactions sitting on top of a minimal supply of precious metals.

Central Banks: Gold for me but not for thee.

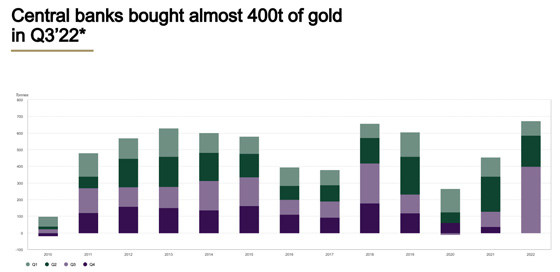

Global central bank purchases leaped to almost 400 tonnes in Q3 2022, up 115%. This is the largest single quarter of demand from this sector in records dating back to 2000 and nearly double the previous record in Q3 2018.

It also marks the eighth consecutive quarter of net purchases. It lifts the year-to-date total to 673 tonnes, higher than any other full-year total since 1967.

Regardless of what fiat currency overlords may say about gold, their actions reaffirm its essential role as a monetary asset – in more ways than one.

About the Author:

Jon Forrest Little graduated from the University of New Mexico and attended Georgetown University's Institute for Comparative Political and Economic Systems. Jon began his career in the mining industry and now publishes "The PickAxe" which covers topics surrounding precious metals, energy, history, and politics.