-

Gold price charts

Gold price: Per ounce, Today, Live, Chart, Spot

Money Metals Live Gold Spot Prices

| Gold Spot Price | Spot Change | ||

|---|---|---|---|

| Gold Price per Ounce | $2,329.95 |

-16.15

|

-0.69 % |

| Gold Price per Gram | $74.91 |

-0.52

|

-0.69 % |

| Gold price per kilo | $74,909.63 |

-519.24

|

-0.69 % |

Gold price chart

Check the gold price with the Money Metals interactive live gold and historical chart. The gold chart above allows you to check gold spot prices (Spot contract) dating back 20 years up to the current date.

Contents

- Gold price chart

- What is the gold price right now?

- What is the spot price of gold?

- How is the spot price of gold determined?

- What factors influence gold prices?

- Start Investing in Gold Bullion

- How often does the price of gold change?

- Will gold ever lose its value?

- What is the ask price and bid price of gold?

- What is the spread and premium on gold prices?

- Is the U.S. gold price the same regardless of location?

- Why is gold used as a store of wealth?

- Why should I never attempt to buy gold below spot price?

- What is the gold/silver price ratio?

- Why do investors buy physical gold instead of gold derivatives?

- What is a gold share or gold trust?

- How can traders find arbitrage opportunities in global gold markets?

- How do gold futures affect spot prices?

- Why is gold a hedge against inflation?

- Has gold ever gone over $2,000 an ounce?

- What is the highest gold price ever achieved?

- How has the gold price appreciated over time?

- How high will gold go in 2024?

- How can the Geometric Brownian Motion (GBM) model be used to forecast gold prices?

- What will gold be worth in 5 years?

- What will gold be in 10 years?

- Will gold go up to $3,000 an ounce?

- How do I buy gold?

- When is a good time to buy gold?

- How do I sell my gold bullion online?

- Is the price different if I pay by check vs credit card?

- Should I buy gold bars or gold coins?

- What is gold bullion?

- What is a troy ounce of gold?

- Is there a difference between a troy ounce and a regular ounce?

- Is gold taxed?

- Why is gold valuable?

- Gold price news

What is the gold price right now?

The current gold price can be checked on financial news websites, commodities trading platforms, or apps that track precious metal prices. Money Metals provides live updates on the gold price.

What is the spot price of gold?

The spot price of gold is the current market price at which gold can be bought or sold for immediate delivery. To find out what the current spot price of gold is, visit the Money Metals Exchange gold price page.

How is the spot price of gold determined?

The spot price of gold is determined through trading in the commodities markets, particularly in London (LBMA) and New York (NYMEX & COMEX owned by CME Group), based on supply and demand dynamics and other factors.

What factors influence gold prices?

The key factors that influence gold prices include a combination of 8 main elements:

- Basic supply and demand: The price of gold is largely determined by the balance between the supply of gold, which is limited, and the demand for gold, which can fluctuate based on various economic and geopolitical factors.

- Global economic stability: Gold is often seen as a safe-haven asset, and its price tends to rise during times of economic uncertainty or market volatility as investors seek to protect their wealth.

- Inflation rates: Gold is a popular hedge against inflation, as its value tends to increase when the purchasing power of fiat currencies declines. Higher inflation rates can drive up the demand for gold and push its price higher.

- Foreign currency exchange: Since gold is priced in U.S. dollars, a weaker dollar can make gold more affordable for foreign buyers, increasing demand and pushing up prices. Conversely, a stronger dollar can make gold more expensive for international investors, reducing demand and causing prices to fall.

- U.S. dollar strength: The value of the U.S. dollar and the price of gold have an inverse relationship, as a stronger dollar makes gold more expensive for non-U.S. buyers, reducing demand and putting downward pressure on prices.

- Central bank policies: Central banks around the world hold significant gold reserves, and their decisions to buy or sell gold can have a significant impact on global gold prices.

- Demand in industries and jewelry: Gold is used in various industries, such as electronics and healthcare, as well as in the production of jewelry. Changes in industrial and jewelry demand can affect gold prices.

- Geopolitical tensions: Periods of geopolitical uncertainty or conflict can drive investors to seek safe-haven assets like gold, increasing demand and pushing up prices.

These factors can have a significant impact on the gold price, causing it to fluctuate over time. For example, when the U.S. dollar is strong, gold prices tend to be lower as it becomes more expensive for foreign buyers. Conversely, when inflation rises, investors often turn to gold as a hedge, driving up demand and prices. Geopolitical tensions can also cause gold prices to spike as investors seek safe-haven assets. Understanding these key drivers is crucial for predicting future gold price movements and making informed investment decisions.

Start Investing in Gold Bullion:

How often does the price of gold change?

Gold prices can change frequently, sometimes several times a minute during market hours, due to continuous trading in global markets. This can be tracked via the live spot price tracker on Money Metals Exchange’s gold price page.

Will gold ever lose its value?

Historically, gold has maintained its long-term value due to its scarcity, aesthetic qualities, and uses in various industries. However, like any asset, its market value can fluctuate.

What is the ask price and bid price of gold?

The ask price of gold is what sellers are requesting for gold, while the bid price of gold is what buyers are willing to pay.

What is the spread and premium on gold prices?

The spread is the difference between the bid and ask prices. Premiums are additional costs above the spot price, reflecting factors like coinage, fabrication, or basic business costs.

Is the U.S. gold price the same regardless of location?

The U.S. gold price can range from location to location and business to business. However, most gold prices in the U.S. are primarily influenced by the Commodity Exchange Inc (COMEX) and the New York Mercantile Exchange (NYMEX). Gold dealers may also have their own gold price.

Why is gold used as a store of wealth?

Gold’s use as a store of wealth is due to its durability, scarcity, and the universal value attributed to it across various cultures and economies. This helps make gold a hedge against inflation.

Why should I never attempt to buy gold below spot price?

Buying significantly below spot price may indicate potential scams or counterfeit products. Legitimate gold dealers and retailers will sell gold at or near the spot price, plus a small premium to cover their costs and profit margin. If someone is offering gold at a price that is substantially below the current spot price, it is likely a sign that the gold is not genuine or the seller is attempting to defraud you.

What is the gold/silver price ratio?

The gold/silver ratio, also written as the gold:silver ratio, measures how many ounces of silver it takes to purchase one ounce of gold, used by investors to assess relative value and decide trading strategies. For example, if the gold:silver ratio is 15:1, that means it takes 15 troy ounces of silver to be equal to 1 troy ounce of gold.

Why do investors buy physical gold instead of gold derivatives?

Investors buy physical gold instead of gold derivatives because physical gold provides tangible assets, not subject to counterparty risks, and can be more appealing during times of crisis. The closer a person is to the yellow metal the more they have control over it with fewer overhead costs.

What is a gold share or gold trust?

Gold shares and trusts are investment vehicles that represent physical gold holdings or gold trading strategies, such as ETFs. The SPDR Gold Shares (GLD) is one of the most well-known and largest gold ETFs, holding over 37 million ounces of physical gold bullion in vaults as of June 2020. These gold ETFs allow investors to gain exposure to the gold market without the need to physically store or insure the precious metal themselves.

Gold trusts, like the SPDR Gold Trust, are structured as investment funds that hold allocated gold on behalf of shareholders. Each share of the trust represents a fractional, undivided beneficial ownership interest in the trust's gold holdings. This provides investors a cost-effective and secure way to access the gold market through the trading of a regulated security on an exchange.

How can traders find arbitrage opportunities in global gold markets?

Traders find arbitrage opportunities in global gold markets by looking for price discrepancies between different markets or forms (coins, bars, rounds, ingots, derivatives) to buy low in one and sell high in another.

How do gold futures affect spot prices?

Futures can influence spot prices by setting expectations of future supply and demand, and by providing an indicator of investor sentiment.

Why is gold a hedge against inflation?

Gold is considered a hedge against inflation because its price often rises when the purchasing power of fiat currency falls. Historically speaking, gold has maintained its long-term value beyond any other currency or fiat currency in the world making it universally tested.

Has gold ever gone over $2,000 an ounce?

Yes, gold has surpassed $2,000 an ounce, notably during times of significant economic uncertainty. Gold has consistently remained over $2,000 an ounce in the first quarter of 2024.

What is the highest gold price ever achieved?

The highest gold price was a little over $2,300 per ounce which occurred in April 2024.

How has the gold price appreciated over time?

Historically, gold prices have shown long-term appreciation, although the price can be volatile in the short term when compared to a currency such as USD.

How high will gold go in 2024?

Predicting exact prices is challenging due to the many economic variables involved; analysts use trends, global economic conditions, and monetary policies to make educated guesses. With that being said, some experts are calling for $2,400 per ounce for gold in 2024. According to Dr. Peter St. Onge, an economist at The Heritage Foundation, Goldman Sachs has claimed the price of gold will exceed $2,700 an ounce; Bank of America says $3,000 by 2025; and, UBS is saying $4,000 by 2027.

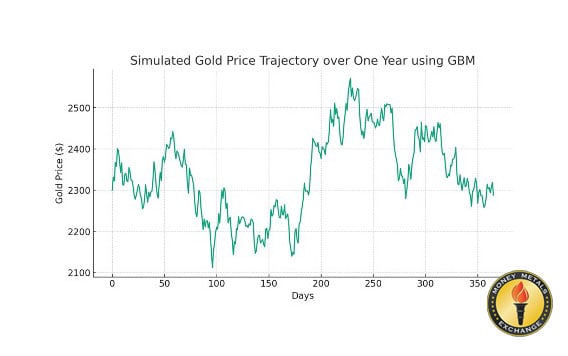

How can the Geometric Brownian Motion (GBM) model be used to forecast gold prices?

The Geometric Brownian Motion (GBM) model can be used to forecast gold prices by modeling them as a continuous random walk influenced by a "drift" representing the average rate of return and a "volatility" component that introduces random shocks. GBM models gold prices as a widely used tool for forecasting commodity prices, including gold.

While GBM captures the general stochastic trend of gold prices, its reliance on constant parameters can lead to underestimating the potential for extreme price changes during turbulent market conditions. Historically, gold prices have seen significant fluctuations, ranging from around $35 per ounce in the early 1970s to over $2,000 per ounce in recent years. Gold's role as an inflation hedge is historically significant, as it is often seen as a safe store of value when real returns on other investments fall due to inflation.

What will gold be worth in 5 years?

Predictions vary based on economic forecasts, but many analysts see genuine potential growth depending on inflation, currency values, and global economic health.

What will gold be in 10 years?

In 10 years, the gold price will likely remain relatively stable or potentially increase in value, as gold is generally viewed as a stable long-term investment. While long-term predictions about the future price of gold are inherently speculative, several key factors suggest gold may maintain or grow its value over the next decade.

Will gold go up to $3,000 an ounce?

It is possible that gold will go up to $3,000 an ounce one day, especially as the U.S. dollar loses purchasing power. While possible, reaching $3,000 would depend on significant economic shifts or crises.

How do I buy gold?

Gold can be purchased through brokers, dealers, online platforms, or sometimes banks—either as bullion, coins, or shares in gold-related investments. Money Metals Exchange is one of the leading reputable online gold and precious metals dealers in the United States.

When is a good time to buy gold?

A good time to buy gold is typically during periods of lower prices influenced by market conditions or when inflation expectations are high. Investors often view gold as a hedge against inflation, as its value tends to rise when the purchasing power of fiat currencies declines. When inflation is on the rise, the demand for gold often increases, driving up its price.

How do I sell my gold bullion online?

Selling can be done through online gold-buying platforms, precious metal dealers, or peer-to-peer through marketplaces.

Is the price different if I pay by check vs credit card?

Yes, the price of gold can be different depending on the payment method. Many dealers offer a discount for less risky payment methods like bank wires or checks compared to credit cards.

Should I buy gold bars or gold coins?

The choice depends on investment goals: gold bars for significant bullion reserves and gold coins for more divisible, tradeable options. To pay the least in premiums when buying gold and to make the most in returns when selling gold, it is typically better to buy gold bars instead of gold coins. Gold coins tend to be more expensive and speculative in value.

What is gold bullion?

Gold bullion is gold in pure bulk form, typically bars or ingots, valued by its mass and purity rather than shape or design. Bullion is the purest form of gold available, with a minimum purity of 99.5% for gold bars and 99.9% for gold coins. The term "bullion" comes from the French word "bouillon," meaning "boiling," which refers to the process of melting and purifying gold.

What is a troy ounce of gold?

A troy ounce (oz t) of gold is a unit of measure for precious metals, about 31.1 grams, different from the standard ounce (also known as an avoirdupois ounce, and abbreviated as avdp or simply oz) of 28.35 grams. 1 troy oz is equal to about 1.09714 standard ounces. While 1 standard oz is equal to about 0.911458 troy ounces. Even if the gold item does not specify that it is in troy ounces, it is likely weighed in troy ounces.

Is there a difference between a troy ounce and a regular ounce?

Yes, there is a difference between a troy ounce and a regular ounce. A troy ounce is specifically used for precious metals and gems and is slightly heavier than the regular (avoirdupois) ounce.

Is gold taxed?

Gold can be subject to capital gains tax if sold at a profit, depending on local tax laws. According to Jp Cortez of the Sound Money Defense League, there is a state-by-state gold and precious metals tax map known as the Sound Money Index that can tell you if your state has taxes on gold and how much that tax is.

Why is gold valuable?

Gold is valuable because it is rare enough to be considered precious, yet abundant enough to create coins and jewelry. Its scarcity is a key pricing factor, with only around 208,000 metric tons of gold ever mined, most of it since 1950. This limited supply contributes to gold's enduring value.

Gold’s value comes from its physical properties, scarcity, and universally historical role as a form of currency and investment. These intrinsic qualities make gold a highly sought-after asset, particularly during times of economic uncertainty or market volatility

Gold price news

Sign Up for Free Price Alerts

In a few short seconds, you can direct us to alert you whenever precious metals prices reach your specified target. It's free!

Simply enter your email address and price target on the form below, and we will email you the moment your price objective is reached.