Is your state destroying your money?

Sound Money Index: Gold & Silver Laws in 2024

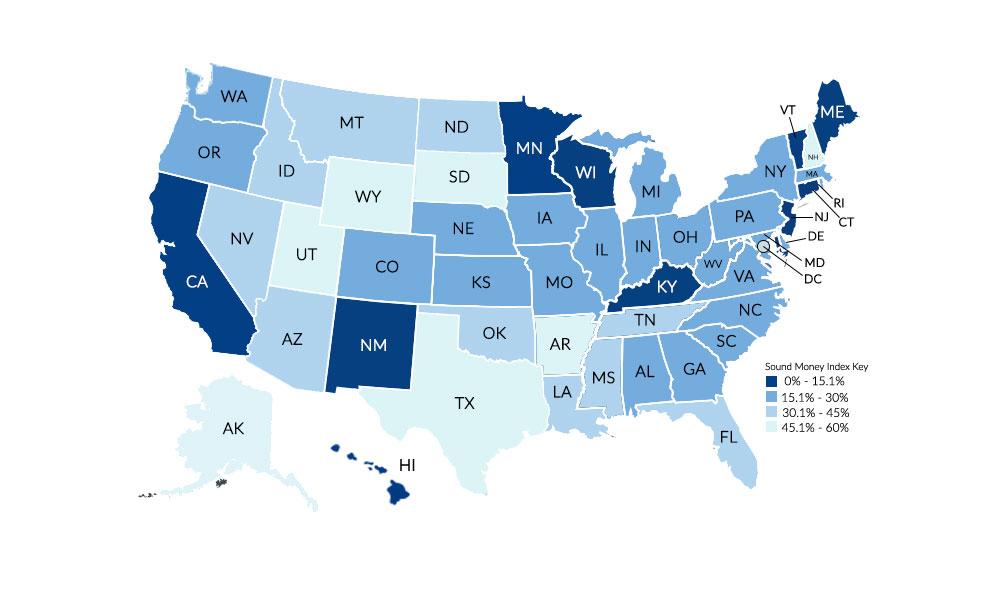

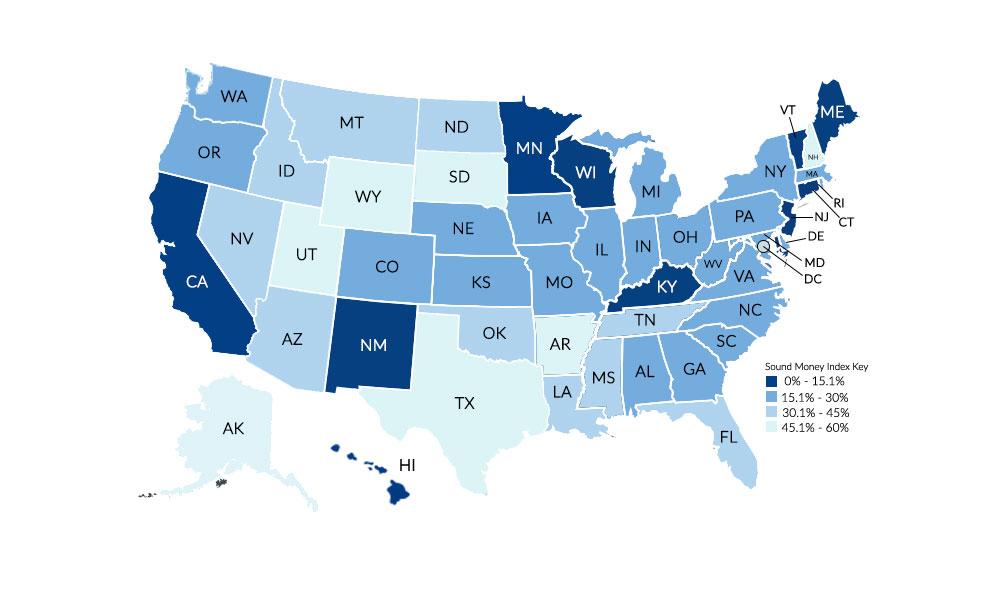

The 2024 Sound Money Index is the first index of its kind, ranking all 50 states using fourteen indicators to determine which states offer the most pro-sound money environment in the country.

States are awarded points for each pro-sound money policy they enact, with 40% off the possible points connected with sales and income taxes on the monetary metals.

The remaining points are awarded when states pursue other sound money policies such as holding state reserves or pension funds in gold bullion, enforcing gold clause contracts, reaffirming gold as money, or limiting harassment of precious metals dealers and investors.

Is your state destroying your money? Download the 2024 Sound Money Index to see where your state ranks on sound money issues...

Sound Money Background

Sound money is discovered, not invented. Through market processes, the “most marketable commodity,” as Austrian economist Carl Menger described money, makes itself known.

Gold and silver are money – not by government decree, but because they have proven to be over the test of time, by maintaining their value.

But for more than a century now, the federal government and the Federal Reserve – a privately-owned bank cartel which enjoys a federal charter – have warred against sound money in America. They've ended the free circulation of gold (and, for a time, criminalized its ownership), while taxing those who sell, spend, or exchange it. Unbacked paper currency and electronic credit have replaced our constitutional money: gold and silver.

The Constitution's Framers were mindful of the hardships brought by continentals, the fiat paper money issued by the Continental Congress to finance the Revolution. Notable Founders — including Thomas Jefferson, George Washington, James Madison, and Thomas Paine — warned about the ravages of issuing unbacked currency. That's why the Constitutional Convention overwhelmingly embraced gold and silver.

Washington wrote that paper money was “wicked.” Madison called it “unjust” and “unconstitutional.” Jefferson wrote that “its [paper money's] abuses also are inevitable and, by breaking up the measure of value, makes a lottery of all private property.”

While the debasement of the Federal Reserve Note — commonly known today as the “dollar” — is, in large part, the result of inflationary policies enacted by the Federal Reserve System. Its effects are pervasive; Governments can fund enormous welfare-warfare states, while everyone holding the currency can only watch as their wealth is sapped away.

The root of the problem is in federal policy. However, there are practical steps that can be taken at the state level to promote the use and acceptance of sound money.

Since 2014, the Sound Money Defense League has advocated for state and federal sound money legislation while providing interested readers, politicians, and concerned citizens with timely information on the subject.

To that end, the Sound Money Defense League and Money Metals Exchange are proud to present the 2024 Sound Money Index – the authoritative and comprehensive ranking of all 50 U.S. states' monetary policies.

2024 Sound Money Index

Sound Money Index Key:

Rank

State

Total Percentage

Points Received: 56 out of 100

Visit Wyoming State PagePoints Received: 50 out of 100

Visit South Dakota State PagePoints Received: 50 out of 100

Visit Alaska State PagePoints Received: 50 out of 100

Visit New Hampshire State PagePoints Received: 50 out of 100

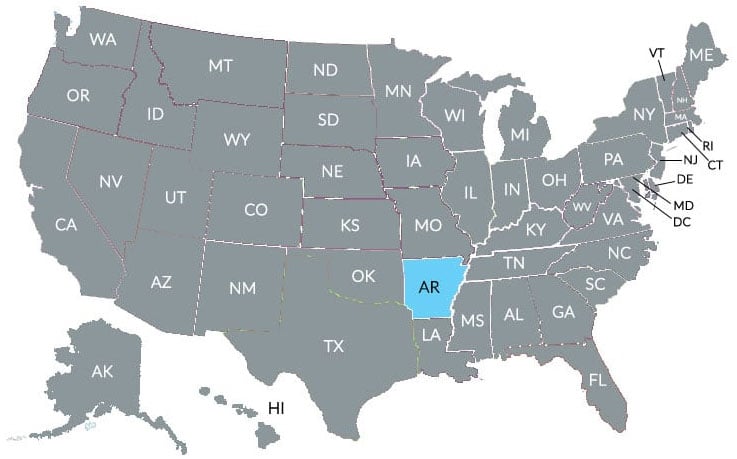

Visit Arkansas State PagePoints Received: 47 out of 100

Visit Texas State PagePoints Received: 47 out of 100

Visit Utah State PagePoints Received: 40 out of 100

Visit Arizona State PagePoints Received: 40 out of 100

Visit Nevada State PagePoints Received: 40 out of 100

Visit Florida State PagePoints Received: 38 out of 100

Visit Tennessee State PagePoints Received: 36 out of 100

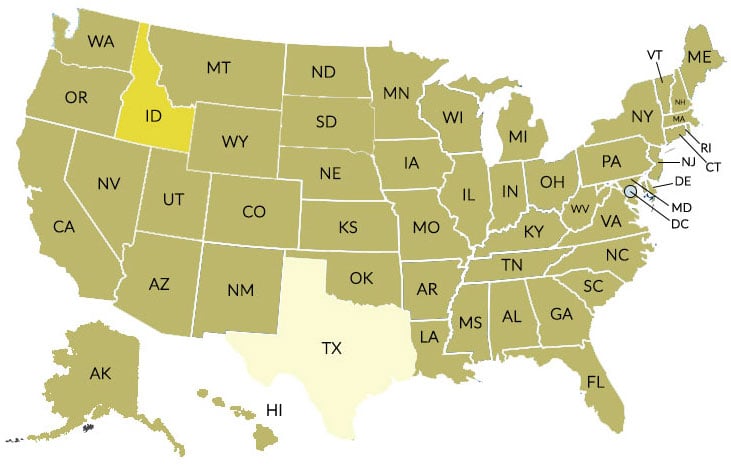

Visit Idaho State PagePoints Received: 34 out of 100

Visit Oklahoma State PagePoints Received: 34 out of 100

Visit North Dakota State PagePoints Received: 34 out of 100

Visit Montana State PagePoints Received: 32 out of 100

Visit Mississippi State PagePoints Received: 32 out of 100

Visit Louisiana State PagePoints Received: 30 out of 100

Visit Delaware State PagePoints Received: 30 out of 100

Visit Georgia State PagePoints Received: 30 out of 100

Visit Iowa State PagePoints Received: 28 out of 100

Visit Missouri State PagePoints Received: 28 out of 100

Visit Nebraska State PagePoints Received: 28 out of 100

Visit Colorado State PagePoints Received: 28 out of 100

Visit Oregon State PagePoints Received: 26 out of 100

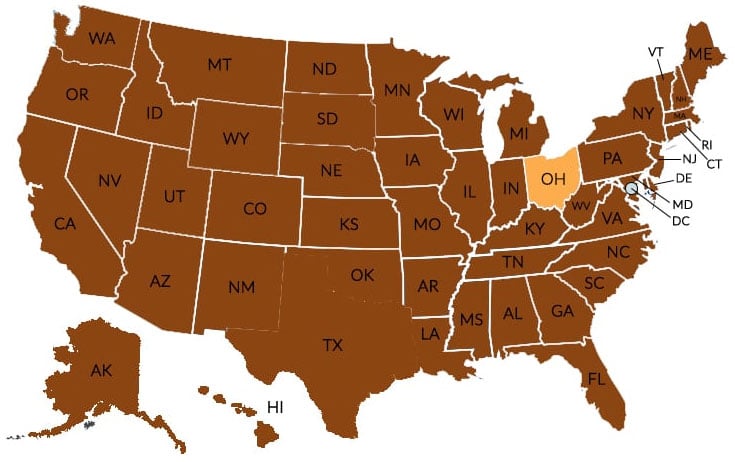

Visit Ohio State PagePoints Received: 26 out of 100

Visit Kansas State PagePoints Received: 26 out of 100

Visit North Carolina State PagePoints Received: 26 out of 100

Visit Alabama State PagePoints Received: 26 out of 100

Visit New York State PagePoints Received: 24 out of 100

Visit Virginia State PagePoints Received: 24 out of 100

Visit Rhode Island State PagePoints Received: 24 out of 100

Visit Pennsylvania State PagePoints Received: 23 out of 100

Visit Michigan State PagePoints Received: 23 out of 100

Visit Illinois State PagePoints Received: 22 out of 100

Visit West Virginia State PagePoints Received: 21 out of 100

Visit South Carolina State PagePoints Received: 21 out of 100

Visit Indiana State PagePoints Received: 20 out of 100

Visit Washington State PagePoints Received: 20 out of 100

Visit Massachusetts State PagePoints Received: 16 out of 100

Visit Maryland State PagePoints Received: 16 out of 100

Visit Connecticut State PagePoints Received: 14 out of 100

Visit New Mexico State PagePoints Received: 14 out of 100

Visit Hawaii State PagePoints Received: 14 out of 100

Visit Wisconsin State PagePoints Received: 14 out of 100

Visit Kentucky State PagePoints Received: 12 out of 100

Visit California State PagePoints Received: 12 out of 100

Visit Minnesota State PagePoints Received: 8 out of 100

Visit Maine State PagePoints Received: 8 out of 100

Visit New Jersey State PagePoints Received: 6 out of 100

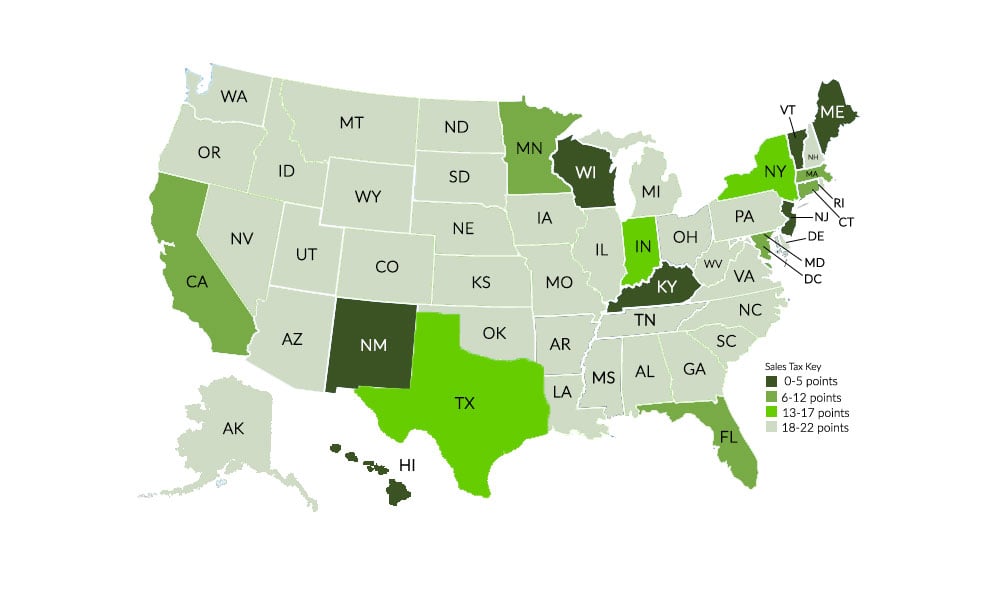

Visit Vermont State PageState Sales Tax on Gold & Silver

(14 possible points)

- NO Sales Tax: 7 Points

- PARTIAL Sales Tax: 4 Points

- FULL Sales Tax: 0 Points

- NO Sales Tax: 7 Points

- PARTIAL Sales Tax: 4 Points

- FULL Sales Tax: 0 Points

State Sales Tax on Platinum & Palladium

(4 possible points)

- NO Sales Tax on Platinum Coins: 1 Point

- NO Sales Tax on Platinum Bullion: 1 Point

- NO Sales Tax on Palladium Coins: 1 Point

- NO Sales Tax on Palladium Bullion: 1 Point

State Sales Tax Rate

(2 possible points)

- NO Sales Tax or Sales Tax BELOW the National Average: 2 Points

- Sales Tax Rate AT or ABOVE the National Average: 0 Points

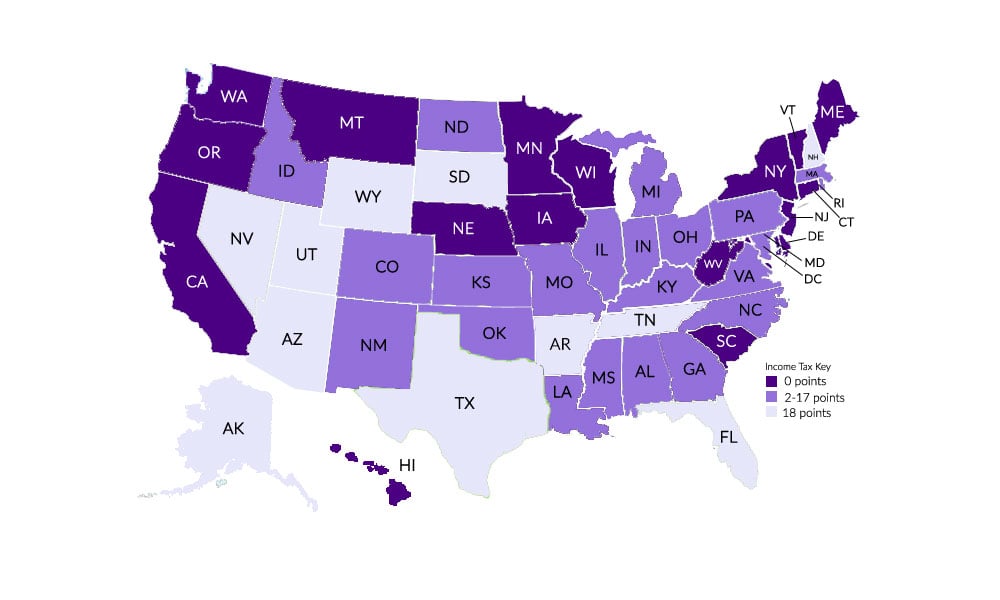

State Income Tax

(16 possible points)

- NO Sales Tax: 8 Points

- PARTIAL Sales Tax: 4 Points

- FULL Sales Tax: 0 Points

- NO Sales Tax: 8 Points

- PARTIAL Sales Tax: 4 Points

- FULL Sales Tax: 0 Points

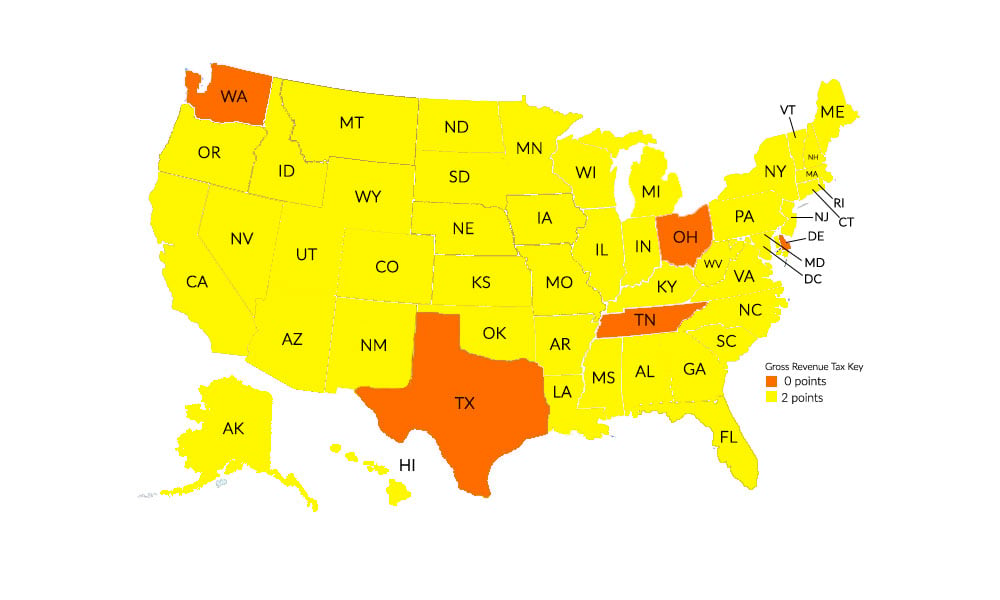

Gross Revenue Tax

(2 possible points)

- NO State Gross Revenue Tax: 2 Points

- State Gross Revenue Tax: 0 Points

State Income Tax Rate

(2 possible points)

- NO Sales Tax or Sales Tax BELOW the National Average: 2 Points

- Sales Tax Rate AT or ABOVE the National Average: 0 Points

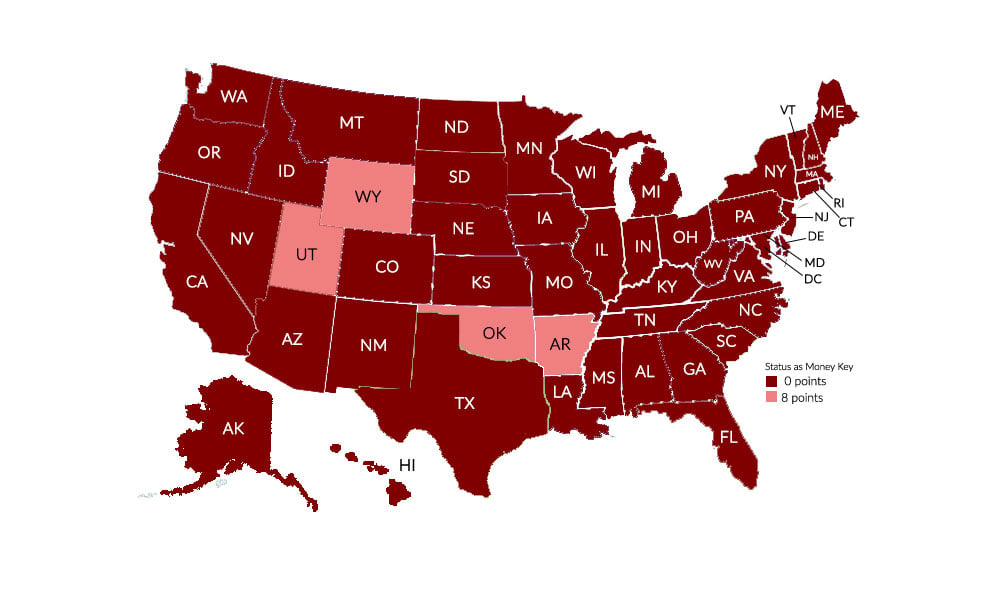

Gold & Silver's Status as Money

(8 possible points)

- Gold & Silver Affirmed as Money: 8 Points

- Gold & Silver NOT Affirmed as Money: 0 Points

Gold & Silver Clause Contracts

(4 possible points)

- STRONG Enforcement of Gold & Silver Clause Contracts: 4 Points

- WEAK Enforcement of Gold & Silver Clause Contracts: 0 Points

State Gold & Silver Bullion Depository

(8 possible points)

- Bullion Depository: 8 Points

- NO Bullion Depository: 0 Points

State Reserve Funds

(8 possible points)

- AT LEAST 10% of Reserve Funds held in Gold & Silver: 8 points

- SOME Gold & Silver held in Reserve Funds: 4 points

- NO Gold & Silver held in Reserve Funds: 0 points

State Public Pension Funds

(8 possible points)

- AT LEAST 10% of Pension Funds held in Gold & Silver: 8 points

- SOME Gold & Silver held in Pension Funds: 4 points

- NO Gold & Silver held in Pension Funds: 0 points

State Gold Bonds

(4 possible points)

- Invested IN or ISSUED a Gold Bond: 4 points

- NOT Invested IN or ISSUED a Gold Bond: 0 points

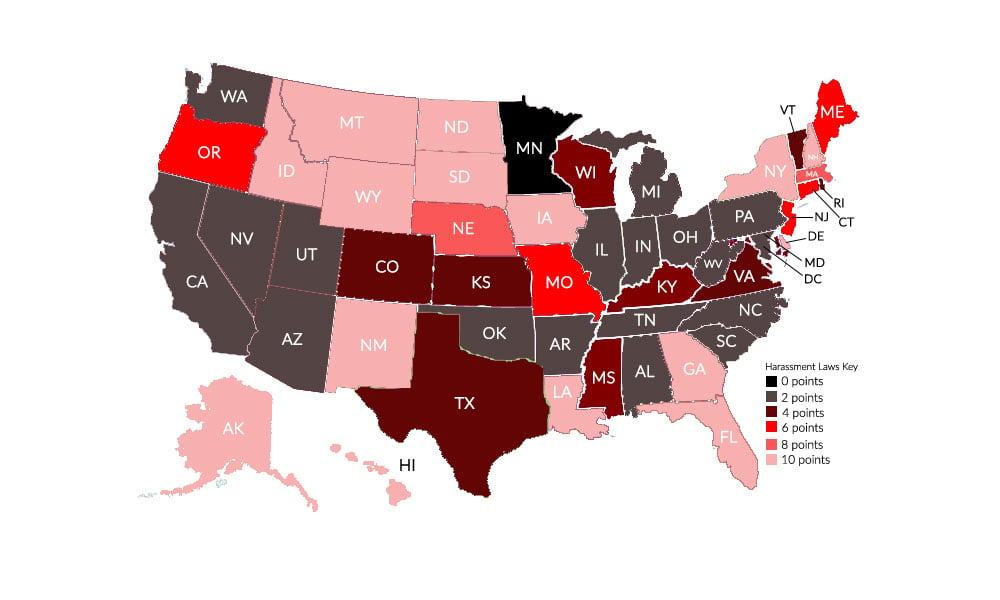

Precious Metals Dealer & Investor Harrassment Laws

(8 possible points)

- Dealers are NOT FORCED to Collect Unusually Invasive and Sensitive Information from Innocent Customers: 2 points

- No Mandatory, Automatic Submission to Law Enforcement of Sensitive Information from Innocent Customers: 2 points

- No Arbitrary Holding Period Required on Purchased Inventory: 2 points

- No Ban on Using Cash in Precious Metals Transactions: 2 points

Does the state levy sales taxes against precious metals coins and bullion?

Imagine if you had a grocery clerk break a $5 bill, and the government charged you a 35-cent sales tax. Silly, right? After all, you were only exchanging one form of money for another.

But try walking into a local precious metals dealer in almost two dozen states and exchanging 20 Federal Reserve Notes for an ounce of silver. If you make that kind of exchange, you will get hammered with a sales tax. That's the price you pay for picking up a piece of true money mentioned in the U.S. Constitution.

It's not difficult to see how levying sales taxes against monetary metals negatively affects those who aim to protect themselves from inflation and financial turmoil. It's a competitive marketplace, so buyers may be lured into financial assets that aren't subjected to sales taxes but that leave them at greater risk.

Sales taxes on precious metals coins and bullion products are unfair. These items are held as forms of wealth like another investment or currency. They are inherently held for resale, not consumed.

States that remove sales taxes against gold and silver go about it in different ways. Some states include other precious metals, such as platinum and palladium. Some will exempt only some coins, some bullion, or a combination of both. Some states set a purchase amount that triggers the exemption, while others offer a complete exemption.

Does the state impose a Gross Revenue Tax on precious metals businesses?

A Gross Revenue Tax (GRT) is levied by a handful of states on companies that do business with customers in that state. These are also known as Commercial Activity Taxes (CAT) or corporate activity taxes. It is typically a tax on all topline revenue received by a business.

A GRT imposed on precious metals sales revenue is extremely burdensome when compared to other GRT payers. Unlike most types of businesses, precious metals dealers operate on extremely small gross profit margins – margins that are similar in scale to those on transactions involving real property, investments, or other goods sold by brokerages, which are usually exempt from a GRT in the first place.

These GRT costs are passed indirectly onto savers and investors, making it more expensive to acquire gold and silver.

Precious metals are typically purchased for investment, as a hedge against economic uncertainty, and as a store of value. Applying a GRT to precious metals dealers discriminatorily stifles an industry that fulfills a vital role in the economy. That's why such states are penalized on the Sound Money Index.

Does the state levy income taxation against gold and silver coins and bullion?

The Federal Reserve’s inflationary policies erode away the purchasing power of Federal Reserve Notes, decreasing the value of each individual note in your wallet as time goes on.

Yet taxpayers are not entitled to deduct the staggering capital losses they incur when holding depreciating currency. So why should they be forced to pay income taxes on nominal gains when holding monetary metals?

Under IRS regulations, those who own gold and silver to protect against devaluation of America’s paper currency must report any realized “gain” in terms of Federal Reserve Notes. This is not necessarily a real gain. It may entirely be a phantom “gain” that results from the inflation created by the Federal Reserve, but the U.S. government, and most states, assess a tax on that supposed income anyway.

States that remove income taxation from the monetary metals are taking an important step toward adoption of sound money.

Has the state reaffirmed gold and silver as money?

Economist Ludwig von Mises defined money as a commonly used medium of exchange in his 1949 seminal work, Human Action. Actors in the market originally conducted trade through barter, also known as direct exchange.

In direct exchange, those involved in a transaction expect to consume what they’ve traded for. The shortcomings of a direct exchange system are vast: no common measure of value, difficulties storing wealth, indivisibility of goods, and more. From this system, indirect exchange was born.

Indirect exchange—the process of exchanging goods and services for goods that later can be exchanged for additional goods and services—highlighted the importance of marketable commodities. People realized that there were certain goods that other market actors were more likely to accept as payment, even if they had no direct use for said goods except as a medium of exchange.

Money is not a creation of government. The process through which money was “created” was not one of central planning but of markets. Gold and silver were chosen as true money by the free market over thousands of years and should thus be recognized as money.

Following the example envisioned by the Founding Fathers and described in Article I, Section 10 of the United States Constitution, states should reaffirm gold and silver as a tender in payment of debts. By acknowledging gold and silver as real (not to mention constitutional) money, states and citizens will be more likely to use them in transactions.

Does the state provide strong enforcement of gold and silver clause contracts?

Assuming you had the money, would you loan $10,000 to be paid back over 30 years plus 3% interest?

What if the annual inflation rate skyrocketed to 7%, 15%, or higher? That would benefit the borrower and deeply harm you, the lender. Even if you were repaid, the declining value of those repayments wouldn’t come close to making up for your loss in purchasing power.

Because today’s rate of inflation could head much higher in the years ahead, agreeing to be paid at a fixed rate over a long period is risky. The purchasing power of the Federal Reserve Note has already fallen dramatically since its last link to gold was severed in 1971. In the coming decades, America’s currency will continue to depreciate—possibly at an even higher rate.

One way to reduce uncertainty facing both parties who enter a long-term financial arrangement is to employ what is called a “gold-clause contract.”

This tool gives creditors and borrowers alike a significant degree of insulation from currency risk, including both inflation and deflation.

Simply put, a gold-clause contract specifies payment in gold or silver (or both), and therefore can only be satisfied by such payment. That means if a contract calls for repayment in gold or silver, Federal Reserve Note “dollars” are not an acceptable substitute. A guarantee of specific performance is crucial to the reliability of gold-clause contracts.

Gold-clause contracts are already legal and generally enforceable, but states can and should encourage their use by enacting legislation that requires state courts to provide iron-clad enforceability. The first states that do so may benefit the most by attracting new business from all over the nation.

Since no state has yet adopted this particular sound money policy, we have not created a map.

Does the state have a gold and silver bullion depository?

In 2015, Texas enacted legislation to establish a state-chartered precious-metals depository. Texas hopes to eliminate the risk involved in using storage provided by Wall Street bankers for its state pension fund gold, but also to save money on fees and create jobs by holding the gold inside the Lone Star State.

Privately owned and operated, a state-chartered depository enables citizens to store their precious metals for a fee. And the involvement of the state in an otherwise private depository potentially provides an additional layer of constitutional protection against federal-government aggression, such as the gold expropriation of 1933.

Using a depository account, citizens could also engage in transactions using gold and silver electronically. An account holder could make a purchase and pay the seller by transferring precious metals to the seller’s account. The funds being transacted could also be converted to Federal Reserve Notes and deposited into an account at a typical bank.

States that help set up depository systems will help further to bring gold and silver into use as an alternative to the inflationary paper-money system.

Does the state hold some of its reserve fund in gold and silver?

Financially prudent individuals set aside surplus funds to protect against unforeseen expenditures. This way, when faced with loss of income or unexpected expenditure, they will have a buffer against unanticipated downturns.

Similarly, almost every state in the United States has a “savings account” for government operations. Primarily to mitigate unexpected declines in tax revenues, states have created funds colloquially known as “rainy day funds.”

Every state takes a different approach to these funds — from the mechanisms by which they are funded, to the caps placed on balances, to the way the funds can be allocated. If a state can put funds aside during years of increased revenue and growth, that state will be better equipped to handle a decrease in tax revenue, a natural disaster, or an unexpected expenditure.

Any individual or organization — including a state government — that has the long-term objective of maintaining the purchasing power of its reserves must include gold and silver in its asset mix. It’s true that precious metals’ spot prices won’t necessarily hold steady over any given near-term period. But the longer the time horizon, the more reliably gold and silver will reduce portfolio volatility, increase overall returns, and insulate the state against a future financial crisis.

Since no state has yet adopted this particular sound money policy, we have not created a map.

Does the state hold some of its public pension funds in gold and silver?

Tens of millions of Americans and their employers pour money into pension fund plans each month, counting on those funds to grow and be there when needed at retirement.

But a time bomb awaits. The bulk of U.S. pension funds are dangerously underfunded, and the assets are often invested in securities that have bleak prospects for providing returns that keep up with a general decline in the Federal Reserve Note’s purchasing power.

In 2020, Ohio joined Texas as the only other state to hold physical gold and silver in their state pension fund. The Ohio Police & Fire Pension Fund, worth almost $16 billion, allocated 5% of its portfolio to sound money. Hopefully other states follow suit.

Pension fund managers have a fiduciary duty to safeguard funds against foreseeable risk. With the practices of today’s Federal Reserve, there is no risk more foreseeable than inflation. But almost none of these fiduciaries are fulfilling their duty to protect against this significant risk through an allocation to gold and silver.

While most public employee pension fund managers shy away from gold, they do so at their own risk, the risk of their pensioners, and the risk of taxpayers in their state. As a non-correlated asset to bonds, stocks, and other investments, precious metals are key to true diversification – they are proven to increase overall returns while reducing volatility and severity of drawdowns.

Does the state issue – or invest in – gold bonds?

A gold bond is a debt obligation dominated in gold, with interest and principal paid in gold.

It’s prudent to match up debt obligations and revenues using the same currency. If a state has debt denominated exclusively in Federal Reserve Note “dollars” but has some revenue denominated in gold (such as through mining severance taxes), fluctuations in the prices of either can affect the state’s ability to amortize its debt payments without risk and/or hedging costs.

If a state were to issue a gold bond, it could likely borrow at a lower rate of interest. This solution would be particularly advantageous for a state that has a gold-related income stream.

Meanwhile, states that have little-to-no debt, but that invest in gold bonds, are also acting prudently.

A gold bond investment should not only maintain its purchasing power, but also provide a real income stream to the state – unlike bonds denominated in fiat currencies where the yield does not generally compensate for losses resulting from inflation.

The interest rate on dollars has both rapidly fallen and risen in recent years, but a gold interest rate will tend to be more stable. Additionally, a gold component in a state’s investment portfolio reduces volatility while increasing overall returns.

Accordingly, states that either issue – or invest in – gold bonds are given points in the Sound Money Index.

Since no state has yet adopted this particular sound-money policy, we have not created a map.

Does the state maintain laws intended to harass precious metal dealers and investors?

Some states require the collecting of fingerprints, physical measurements, hair and eye color, Social Security numbers, or other forms of identification – coupled with requirements to submit sensitive information to law enforcement on a daily routine. This places substantial and unusual burdens on the dealers and introduces privacy risk for the buyer.

Some states even mandate that dealers cannot sell gold or silver purchased from the public for a specified amount of time. Making it illegal for dealers to sell their inventory for days or weeks severely harms those who provide precious metals services to the public by tying up their capital.

Additionally, forcing dealers to hold inventory for arbitrary periods is a security risk. The extra cost of insurance and security required to adequately safeguard larger amounts of metals undermines an industry that already operates with razor-thin margins, large capital requirements, and volatile spot prices.

A few states also prohibit the use of cash when buying or selling precious metals. Perhaps restricting transactions to checks and credit cards may make it easier for the government to track every transaction, but such discrimination against cash is nearly unprecedented in American commerce.

Has the state created specie tender mechanisms to accept and remit gold and silver?

Article I, Section 10 of the U.S. Constitution prescribes that no state shall “make any Thing but gold and silver Coin a Tender in Payment of Debts.” Pursuant to this, states can create payment mechanisms for accepting and remitting taxes and other payments in gold and silver.

By creating the infrastructure required for the state to collect taxes and make payments in gold and silver, states can ensure an alternative unit of payment as the Federal Reserve Note continues its collapse, and citizens and states can more easily protect themselves from inflation and financial turmoil.

Since no state has yet adopted this particular sound money, we have not created a map.

The Sound Money Defense League is a nonpartisan, sound money advocacy group working to restore gold and silver to its historic role as America’s constitutional money. By working at the state and federal level, the Sound Money Defense League has rallied tens of thousands of concerned Americans to oppose the actions of government officials and central bankers that further debase the currency.

Sound Money Defense League works with allies in elective office to introduce legislation to support sound money such as removing taxation on gold and silver, auditing the nation’s gold reserves, auditing the private bank cartel that has been delegated government power (known as the Federal Reserve System), and otherwise supporting recognition and use of sound money.

Through aggressive grassroots citizen action, the Sound Money Defense League works to expose the global money managers running the Federal Reserve and the tax-and-spend politicians who undermine the U.S. economy by supporting crushing debt, crony bailouts, and reckless money printing.

Money Metals Exchange is an online bullion exchange. Working with retail customers in the U.S., it buys and sells gold, silver, copper, palladium, platinum, and rhodium. Clients can also store their gold and silver, invest through IRAs, or borrow against their metals. The online bullion dealer also publishes news and analysis about the precious metals markets and promotes sound money public policy.

Now you can safeguard your assets from financial turmoil and the devaluing dollar – without paying costly middleman mark-ups or fending off high pressure, bait-and-switch sales tactics. Savvy, self-reliant investors are embracing Money Metals Exchange as their trustworthy resource for gold and silver bullion.

The reasons for the company's rapid growth and stellar reputation and are simple and straightforward – Money Metals Exchange is discreet, dependable, and extremely competitive on pricing. Investopedia recently named Money Metals as the "Best Overall" precious metals dealer on the Internet in recognition of its high integrity, value pricing, wide array of services, and beginner friendly approach -- focusing on educating customers and giving them white-glove service regardless of their order sizes.