History is littered with the corpses of failed currencies. Sometimes the host nation was destroyed in war or revolution. Spectacular hyperinflations killed others. Governments don’t much care for borrowing and spending limited by the amount of physical metal in their vault so they float paper money instead. Eventually, recklessness and overreach fueled by this lack of accountability do them in.

Fractional Silver as an Alternative

Still, it is hard to imagine “King Dollar” meeting such a disgraceful end. But that has more to do with normalcy bias than any objective evaluation. The charts show exponential growth in debt and money creation. Confidence, the main underpinning of the U.S. dollar, will eventually break absent some extraordinary reforms.

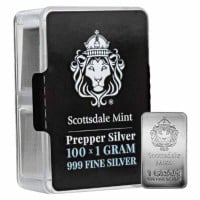

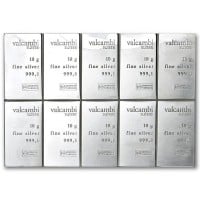

One day Americans may find merchants reluctant to accept dollars. The next they may flat out refuse. Foresighted people are preparing for a situation where they may need to use a trusted alternative. Building a stash of silver to barter and trade with is a way of insuring against this kind of scenario. Fractional-sized mint silver coins and rounds, suitable for very small transactions such as buying a loaf of bread, fill a gap in a holding that consists only of one ounce and larger products.

The most popular fractional silver products include Pre-1965 U.S. Dimes, Quarters, and Half Dollars containing 90% silver along with .999 pure silver rounds in 1/10 ounce and ½-ounce sizes. Money Metals Exchange carries them all, including Mercury dimes at a slight upcharge.

Proportional to their silver content, the cost per one oz of silver to fabricate silver rounds is higher for small denominations. That means somewhat higher premiums, so investors will not want to build their entire holding with these products. However, owning some “small change” is a great idea. It could easily command an additional premium if a currency crisis leads to short supplies.

Why Should I Choose Fractional Silver?

Buying fractional silver is a sensible investment for when prices of silver rise. As the price of silver rises, you will not want to pay in full rounds or bars of silver, but instead, you will want to use smaller coins that are closer to the original value. Imagine paying for a chocolate bar with a $5 bill, only to find out the person cannot give you any change. You wouldn’t want to give them more than it’s worth, but you may not have any choice.

This is where fractional coins are sensible. It is wise for you to have a bag of silver junk coins that have little collector value. If you are wondering how many junk coins, fractional silver coins, and rounds you should have, that depends on how much change you think you might use as part of your day-to-day business.

If you also want to know the difference between silver rounds, like the Silver Walking Liberty, and silver coins such as the US Silver Eagle, rounds are minted privately while coins are minted by the government. They both hold the value of silver content they hold, however, silver rounds do not hold legal tender since they are not government minted.

When Will I Need Junk Silver?

Silver may be used as a currency once again, but even if it is not, silver will likely rise in value in the coming years. Historically, paper currencies are prone to collapse. Some of the more notable examples are Germany’s hyperinflation from 1923 and 1924 -- or much more recently, the collapses in Zimbabwe, Argentina, and Venezuela. However, all of the world’s currencies are slowly but surely declining in purchasing power.

The recent global financial crash is having ongoing effects, and it is becoming increasingly clear that holding significant wealth in currencies is unstable and dangerous. Political events such as Brexit and the election of President-elect Donald Trump have only increased the volatility of fiat currencies. Central banks have been attempting to prop up the economy by printing more money, and as inflation rises, the value of paper notes drops.

It’s sensible for everybody to invest in silver, especially in fractional coins that can be used as small changes. This is because silver is a finite resource with many different uses as a financial asset, a currency, and a key component in numerous technologies. Recently, silver peaked in production, meaning that we are likely to see the value rise in the coming years. As the value of silver rises and the over-leveraged world economy continues to lose stability, it becomes increasingly important that you have pre-1965 coins, otherwise known as "junk" silver, in your vault as a hedge against inflation and financial turmoil as well as an alternative medium of exchange.

Should I Only Buy Junk Silver?

Many people are unsure if they should buy silver coins, silver rounds, or fractional silver. The correct answer is you should have some of each. Think about silver like you do any currency, you may want to have a $20, $10, and $5 bill in your wallet, but you may also want a quarter, nickel, and dime.

Pre-1965 silver coins are a great way of making sure that you have that smaller change, while silver rounds, coins, and bars offer you the larger bills that you may need for bigger purchases.

To order any form of fractional silver or the cheapest silver rounds for your stash, please give us a call at 1-800-800-1865 or order online today.

.jpg)