Investing in Gold Gram Bars: A Comprehensive Guide for Beginners

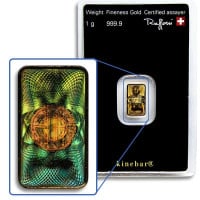

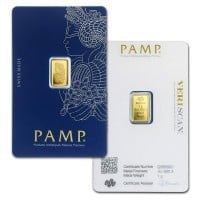

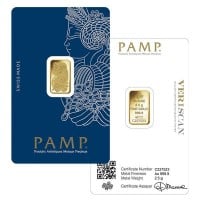

Gold gram bars are popular among investors and collectors due to their affordability and portability. They are smaller in size and price than larger gold bar options. Gold gram bars are typically made from 99.99% pure, 24-karat (24k), gold. All gold bars are weighed in Troy ounces, and 1 gram of gold is 0.0321507 of a Troy ounce of gold. One gram of gold is roughly the size of a thumbtack, which is relatively small compared to other sizes of gold bars. One-gram gold bars often come with an assay certificate, providing authentication and details about the bar's purity, weight, and company name with logo.

As a tangible asset, gold gram bars offer individuals a way to diversify their investment portfolio at a low cost of entry when compared to larger sized gold bars. The majority, about 67%, of individuals who purchase 1 gr gold gram bars do so as a long-term investment strategy for retirement planning instead of a quick buck. Investing in precious metals tends to be a long-term investment instead of quick turnarounds. Since gold tends to stay above the rate of inflation and outperform the debased U.S. dollar (USD), it maintains its value over the years much better than saving dollars in a bank.

Due to their small size, gold gram bars are often used as gifts or souvenirs for special occasions or events. During economic downturns, the demand for gold gram bars tends to increase by a minimum of 17% due to their stability and hedging properties. Over the past five years, the demand for gold gram bars has grown by nearly 23% annually, as the world is going through various stages of government-caused recessions. In the year 2023, gold gram bars accounted for an estimated 16% of total gold sales globally.

Approximately 9 out of 10 investors consider gold gram bars as a safe and reliable investment option. With the price of gold typically rising with time, it is very likely that in the future it will continue to do so. 1 gram of gold in 2003 would have been around $12 without additional premium (i.e. industry standard company overhead charges). In 2023, 1 gram of gold would be around $63 without additional premium.

Who manufactures gold gram bars?

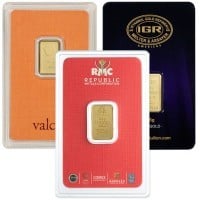

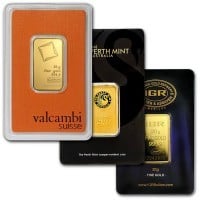

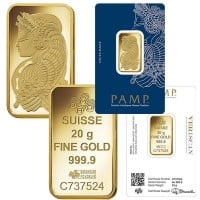

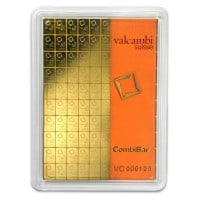

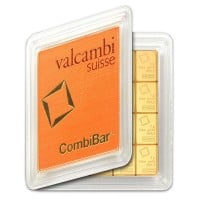

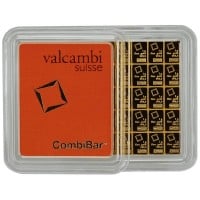

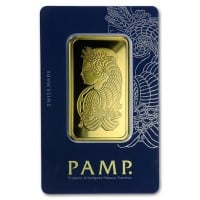

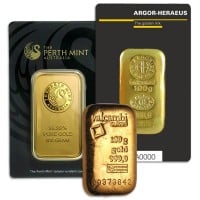

Government mints and private mints that have produced some 1-gram gold bars include PAMP Suisse, Credit Suisse, Argor Heraeus, Perth Mint Australia, British Royal Mint, Austrian Mint, Royal Canadian Mint (RCM), Sunshine Minting, Geiger Edelmetalle, Italpreziosi, Republic Metals Corporation (RMC), Valcambi, Benchmark Strategic Metals, Istanbul Gold Refinery (IGR), and Rand Refinery.

What designs do gold gram bars have?

There are a variety of 1-gram gold bars designs available on the market today. Some bars are much more bare or simplistic, while others are elaborately designed. The vast majority of 1-gram gold bars have the weight, purity, and company name and/or logo listed on the bars themselves. Examples of designs include Lady Fortuna (luck), Lady Liberty, the Statue of Liberty, a torch, a swan, a tiger, a lion, a rose, the number one (1), Britannia, commemorative designs, state designs, country designs, and more.

Where to Buy Gold Gram Bars

When its time to purchase gold bars, it is important to know the current gold spot price to be sure you have a good idea of the price of the gold bars as well as to determine the premium on each gold gram bar. Premiums tend to be higher on smaller gold bars than larger ones such as a one-ounce gold bar or one-kilo gold bar. Additionally, it is important to only buy, sell, or trade with a reputable dealer. Too many people buy from unknown sources on auction websites or from nameless sites. By buying gold from a reputable dealer you can feel confident that you receive what you paid for, and that you receive it within a quick and reasonable timeframe. When precious metals companies have long shipping delays, this is a telltale sign of a struggling company with mismanaged funds and products.

Money Metals Exchange provides spot prices 24/7 on our website to keep customers informed about market changes and pricing updates. Money Metals Exchange has been in business since 2010 receiving an A+ rating from the Better Business Bureau (BBB) and thousands of 5-star reviews from satisfied customers all over the United States of America. Money Metals Exchange has been voted as the Best Overall Precious Metals Dealer in the U.S. by Investopedia.

Be sure to sign up for the Money Metals Newsletter to stay informed about the latest precious metals news, geopolitics, economy insights, product reviews, product details, sales deals, and more.

If you have any questions (FAQ) about one-gram gold bars, other sizes of gold bars, other precious metal items, placing an order, past orders, payment options, shipping insurance, delivery address, your experience, or anything else, please call our friendly customer care representatives at our phone number: 1-800-800-1865