The Federal Reserve's $34.5 Trillion Problem

The national debt is a big problem for the Federal Reserve because it is hamstringing the central bank's ability to fight inflation....

Mike Maharrey

April 26th, 2024

Important precious metals market news and pithy commentary for savvy investors. High-quality issue briefs, gold and silver price charts, and breaking news alerts. Join over 1.2 million individuals who receive our email news alerts.

The national debt is a big problem for the Federal Reserve because it is hamstringing the central bank's ability to fight inflation....

Mike Maharrey

April 26th, 2024

Exploring Economic Insights with Mark Skousen on Money Metals' Midweek Memo...

Money Metals News Service

April 26th, 2024

With Gov. Jim Pillen's signature, Nebraska has become the 12th state to end capital gains taxes on sales of gold and silver....

Money Metals News Service

April 25th, 2024

Fading hope of imminent Fed rate cuts has created some headwind for gold bulls, but Chinese demand is expected to support the gold price throughout 2024....

Mike Maharrey

April 25th, 2024

Demystifying Inflation: Insights from the Money Metals' Midweek Memo with Mike Maharrey...

Money Metals News Service

April 24th, 2024

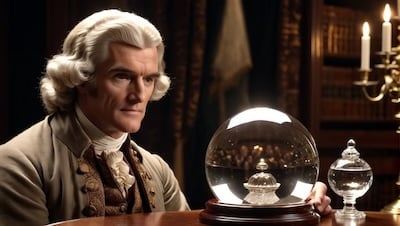

Did you know Thomas Jefferson and many other prominent Founding Fathers predicted our current economic problems? No, they didn't have a crystal ball. They didn't need one....

Mike Maharrey

April 23rd, 2024

Interview Summary: Stefan Gleason on Sound Money and the U.S. Economy...

Money Metals News Service

April 23rd, 2024

Silver prices have finally begun playing some catchup to gold. Perhaps speculators in the futures market have finally begun paying attention to fundamentals like supply and demand....

Clint Siegner

April 22nd, 2024

Big money managers are starting to jump on the gold bandwagon. Why? Because they are starting to grasp the ugly reality of price inflation....

Mike Maharrey

April 22nd, 2024

Executive Director of the Sound Money Defense League, Jp Cortez, sat down with Monetary Metals GC, Jeff Deist, to discuss sound money, CBDCs, inflation, and more...

Money Metals News Service

April 22nd, 2024

Gold's gone on another wild ride today, plummeting in price as late-arriving speculators sell on calming tensions in the Middle East....

Brien Lundin

April 22nd, 2024

Even with softer overall demand, the silver market charted a third straight structural deficit in 2023 with demand outstripping supply....

Mike Maharrey

April 19th, 2024

An Insightful Discussion on Silver and the Economy with Peter Krauth...

Money Metals News Service

April 19th, 2024

As the Chinese accumulate more and more gold, they're dumping Treasuries. That raises a question: who is going to keep funding the U.S. government's borrowing spree?...

Mike Maharrey

April 19th, 2024

Court Filing: Officials Lost Federal Welfare Funds to African Gold Scam...

Ken Silva

April 19th, 2024

In case you've been living under a rock, Gold prices have been on fire, jumping 20% in just the past 2 months....

Peter St. Onge

April 19th, 2024

Americans throw away millions of dollars in coins every year. That's because American money is junk. But that wasn't always the case....

Mike Maharrey

April 18th, 2024

The Federal Reserve is the engine that runs the massive U.S. government. But is a central bank even constitutional?...

Mike Maharrey

April 18th, 2024

Is the Biden Administration Trying To Destroy the Dollar?...

Peter St. Onge

April 18th, 2024

Navigating the Complexities of Taxes and Precious Metals in Today's Economy...

Money Metals News Service

April 17th, 2024