While the world has entered into a financial crisis, the worst is still yet to come. When the global contagion continues to spread, the crisis will turn into a FINANCIAL STORM, in which few are prepared. Unfortunately, the analysts on CNBC and Bloomberg continue to provide incorrect forecasts because they are looking at the markets in a linear fashion. What lies DEAD ahead is a collapse and disintegration of a way of life that won’t return as it was in December 2019.

Thus, it is important to understand that “Business, as Usual” is over for good. With the United States on lockdown for at least another month, the situation in the financial system and economy will continue to deteriorate. It won’t matter how much the Fed and central banks prop up the markets, because the Fundamental Economy has suffered a massive heart attack.

In my newest video update, Silver Investing During The Coming Financial Storm, I explain why it’s essential to acquire physical silver bullion as the negative impacts from the global contagion has just only begun:

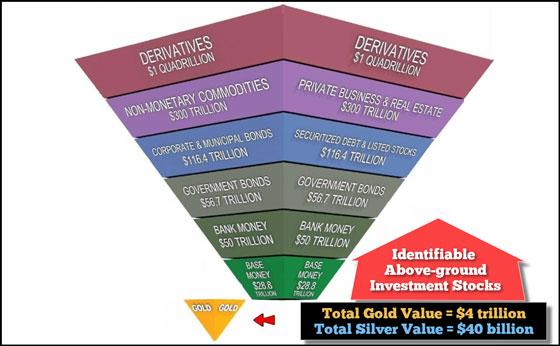

In the video, I explain how the global contagion has forced investors to move down the Exter’s Pyramid to safer assets, with gold and silver being at the bottom. The largest financial assets (in dollars) at the top, are the weakest. And, now, with Global GDP currently forecasted to decline 36% in Q2 2020, a lot of these financial assets are in serious trouble.

With Government Bonds, Bank Money, and Base Money being the safest financial assets at the bottom, totaling $136 trillion, gold and silver valued at $4+ trillion represents only 3% of those assets or supposed assets. Investors that are currently trying to acquire physical gold and silver bullion are finding it very difficult to obtain supplies. This will only become more difficult as time goes by.

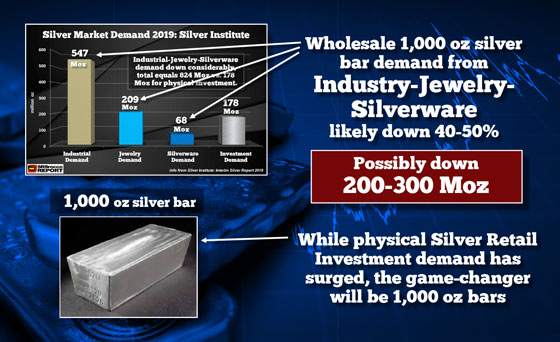

One question that I receive the most is… “Why is the paper futures silver price so much lower than the physical retail bullion price?” While I explained it briefly in my last video, I provide more details using the chart below. HOWEVER…. this is only a temporary situation.

I forecast that as the financial system continues to implode, Large Investors, Hedge Funds, and Institutions will start acquiring 1,000 oz wholesale silver bars to protect wealth. They will not be buying these bars for Industrial-Jewelry-Silverware consumption, but rather, to protect their wealth during the coming Financial Storm.

If it is challenging to acquire smaller retail silver productions (1-100 oz), back ordered for weeks-months, then it makes logical sense to seek out the larger (lower premium) 1,000 bars. While some investors may acquire these 1,000 oz silver bars to make smaller retail products, I believe a large percentage will hold them as an investment while a lot of financial assets continue to lose value.

If you haven’t purchased any Gold or Silver Insurance, you may want to consider doing so before it’s difficult to acquire the physical metal.

About the Author:

Independent researcher Steve St. Angelo started to invest in precious metals in 2002. In 2008, he began researching areas of the gold and silver market that the majority of the precious metal analyst community has left unexplored. These areas include how energy and the falling EROI – Energy Returned On Invested – stand to impact the mining industry, precious metals, paper assets, and the overall economy.