So far this year, my base case on the economy has been that we're repeating the 1970's stagflation. With a first bout of high inflation followed by a period of rapid GDP growth that ends in a second, even worse, stagflation.

Going by the 70’s, that second stagflation could go on for a long time considering the last one was only ended by a brutal series of engineered recessions that cost Jimmy Carter his job.

In other words, Washington won't make that mistake again – next time they'll just let it run.

All pretty dire, but there's actually another shoe to drop an even worse outcome that – going by commenters – a lot of people are worried about: A Depression. Meaning an extended period not just of stagnation but a dramatic plunge in our living standards.

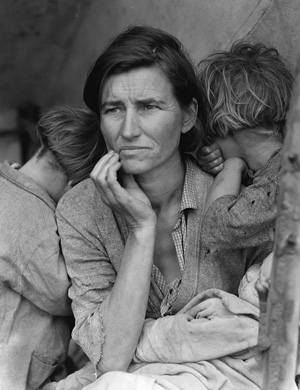

Soup kitchens, kids without shoes, former middle class bread-winners riding trains as hobos in search of work.

So it's worth asking: What would it take to get a Depression?

The key here is that Depressions don't fall from the sky. They're not divine retribution for exploiting the proletariat. No, Depressions are made in Washington.

Namely, they're made of a never-ending series of government interventions that ultimately scare investors and businesses into what's called a "capital strike."

In other words, businesses freeze in place, cutting investment and even shutting down because they don't know what the rules of the game will be tomorrow. They, prudently, stand down and try to stem the losses.

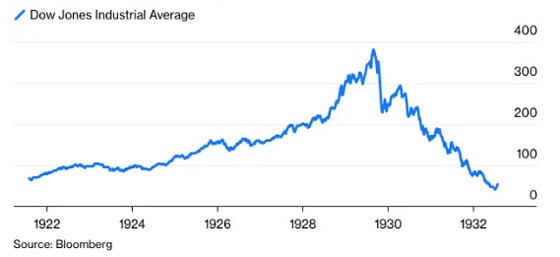

That's exactly what happened in the 1930's as Hoover and then FDR threw the kitchen sink at regulations, mandating everything from above-market wages – which force companies to lay off workers – to political commissars deciding what price you can sell – indeed deciding if you'll have to sell your product for less than it cost.

All this while FDR hiked income tax to, ultimately, 94%. Meaning if you somehow dodged all the regulatory bullets you ended up with 6 cents on the dollar.

Why bother? Just keep your powder dry and wait and see.

In raw numbers, investment went from 16% of GDP in 1929 to less than 2%. So a fall of almost 90%. That's how you get to the kids without shoes while their Dads hop the train to the next soup kitchen.

The great economist Bob Higgs coined a fantastic term to describe this: Regime Uncertainty. As in, business and entrepreneurs no longer know what the rules of the game will be tomorrow, next month, next year.

After all, only a fool hires new workers, who are an ongoing expense. Or invest in new assembly lines – also a cost – if you have no idea if you'll be forced to fire them tomorrow or sell it for scrap.

So what's next?

Joe Biden is still a long way from Hoover or FDR, who HL Mencken dubbed a "Fuhrer" peddling envy and hatred. We won't see truly stupid ideas until we hit the recession.

Going by last time, that could mean price controls, shortages, top-down dictates and extortionate taxes that shutter even health businesses, and probably a UBI — “Universal Basic Income” — to put another 5 million Americans on the couch permanently.

In the meantime, the rule of thumb is the dumber the solutions, the closer we are to a Depression.

About the Author:

Peter St. Onge writes articles about Economics and Freedom. He's an economist at the Heritage Foundation, a Fellow at the Mises Institute, and a former professor at Taiwan’s Feng Chia University. His website is www.ProfStOnge.com.