Gold just set a new record high, although you’d be forgiven for not noticing in the absence of any hoopla or even commentary.

This stealth bull run, accomplished without the help of Western investors and just as the Fed is about to pivot, will make for a very Happy New Year for gold bugs.

It seems the entire world is taking the last few days off, and so did I.

But with gold just setting a new record and flirting with a key breakout level, I’ve forced myself to come in to offer you a few notes.

An “Interesting” Year and Month

Gold ended up about 14% higher for the year, but it’s been anything but simple or easy. Despite what’s been arguably the harshest tightening cycle in central banking history, gold not only held its ground but managed to advance.

And, true to the form established over the last 12 months, it’s been an interesting close to 2023.

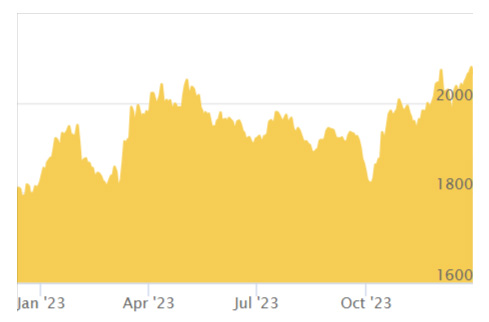

2023 Gold Chart

Looking at the past month or so in the chart, we see the remarkable spike to $2,150 on that infamous Sunday evening earlier this month, and the slam that quickly followed on the Monday morning.

The result of that shove was a decline back below $2,000, and the typical calls for “one last dive before we soar” coming from various corners of the gold bug universe.

It was not to be so, as gold began steadily rising, even as traders and speculators began to divert their attention to holiday parties and year-end positioning.

This stealth rally took us to an all-time record spot close of $2,089 this week, amid virtually zero fanfare or even mention in the gold forums, much less the mainstream financial media.

This rally, like those of the past few months, has been driven not by Western investors, but by central banks and Eastern buyers. We know this because the holdings in the primary tool of Western gold speculators, the GLD gold ETF, has been largely unresponsive to gold’s fall rally...and completely unresponsive to its most recent run higher.

As I’ve been saying in recent weeks, this means there’s tremendous buying power remaining in this bull market, especially when you consider that Western investors are typically trend-following. In addition, the central banks can print all the money they want to buy gold, and their appetite seems unlikely to wane anytime soon.

From a technical standpoint, it’s very simple: $2,100 or bust. If gold doesn’t get past that level, to establish a clear break from the previous rallies, this one will be quickly chalked up as just another failure — a quadruple peak, if you will.

The good news is that, from a fundamental standpoint, the odds favor gold breaking through $2,100 very soon.

As I predicted a few months ago, the markets are now pricing in the inevitable Fed pivot — and considering its stellar performance while Powell & Co. were eagerly hiking rates, gold stands to be among the biggest beneficiaries when they finally begin the cutting cycle.

If you’ve been listening to my advice over the past year, you’re well positioned for this move.

In short, it looks like we’ll have a very Happy New Year ahead, and we’re certainly ready for it.

About the Author:

Brien Lundin is the publisher and editor of Gold Newsletter, the publication that has been the cornerstone of precious metals advisories since 1971. Mr. Lundin covers not only resource stocks but also the entire world of investing. He also hosts the annual New Orleans Investment Conference. To get Brien Lundin’s ongoing commentary on the markets at no charge, click here to subscribe to his free Golden Opportunities newsletter.