The holidays are done and inflation is back.

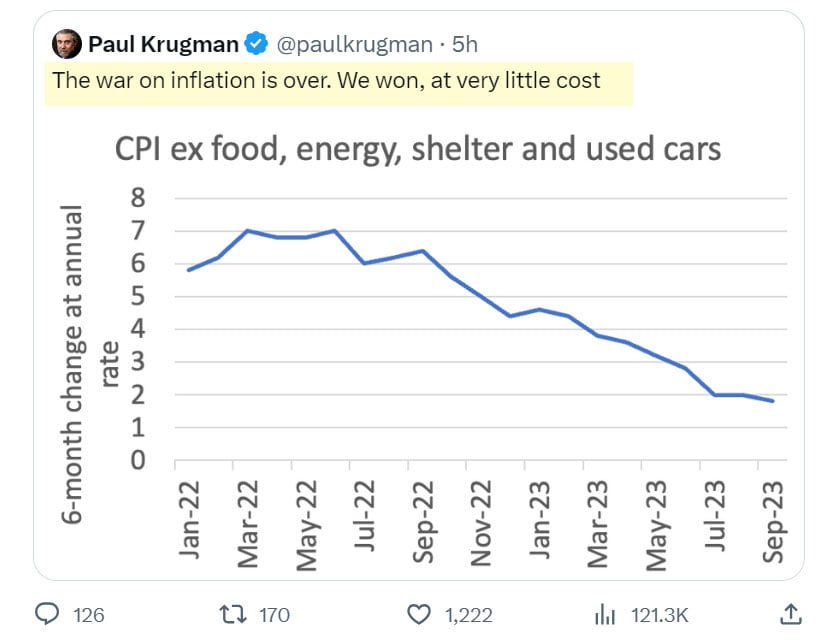

After months of mainstream victory laps – including Paul Krugman's famous "inflation is over. We won at very little cost" – it turns out inflation's not dead after all. It's not even resting.

As my colleague EJ Antoni put it, inflation ripped the stake out of its chest and loosened a blood-chilling scream.

So first the numbers. The Bureau of Labor Statistics, who lovingly hand-craft our alleged inflation numbers, put out fresh data for December. Saying headline CPI went up at an annualized pace of 3.7%.

That's a problem because it's almost 3 times higher than the previous month – the month that Paul Krugman was celebrating.

Worse, the CPI is currently running double the pace of last December – a year ago.

So "transitory" is looking a lot longer than it used to.

It's even worse on so-called "core" CPI – which strips out food and energy. That came in at an annualized 3.8. About a half point higher than the previous month.

Finally, so-called "SuperCore" inflation – not a joke. Which the Fed pulled out of its hat to strip out housing costs. That one's doing even worse, hitting almost 5% annualized.

That feeling when your fake statistics don't work out.

The problem is none of this should be happening since we've just gone through the most savage Fed-induced credit strangle since the 1970's. In fact, in terms of money supply – how much confetti is in existence – it's been the worst Fed-induced credit strangle since the 1930's.

So we've got the creeping recession to show for it – as everybody, including the Fed, expected. And yet inflation isn't just undead, it's positively rocking the graveyard.

Why Inflation’s Back...

So what happened? Two things.

First, the Federal government never actually cut spending.

Second, there was so much bank and hedge fund money parked at the Fed that as it drained out – especially the reverse repo – that meant there was plenty of money sloshing around Wall Street. It was only tight for the unwashed voters trying to, say, buy a house. Or pay down their credit card.

The federal spending, in particular, has been eye-watering. In fact, just hours after the BLS inflation report, Janet Yellen rolled up with her bag of goodies, reporting the federal deficit for December soared to one hundred and thirty billion dollars. in a single month.

For perspective, the typical budget deficit during the Trump years was on the order of $20 billion. Under Biden it was 80 billion last year, and now it's 130.

And there's still another year to go – maybe more if the dead vote swings blue again.

Inflation Going Worldwide

Later in the week, we got further confirmation from British inflation numbers, which showed the first rise in almost a year. It's worth noting Reuter's economist survey had expected inflation to go down. Not up.

Throw in rising inflation rates in Canada and the Eurozone, and inflation is now rising pretty much across the West.

Now, the UK had been a canary in the coalmine since it had gone up so bad these past few years – even worse than the US. In fact, early last year official food prices in the UK were running 20% inflation.

At this point British food's still running 8%, but the big surprise was everything else: services, transport, recreation, stuff you drop on your foot and stuff you do not.

Air fares were up 60% on the month. Clothes went up when they normally collapse post-Christmas. Live music, holidays, theater — it’s all up.

In fact services rose to 6.4% annual inflation. Which is a problem since they make up the majority of what the British buy.

This mirrors what's been happening across the West. Indeed, that same FT article notes what I've been saying in videos: there's been essentially zero progress on inflation outside energy, which is driven by looming recession and the winding down of Mr Putin's war.

Why hasn’t inflation gone anywhere? For the simple reason that obscene government spending has continued also across the West.

Essentially taking the money they grabbed for Covid lockdowns and recycling it into everything from diversity to global warming to millions of random migrants.

The Fed Has Painted Itself Into a Corner

Interestingly enough, surging inflation hasn't really changed market expectations of rate cuts. That's weird, since normally you'd expect central banks to not cut rates if inflation is rampant.

There are a number of hypotheses why: perhaps, as I've argued, the Fed is so afraid of recession that it'll just let inflation rip to knock down those coming unemployment headlines.

Of course, there's a much darker possibility: perhaps the Fed isn't actually looking at inflation or the economy. Because what they're afraid of is the stability of the financial system itself.

As in, the Fed and its minion central banks are desperate to cut rates even in the face of inflation because the alternative is a financial collapse too big to bail out.

After all, high rates were what crashed all those banks back in March, and they never really fixed it, they just papered it over.

Indeed, the Wall Street Journal notes that most cases when central banks slash rates to the degree markets currently expect are driven precisely by "some form of financial panic."

Central banks across the West – really across the world – have painted themselves into the mother of corners, potentially facing durable global stagflation for the first time in 50 years, this time paired with a financial crisis that would make it a combination not seen since the 1930's.

About the Author:

Peter St. Onge writes articles about Economics and Freedom. He's an economist at the Heritage Foundation, a Fellow at the Mises Institute, and a former professor at Taiwan’s Feng Chia University. His website is www.ProfStOnge.com.