America is borrowing its way to prosperity.

When I was growing up, my stepdad had a “rich” friend. The guy lived in a massive house. He owned several fancy sports cars. He was always dressed to the nines. He was among the first to buy the latest, coolest gadgets.

As it turns out, he wasn’t rich. He borrowed hundreds of thousands of dollars for a construction project, spent a lot of the money on himself, and eventually went bankrupt. He had to sell the cars. The bank repossessed his house. He ended up selling a lot of his fancy toys.

He is the personification of the U.S. economy.

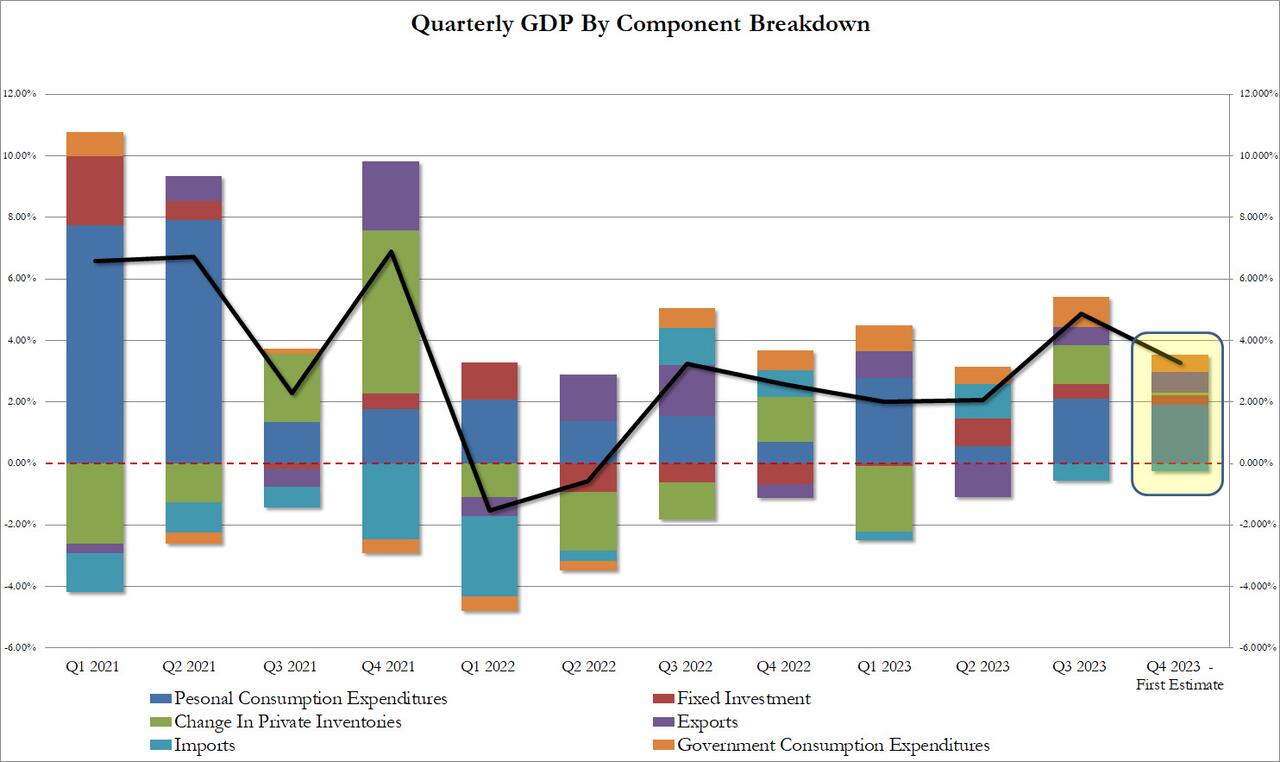

Fourth quarter GDP came in much better than expected at 3.28 percent. This set off waves of celebration at the White House. Nothing makes presidents happier than solid economic data in an election year. (Come to think of it, this might be a reason to be skeptical of government-generated numbers.)

But when you put the GDP growth into a broader context, the celebration isn’t warranted.

This “booming” economy is built on debt. It looks good now, but riches built on borrowing have a limited shelf life. Just ask my father’s buddy.

THE NATIONAL DEBT

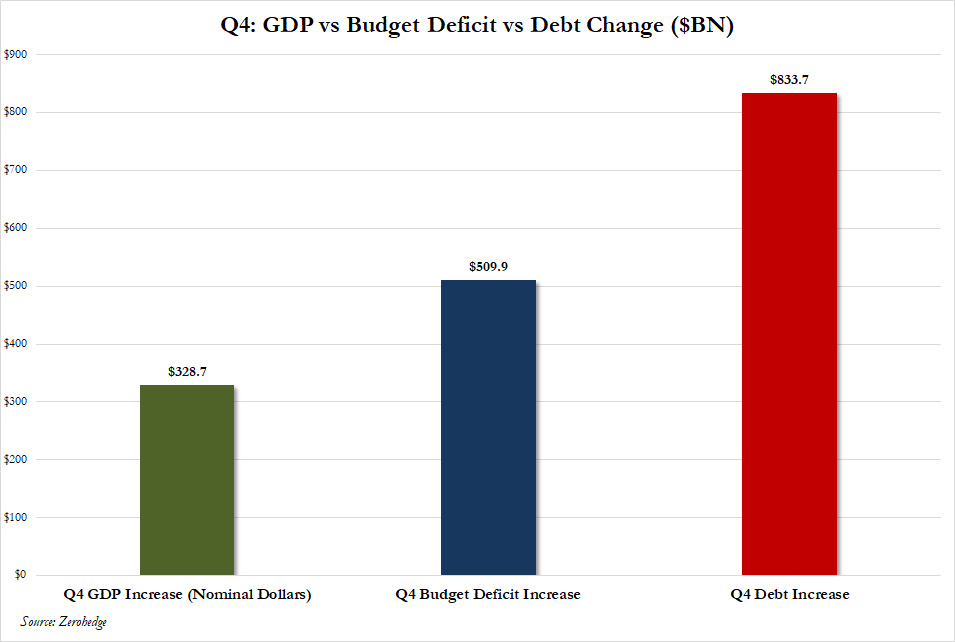

If you think GDP growth in Q4 was impressive, check out the growth in the national debt. In just three months, the U.S. government added $833.7 billion to the debt.

In other words, the U.S. government borrowed $833.7 billion to buy $328.7 billion in economic growth.

Government was one of the biggest contributors to GDP growth, accounting for more than half a percent of the 3.28 percent increase. In other words, if you remove government spending borrowed money, GDP drops to 2.72 percent.

The national debt topped $34 trillion on December 29. On its way to the third-largest budget deficit in U.S. history, the Biden administration spent $6.46 trillion in fiscal 2023. That was an 8.8 percent year-over-year increase in actual spending.

When you put GDP growth into that perspective, it doesn't seem so grand.

According to the U.S. Debt Clock, the debt-to-GDP ratio currently stands at 122.47 percent. In 2000, it was a mere 59.43 percent

Any discussion of GDP growth needs to be viewed through the debt prism.

In fact, the massive level of debt is hindering real economic growth. According to a study by the World Bank, countries with a debt-to-GDP of over 77 percent for prolonged periods experience significant slowdowns in economic growth.

If debt rises above this threshold, each additional percentage point of debt costs 0.017 percentage points of annual real growth.

SURGING CONSUMER AND CORPORATE DEBT

Consumer spending was the biggest contributor to the GDP print in Q4. Personal consumption added 1.91 percent to the GDP increase, more than half of the 3.28 percent growth.

So, where did Americans get the money to go on this spending spree?

They raided savings and borrowed it.

Personal savings as a percentage of disposable personal income was 4.0 percent in the fourth quarter That dropped 4.2 percent in the third quarter.

Meanwhile, consumer debt eclipsed $5 trillion for the first time ever in November. That same month, revolving credit, primarily made up of credit card debt, rose by $19.1 billion, a whopping 17.7 percent increase. To put the percentage increase into perspective, the annual increase in 2019, prior to the pandemic, was 3.6 percent.

As of the end of November, Americans owed just over $1.3 trillion in revolving credit.

We’ll get the December consumer credit data early in February, but it will almost certainly show another big jump in consumer debt.

Meanwhile, U.S. nonfinancial corporate debt has surged to $13.7 trillion, according to data compiled by the Federal Reserve. Business debt has increased by 18.3 percent since 2020.

So, yes, we’re seeing economic growth. But everybody is borrowing to the hilt to drive it.

Like my dad’s “rich” friend, it’s wealth created by smoke and mirrors. That’s all well and good until the smoke clears and the mirror cracks.

About the Author:

Mike Maharrey is a journalist and market analyst for MoneyMetals.com with over a decade of experience in precious metals. He holds a BS in accounting from the University of Kentucky and a BA in journalism from the University of South Florida.