Gold is looking like an irresistible force, and now silver is joining the party!

For today’s headline, I tried to come up with one word to describe gold’s incredible run, and you can see what I came up with above.

I decided to look up the definition of “juggernaut” on Dictionary.com, and this is the first of two listed:

1. any large, overpowering force or object, such as war, a giant battleship, or a powerful football team.

Yep, that applies!

I couldn’t help but laugh to myself, however, when I saw a second definition that I wasn’t aware of:

2. anything requiring blind devotion or cruel sacrifice.

Hah... that would certainly apply to gold as well!

In all seriousness, the gold juggernaut has continued its stampede this week. Yesterday, the price was up “only” about $6.00 before CNBC finally began to cover the metal’s run with some positive commentary (only a month late, but better late than never).

Whether coincidence or not, gold quickly added about $15 after a number of talking heads had spouted bullish forecasts.

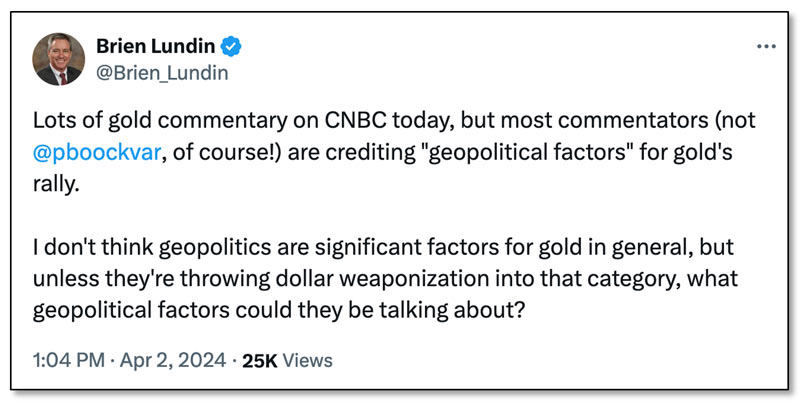

Those analysts, with one exception, were way off the mark, however in trying to explain why gold was soaring. As I noted on X:

That kind of commentary is continuing today, and from some sources that should know better. To reiterate, the demand for gold has been coming from central banks in general, and particularly from the People’s Bank of China, along with remarkable buying from Chinese citizens.

If you want to put a shift away from dollar hegemony under the “geopolitical” heading, I guess that’s fine. But what the pundits have been referring to are Gaza and Ukraine, and these are having zero effect on gold.

Importantly, we’re now seeing Western investors jumping on the trend, as evidenced by the amazing move in silver over the last few days – and even the last several weeks.

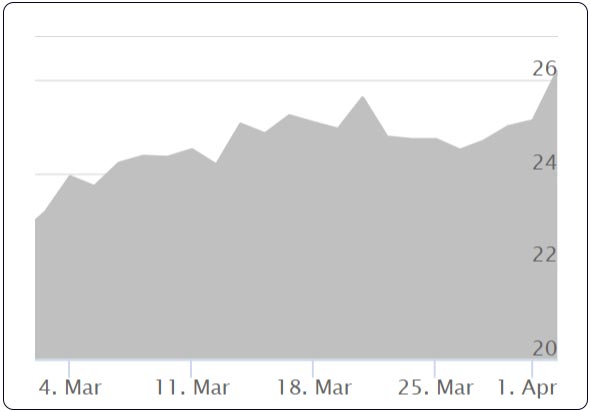

Price of Silver

As you can see, after resistance at $25 was taken out, silver quickly broke through resistance at $26... and is already challenging $27.

Looking at silver’s performance relative to gold, you can see that the gold/silver ratio is plummeting — reflecting how silver is now providing tremendous leverage to the yellow metal.

This is precisely what we want to see, not only for the effect it has on our portfolios of junior silver miners, but also because it’s an important confirmation of a secular bull market in gold.

As I write, gold is up another $12, while silver is continuing to rocket higher.

Again, this is the bull market we’ve been waiting for...and it’s begun before the major catalyst of a Fed pivot.

There’s much more to come, so make sure you’re positioned.

To get Brien Lundin’s ongoing commentary on the markets at no charge, click here to subscribe to his free Golden Opportunities newsletter.

About the Author:

Brien Lundin is the publisher and editor of Gold Newsletter, the publication that has been the cornerstone of precious metals advisories since 1971. Mr. Lundin covers not only resource stocks but also the entire world of investing. He also hosts the annual New Orleans Investment Conference. To get Brien Lundin’s ongoing commentary on the markets at no charge, click here to subscribe to his free Golden Opportunities newsletter.