Recent earnings numbers from McDonald's, Kraft, and Coke confirm that Bidenomics is turning into a two-speed affair. With plenty of wealth at the top and plenty of pain for normal people.

Last week, I joined Charles Payne, one of my favorite people on Fox, to talk about it.

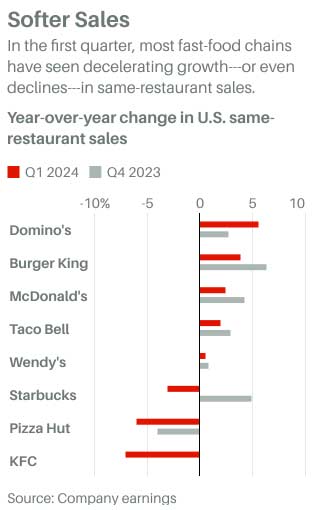

In short, McDonald's, Coke, Nestle, Starbucks, and Pepsi have all now flagged that low-income consumers are no longer able to absorb inflation.

They're cutting back on visits and they're cutting back spending, leading to a nationwide drop in traffic and sales across fast food and even basic groceries.

McDonald's reported same-store sales are down 3%, and transactions dropped 7% -- outpacing 4% price hikes to keep up with inflation.

Pepsi reported a 5% drop in sales, Nestle had an 8% drop for Hot Pockets, frozen pizzas and Stouffer frozen dinners. Kraft Mac n Cheese, Pringles, Pop Tarts are all sagging.

Starbucks is losing the low end altogether, with its stock plunging 14% after turning in lower revenue, transactions, and ticket-size, while losing fully 1.5 million loyalty-reward users.

The CEO blamed "macro headwinds." Meaning lower-end consumers squeezed by inflation and weak wage growth.

Headwinds is quite the understatement: Nestle's chief financial officer estimates the loss in discretionary purchasing power among low-income since Biden took office has come to roughly half.

Plenty of Cake at the Top

It's a whole nother reality on the high-end, where sales are doing fantastic. Molson reported strong growth in pricier beers as more consumers "treat themselves."

More broadly, the luxury ETF LUXX, which includes brands like Hennessy, Hermes, and Ferrari, is actually up 20% in the past 6 months as the wealthy gobble up their Balenciaga and let the poors eat TJ Maxx.

In fact, just a few months ago Lamborghini announced they'd sold 10,000 cars for the first time in history. A third of them in the US, and mostly the Urus SUV that goes for $237,000 -- 269 for the performance model featuring carbon ceramic brakes with subtle off-white coloring and a watermark.

Bentley also reported record sales, with Aston Martin and Rolls Royce close behind. One analyst summed it up as a "K-shaped economy,” with very different realities for those at the top and those at the bottom, reflected in strong credit card spending at the top paired with rising delinquency rates for the rest.

Fed Inflation Helps the Rich, Screws Everyone Else

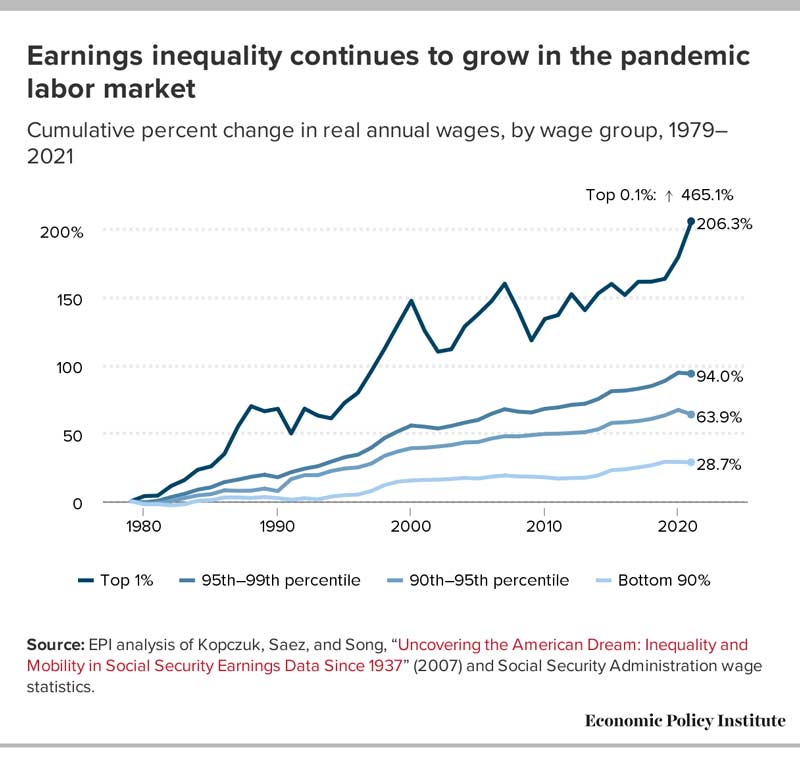

The rich will keep getting richer, and everybody else will keep getting inflation, because that's how the Fed works, and it's how crony government spending works.

The Fed's 6 trillion dollar money-printing orgy and the 8 trillion in deficit spending since the pandemic have flooded money to anybody who either already owned assets -- rich people -- or was lucky enough to work at a politically connected company or government contractor.

As always, government money goes mostly to the powerful, with an obligatory slab for vote-buying at the bottom. And nothing for the middle-class but taxes.

The solution's very easy: a dollar-first monetary policy -- ideally ending the Fed. Along with ending the deficits so Americans aren't forced to run just to stay on the treadmill.

About the Author:

Peter St. Onge writes articles about Economics and Freedom. He's an economist at the Heritage Foundation, a Fellow at the Mises Institute, and a former professor at Taiwan’s Feng Chia University. His website is www.ProfStOnge.com.