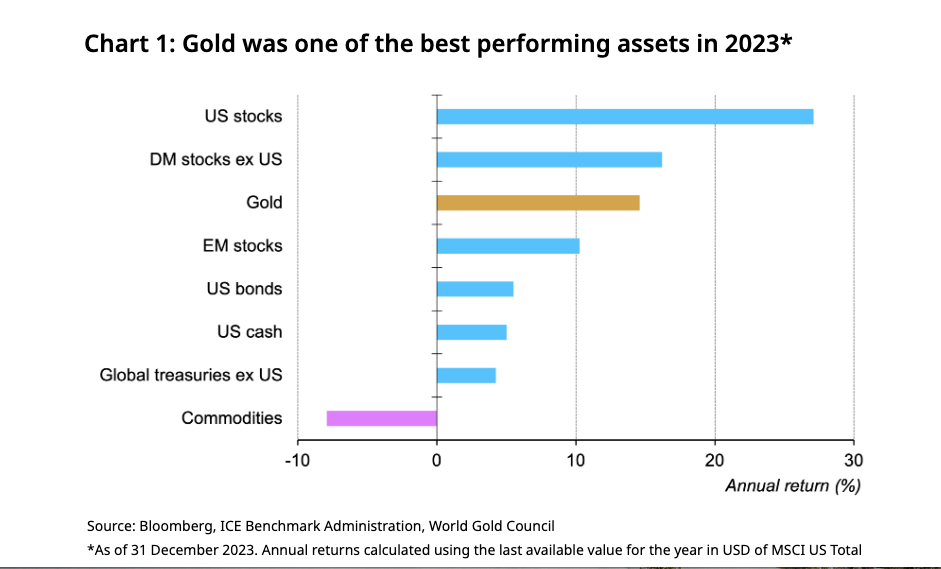

Gold was among the best-performing assets in 2023.

The yellow metal ended the year at $2,064 an ounce and was up over 13 percent on the year.

So, how did gold stack up against other investment assets?

Pretty darn well.

According to analysis by the World Gold Council, gold outperformed emerging market stocks, U.S. bonds, the U.S. dollar, global treasuries, and commodities in general.

The only asset classes that performed better than gold were U.S. stocks and developed-market foreign stocks.

Gold charted this solid performance despite facing significant headwinds of a strong dollar and rising interest rates as the Federal Reserve tightened monetary policy throughout most of 2023.

The prospect of the Fed ending its interest rate hiking cycle and potentially cutting rates in 2024 helped gold rally through the last two months of the year.

Gold surged to a new record high in early December topping out at just over $2,125 an ounce. It couldn’t sustain those highs, but it has since built strong support at $2,000 an ounce, creating a foundation for gold to test new highs in the coming year.

On Dec. 28, the LBMA Gold Price reached a new historical record of $2,078.40 per ounce during the final afternoon auction of 2023.

The World Gold Council pinpointed three factors driving gold's solid performance in 2023.

- Strong central bank demand

- Robust retail demand in key markets

- And increased geopolitical risk, especially in the last part of the year.

There are at least three factors in play that provide reasons to believe the gold rally will continue into 2024. You can read more about that HERE.

About the Author:

Mike Maharrey is a journalist and market analyst for MoneyMetals.com with over a decade of experience in precious metals. He holds a BS in accounting from the University of Kentucky and a BA in journalism from the University of South Florida.