Borrowing continues to get more and more expensive for Uncle Sam.

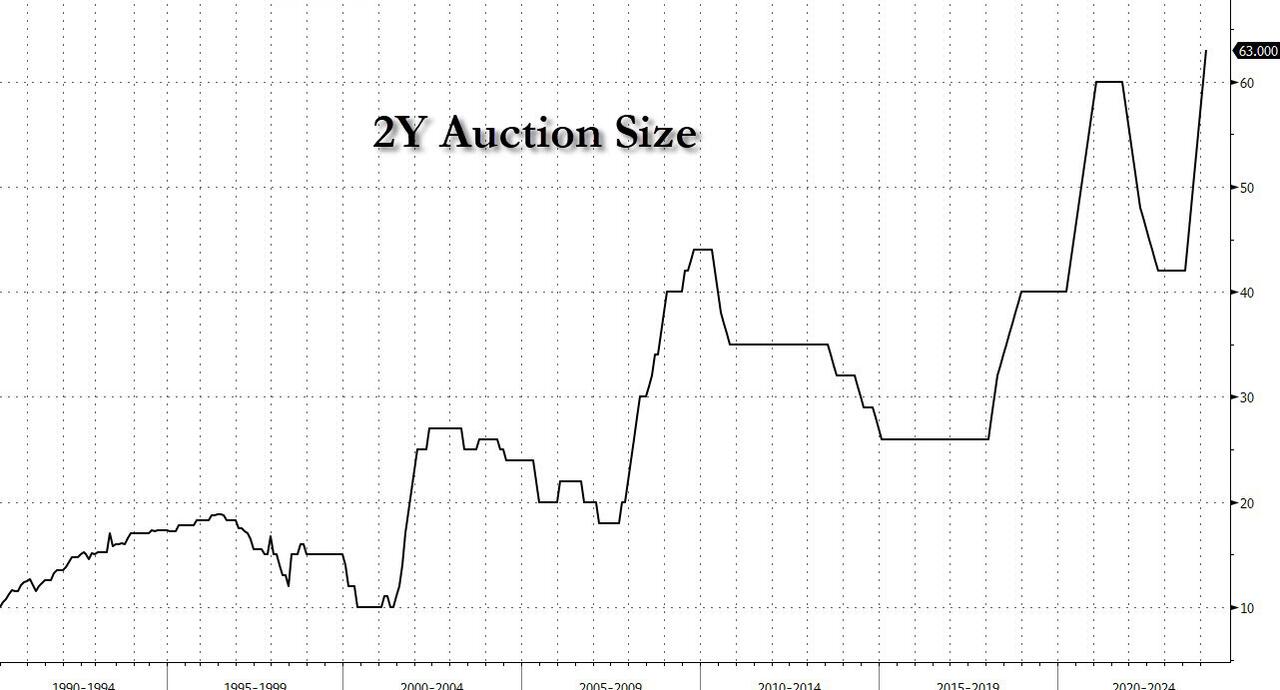

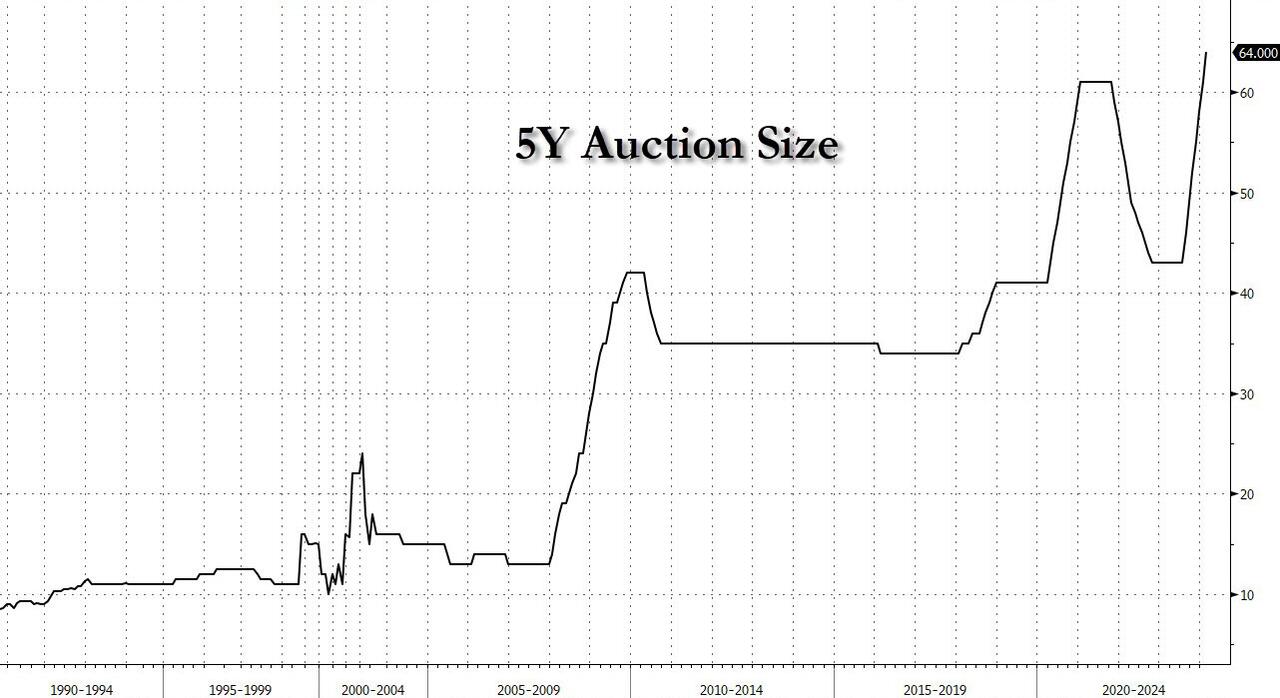

The U.S. Treasury held two auctions on Monday, selling 2-year Treasuries and 5-year notes. Both auctions set a record.

The Treasury sold $63 billion in 2-year notes and $64 billion in 5-year notes.

That means the U.S. government added $127 billion to the national debt yesterday.

Bloomberg described demand as “middling” despite yields near the highs of the year.

The yield on the 2-year started at 4.69 percent, 32.6 basis points higher than the previous auction. The 5-year yield started at 4.32 percent. That was up 26.5 basis points from last month.

After the auctions, interest rates across the yield curve spiked. The yield on the 10-year hit rose above 4.3 percent after the second auction. As ZeroHedge put it, interest rates spiked “with markets realizing just how much supply there is.”

A Big Problem for the Federal Government

Rising interest rates are a big problem for the U.S. government as it tries to finance out-of-control spending. As the budget deficits expand, the government has to borrow more and more to cover the shortfall. The more bonds it issues, the more prices drop. This is a simple function of supply and demand.

Yields are inversely correlated with Treasury prices. This means as the government borrows more and the supply of bonds rises, interest rates go up right along with it.

Uncle Sam isn’t the only one borrowing a lot of money. According to Bloomberg, “Investment-grade companies sold more debt in the U.S. this month than in any other February on record.”

In other words, everybody is borrowing money, despite high interest rates. (This doesn’t bode well for the trajectory of the economy.)

The bottom line is the borrow-and-spend U.S. government can’t function in a high interest-rate environment.

The U.S. government spent $69.2 billion on interest expenses alone in January. This was more than the amount spent on national defense ($60 billion) and more than healthcare ($68 billion).

Interest on the federal debt came in $96 billion higher through the first four months of the fiscal year than in the same period last year. The government has shelled out $357 billion on interest payments in fiscal 2024. The only category with higher spending was Social Security.

And interest expense will only continue to climb as the U.S. government continues to borrow and spend, adding to the supply of Treasuries floating around in the marketplace.

Even Federal Reserve Chairman Jerome Powell has acknowledged that the U.S. is on an “unsustainable fiscal path,” but, of course, he fails to take any blame for the situation.

In fact, most everybody acknowledges the rampant borrowing and spending is a problem, but nobody has the political will to deal with it.

About the Author:

Mike Maharrey is a journalist and market analyst for MoneyMetals.com with over a decade of experience in precious metals. He holds a BS in accounting from the University of Kentucky and a BA in journalism from the University of South Florida.