U.S. Gold Coins for Sale

Our experience suggests, no gold portfolio is complete without including the most popular and widely traded American gold coins. Gold coinage has a long history in the United States mints (e.g. Philadelphia, San Francisco, etc.). Americans relied on gold coins in a variety of denominations for commerce during the first century and a half of our nation’s independence from the British.

Today, those same coins, as well as more modern issues from the US Mint, are used as a form of investment by people, as a hedge against inflation or economic catastrophes. They have proven to be a reliable store of value even if people no longer use them to make payments.

Depending upon the outcome of our government’s experiment with purely fiat dollars, Americans may again see gold at the center of our monetary system once again. Paper fiat currency systems have a way of collapsing because of a lack of trust. And trust is exactly what a gold standard, or gold redeemability, can provide.

What Are United States Mint Gold Coins?

There are two broad categories of old American gold coins. The historic coins minted before 1933 (pre-1933) were intended for circulation and spending, and the modern coins, minted in 1986 and after which, have been primarily held by investors. Money Metals Exchange offers both varieties.

The historic coins were minted at 90% purity and come in a range of conditions, depending upon how long they spent circulating and accumulating wear. The metal content is not marked on the coin, and the gold weights are not in round figures.

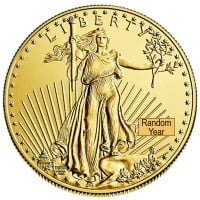

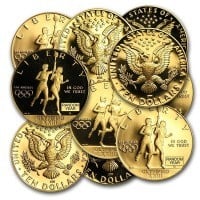

For example, the $20 Saint-Gaudens (aka Augustus Saint-Gaudens) with a double eagle on the reverse, and an image of Lady Liberty on the obverse, these gold eagle coins variety designs contain .9675 troy ounces of actual gold bullion. Although this U.S. Mint coin has a face value of $20, it is certainly worth more than that due to the gold coin's melt value.

On one hand, these older coins can often command higher premiums for their historical interest, condition, quantity, rarity, symbol, mint mark, age, circulated/uncirculated grading (e.g. bu), and designs of pure beauty. Some specimens and series are truly rare and coveted by collectors.

But, by and large, these coins were minted in very large quantities and remain readily available around the world today. Investors should be extraordinarily careful before listening to the song and dance of “rare” coin salespeople who make audacious claims of quick wealth, supposed market security of valuable coins, and paying prices way above melt value.

The US Mint stopped producing gold coins following President Franklin D. Roosevelt’s changes to the monetary system in 1933. Gold coins were pulled from production and circulation while citizens were directed by demand to turn in the gold assets in their possession to the government, under penalty of law.

This “confiscation” of the economy is considered by many today as a black mark in our history. Citizens who complied with Roosevelt’s public executive order were cheated. They received a little over $20 per ounce for the gold they initially tried to save but were coerced to turn in. Shortly afterward, that gold stock was revalued to $35 per ounce. So much for government protection benefits and secure confidence in self-directed retirement.

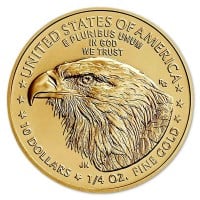

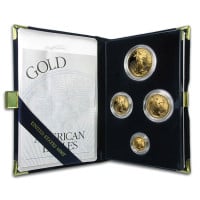

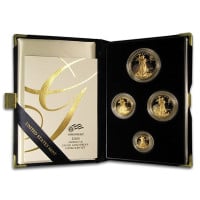

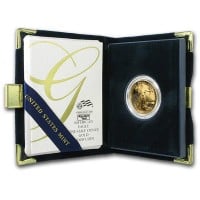

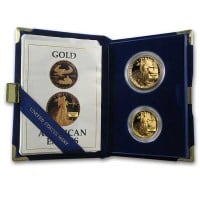

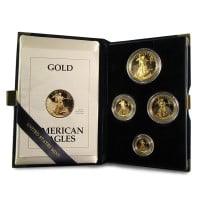

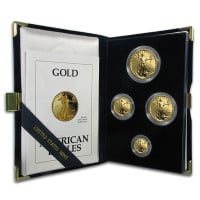

It wasn’t until 1986 that the US Mint began issuing gold coinage once again. They began with the Gold American Eagle in 4 sizes- 1/10 oz, 1/4 oz, 1/2 oz, and 1 oz. The gold American Eagle has a figure of a walking Lady Liberty with flowing hair carrying an olive branch and a torch on the obverse, and an American bald eagle liberty head on the reverse designed by Augustus Saint-Gaudens (post-1986); or, a bald eagle soaring over a nest on the reverse (pre-1986) designed by Miley Busiek. In fact, 2021 has a newer release design piece influenced by artist Jennie Norris.

The popularity of those coins has led to a variety of other options, including commemorative coins and medallions, proof varieties, gold rounds, and the Gold American Buffalo - a .9999 pure alternative to the Eagles which are a type minted in 22k (.9167) purity. The gold American Buffalo, also known as the gold buffalo, features the image of a buffalo (aka bison) on the reverse side and a Native American Indian head on the obverse side. The design is from the US nickel design images by James Earle Fraser.

It is important to note that modern versions of these gold coins are marked with both weight and purity. Weights indicated are always the actual gold content, so the 1 oz American Eagle contains a full troy ounce of gold in addition to a bit of silver and copper as an alloy. You can purchase these Gold and Silver US coins from Money Metals Exchange.

Gold American Eagles are now traded in the largest quantities of any gold bullion coin in the nation or worldwide. These modern gold bullion coins are a great product for investors to take advantage of lower prices and get maximum liquidity, and they make for excellent gifts.

Popular Types of American Gold Coins

There are many types of coins, all having their own unique style, as an investment or a gift. Money Metals always recommends that investors stick with the most popular, lowest-price coins. That makes the gold American Eagles collection a great pick. They are, by far, bought and sold in the largest quantities of any gold bullion coin.

The American Buffalo is another great choice for investors who prefer something in .9999 purity. Visit Money Metals Exchange for the best possible prices on these products, and others.

The popularity of gold coins has inspired other mints around the globe to also create more gold coins. You may see gold coin production by such mints as the Maple Leaf by the Royal Canadian Mint, the Philharmonic by the Austrian Mint, the Kangaroo by the Perth Mint, the Krugerrands by the South Africa Mint, and the Beasts by the British Mint.

Another popular way to learn and shop for precious metal coins is through social media such as TikTok, Facebook, Instagram, and Youtube.

How to Buy U.S. Mint Gold Coins?

Purchasing gold bars, coins, or rounds is easier today than it has ever been. Investors can find products, compare prices, evaluate dealer reputations, and place orders to have metal delivered right to their home or office in just a few minutes and an internet connection. Or by simply making a phone call.

The most important step is to choose a dealer with a reputation for prompt service, fair prices, a wide variety of products, a selection of quality coin series, a catalog webpage or site, and strong quality control.

Money Metals Exchange offers all of these things, plus some of the most knowledgeable and helpful people in the business. We also keep our clients updated and educated on the precious metals markets and geopolitical events which will impact those markets via regular program news, category commentary, and podcasts.

Clients have the option of purchasing via browser at MoneyMetals.com, or by calling us at 1-800-800-1865. All calls are instantly answered by a live person in Eagle, ID, who will be happy to assist by providing information, answering your questions (FAQ), or helping with your account.

We will lock your pricing up front, then promptly confirm your purchase. Clients can make payments via check, money order, credit card, bank wire, or Bitcoin. We will ship your order promptly after clearing your payment, fully insured with signature confirmation at delivery so that your metal will not be left on your doorstep or in your mailbox. We keep you updated throughout the process with regular status updates.

A Word of Warning

Without us having to name each corrupt numismatic company, beware of dealers with high-priced celebrity spokespeople and national television advertising campaigns. The bullion business is very competitive and profit margins are very low. To pay for marketing on that scale, those dealers will aggressively promote very high-priced “collectible” coins. These “rare” coins are generally a disaster for investors who later find the coins they purchased in their portfolios are not at all scarce and command very little premium when it is time to sell.

In fact, we recommend buyers to have a firm handle on what a coin will be worth if they want to sell it before they buy it. If the selling price is more than a few percent below the buying price, they should run the other way. That is why Money Metals' site displays both the buy and sell prices live for each of our products at www.MoneyMetals.com.

How Do I Sell My U.S. Gold Coins?

Selling your gold coins is just as easy as buying them. Customers can sell any of the coins we carry online, or simply give us a call to place an order to sell by phone. We will lock your sell price in advance and send a purchase order with our shipping address. Ship us the items in appropriate shipping boxes and we will issue payment immediately after receipt by check, electronic credit, or bank wire (on request for larger transactions).

When Should I Sell My Gold U.S. Coins?

As with most investments, there is, of course, no simple answer. Perhaps the best advice is to sell when the rationale for investing in the first place has changed.

Investors buying gold today are worried about the future of the US dollar and dismayed by the out-of-control federal spending and borrowing. They dislike the “management” of our monetary system by the Federal Reserve Bank - a private and wholly unaccountable institution with a penchant for taking care of its owners - the nation’s largest banks - at the expense of citizens at large. They are concerned about the rickety nature of the global financial system and holding conventional paper stocks, bonds, and mutual funds whose value can be completely destroyed in a crisis or due to mismanagement.

Gold should remain part of every investment portfolio until those problems have been addressed. Unfortunately, we don’t expect reforms on these issues and factors any time soon, and on that basis will be recommending people buy gold, rather than sell it, until then.

That said, some investors will want to trade metal - trying to sell high and buy low. In other cases, people will need to liquidate metal bullion and pieces to raise cash for an emergency or to take advantage of another investment opportunity. People tend to thank their lucky stars that they have a hedge against inflation or a stock of gold to draw on when in times of need. Money Metals stands ready to buy your gold asset coins, bars, or rounds, whenever you decide it is time.

Why Are U.S. Gold Coins a Good Investment?

US gold coins are beautiful, and because they are so popular and widely traded, no coins will be easier to buy or sell - at a great price. That combination makes them ideal examples for investment.

U.S. Gold Coins for Sale

No gold portfolio is complete without including the most popular and widely traded American gold coins. Gold coinage has a long history in the United States. Americans relied on gold coins in a variety of denominations for commerce during the first century and a half of our nation’s existence.

Today those same coins, as well as more modern issues from the US Mint are used as a form of investment by people as a hedge against inflation or economic catastrophes. They have proven to be a reliable store of value even if people no longer use them to make payments.

Depending upon the outcome of our government’s experiment with purely fiat money, Americans may again see gold back at the center of our monetary system. Paper currency systems have a way of collapsing for lack of trust. And trust is exactly what a gold standard, or gold redeemability, can provide.

What Are United States Mint Gold Coins?

There are two broad categories of old American gold coins. The historic coins minted before 1933 were intended for circulation and spending, and the modern coins minted in 1986 and after which have been primarily held by investors. Money Metals Exchange offers both varieties.

The historic coins were minted at 90% purity and come in a range of conditions, depending upon how long they spent circulating and accumulating wear. The metal content is not marked on the coin, and the gold weights are not in “round figures.” For example, the $20 St. Gaudens variety contains .9675 troy ounces of actual gold bullion.

These older coins can often command higher premiums for their historical interest. Some specimens are truly rare and coveted by collectors. But, by and large, these coins were minted in very large quantities and remain readily available. Investors should be extraordinarily careful before listening to the song and dance of “rare” coin salespeople and paying prices way above melt value.

The US Mint stopped producing gold coins following President Franklin Roosevelt’s changes to the monetary system in 1933. Gold coins were pulled from circulation and citizens were directed to turn in the metal in their possession, under penalty of law. This “confiscation” is considered by many today as a black mark in our history. Citizens who complied with Roosevelt’s executive order were cheated. They received a little over $20 per ounce for the gold they turned in. Shortly afterward that gold was revalued to $35 per ounce.

It wasn’t until 1986 that the US Mint began issuing gold coinage once again. They began with the Gold American Eagle in 4 sizes; 1/10 oz, 1/4 oz, 1/2 oz, and 1 oz. The popularity of those coins has led to a variety of other issues, including commemorative coins and medallions, proof varieties, and the Gold American Buffalo - a .9999 pure alternative to the Eagles which are minted in 22k (.9167) purity.

It is important to note that modern coins are marked with both weight and purity. Weights indicated are always the actual gold content, so the 1 oz American Eagle contains a full troy ounce of gold in addition to a bit of silver and copper as an alloy. You can purchase these Gold and Silver US coins from Money Metals Exchange.

Gold American Eagles are now traded in the largest quantities of any bullion coin worldwide. These modern bullion coins are a great way for investors to take advantage of lower prices and get maximum liquidity

Popular Types of American Gold Coins

There are many types of coins, all having their own unique style. Money Metals always recommends that investors stick with the most popular, lowest-price coins. That makes gold American Eagles a great pick. They are, by far, bought and sold in the largest quantities of any gold bullion coin.

The American Buffalo is another great choice for investors who prefer something in .9999 purity. Visit Money Metals Exchange for the best possible prices on these products, and others.

How to Buy U.S. Mint Gold Coins?

Buying precious metals is easier today than it has ever been. Investors can find products, compare prices, evaluate dealer reputations, and place orders to have metal delivered right to their home or office with just a few minutes and an internet connection. Or by simply making a phone call.

The most important step is to choose a dealer with a reputation for prompt service, fair prices, and strong quality control.

Money Metals Exchange offers all of these things, plus some of the most knowledgeable and helpful people in the business. We also keep our clients updated and educated on the metals markets and geopolitical events which will impact those markets via regular news, commentary, and podcasts.

Clients have the option of purchasing via MoneyMetals.com, or by calling us at 1-800-800-1865. All calls are instantly answered by a live person in Eagle, ID who will be happy to assist.

We will lock your pricing up front, then promptly confirm your purchase. Clients can make payments via check, money order, credit card, bank wire, or Bitcoin. We will ship your order promptly after clearing your payment, fully insured with signature confirmation at delivery so that your metal will not be left on your doorstep or in your mailbox. We keep you updated throughout the process with regular status updates.

A Word of Warning

Beware of dealers with high-priced celebrity spokespeople and national television advertising campaigns. The bullion business is very competitive and profit margins are very low. To pay for marketing on that scale, those dealers will aggressively promote very high-priced “collectible” coins. These “rare” coins are generally a disaster for investors who later find the coins they purchased are not at all scarce and command very little premium when it is time to sell.

We recommend buyers have a firm handle on what a coin will be worth if they want to sell it before they buy it. If the selling price is more than a few percent below the buy price, they should run the other way. That is why Money Metals displays both the buy and sell prices live for each of our products at www.MoneyMetals.com.

How Do I Sell My U.S. Gold Coins?

Selling your gold coins is just as easy as buying them. Customers can sell any of the coins we carry online, or simply give us a call to place an order to sell by phone. We will lock your sell price in advance and send a purchase order with our shipping address. Ship us the items and we will pay immediately after receipt by check, electronic credit, or bank wire (on request for larger transactions).

When Should I Sell My Gold U.S. Coins?

There is of course no simple answer. Perhaps the best advice is to sell when the rationale for investing in the first place has changed.

Investors buying gold today are worried about the future of the US dollar and dismayed by the out-of-control federal spending and borrowing. They dislike the “management” of our monetary system by the Federal Reserve Bank - a private and wholly unaccountable institution with a penchant for taking care of its owners - the nation’s largest banks - at the expense of citizens at large. They are concerned about the rickety nature of the global financial system and holding conventional paper stocks, bonds, and mutual funds whose value can be completely destroyed in a crisis or due to mismanagement.

Gold should remain part of every investment portfolio until those problems have been addressed. Unfortunately, we don’t expect reforms on these issues any time soon and will be recommending people buy gold, rather than sell it, until then.

That said, some investors will want to trade metal - trying to sell high and buy low. Others will need to liquidate metal to raise cash for an emergency or to take advantage of another investment opportunity. Money Metals stands ready to buy your coins whenever you decide it is time.

Why Are U.S. Gold Coins a Good Investment?

US gold coins are beautiful, and because they are so popular and widely traded, no coins will be easier to buy or sell - at a great price. That combination makes them ideal for investment.