The Rise and Fall of North Carolina’s Leadership in Gold and Sound Money

The Rise and Fall of North Carolina's Leadership in Gold and Sound Money...

Joshua D. Glawson

January 24th, 2024

Important precious metals market news and pithy commentary for savvy investors. High-quality issue briefs, gold and silver price charts, and breaking news alerts. Join over 1.2 million individuals who receive our email news alerts.

The Rise and Fall of North Carolina's Leadership in Gold and Sound Money...

Joshua D. Glawson

January 24th, 2024

While the general stock market hits new all-time highs in recent days, gold and silver continue to trade sideways awaiting a catalyst. Gold trades this morning at $2,020 and the current silver price ...

Money Metals News Service

January 24th, 2024

You're probably making more money than you were three years ago. But you can't buy nearly as much stuff. Price inflation has eaten up your paycheck....

Mike Maharrey

January 23rd, 2024

Explore the critical analysis of U.S. fiscal policy and government spending in our latest article. Uncover insights on the escalating federal debt, budget deficits, and their impact on the economy. Di...

Clint Siegner

January 22nd, 2024

Senator Hansen from Nebraska has introduced Legislative Bill 1305, an anti-CBDC measure that also eliminates capital gains taxes from gold and silver...

Money Metals News Service

January 22nd, 2024

Kanye West got titanium teeth. What metal would likely offer Kanye the best return on his investment?...

Mike Maharrey

January 21st, 2024

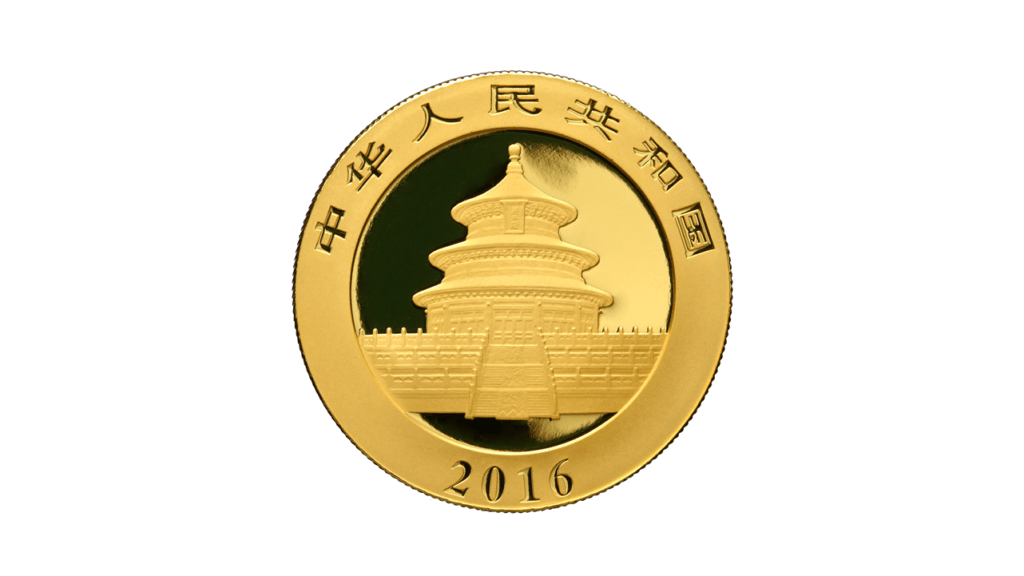

Chinese gold demand improved in 2023 even as the price in yuan soared. China ranks as the world's biggest gold market, and Chinese demand has a significant impact on the global gold market....

Mike Maharrey

January 20th, 2024

The holidays are done and inflation is back. After months of mainstream victory laps – including Paul Krugman's famous "inflation is over. We won at very little cost" – it turns out inflation's n...

Peter St. Onge

January 19th, 2024

A coalition of lawmakers in Honolulu have reintroduced legislation last considered in 2021 to end the sales tax on purchases of gold and silver coins, bars, and rounds....

Money Metals News Service

January 19th, 2024

Countries around the world have been adding gold to their reserves. Which countries have the most gold?...

Mike Maharrey

January 19th, 2024

New Jersey Governor Phil Murphy has unilaterally killed a bill that would have exempted the sales tax on purchases of gold and silver....

Money Metals News Service

January 18th, 2024

The mainstream psyche has latched onto a Goldilocks scenario where inflation dies, interest rates fall, and the economy glides to a soft landing. It's a fairytale....

Mike Maharrey

January 18th, 2024

Representatives in Vermont realize that their state has become a big outlier, and that it's high time for the state to end their practice of taxing purchases of gold and silver. House Bill 295 would d...

Money Metals News Service

January 17th, 2024

A large bipartisan contingent of Wisconsin legislators have reintroduced legislation seeking to end Wisconsin's outdated practice taxing purchases of gold and silver....

Money Metals News Service

January 16th, 2024

You know all about price inflation and how it squeezes your wallet. But there are also ninja price increases out there that you might not notice. It's called "shrinkflation."...

Mike Maharrey

January 16th, 2024

The markets are fixated on what Powell and other Fed officials say. The real question is what will they do? It's important to understand the broader trajectory of the economy as we consider where gold...

Mike Maharrey

January 16th, 2024

The CPI is a lie. Price inflation is even worse than advertised....

Mike Maharrey

January 15th, 2024

Is the market's victory dance in the Federal Reserve's war on inflation premature? Jim Grant thinks so....

Mike Maharrey

January 15th, 2024

With Bitcoin making the news last week when the Securities and Exchange Commission (SEC) finally approved exchange traded funds, it's a good time to review the topic again. Bitcoin still offers the p...

Clint Siegner

January 15th, 2024

Lawmakers in the Kentucky State House and State Senate have introduced seeking to end the state's controversial practice of imposing sales taxes on all purchases of precious metals....

Money Metals News Service

January 15th, 2024