It's not just about selling precious metals at great, low prices...

At Money Metals Exchange, we also believe a significant part of our mission is to educate customers and the public at large about the many aspects of the precious metals market.

While our precious metals specialists have the pleasure of addressing on an individual basis many excellent questions posed by our customers, we occasionally take the opportunity to address some of the best and most common questions in a more public way…

A Customer Receives Dishonest Information about Proof Coins

Robert F. writes: I would love to hear your response to this email from a [major numismatic coin dealer] rep who is saying I would be better served by transferring my regular silver Eagle IRA to a proof silver Eagle IRA. His primary pitch was that I would save up to 2/3 of the tax bite when I liquidate. The upfront cost of the transfer would be about 2% of assets. What say you?

You're being pitched a load of crap.

First of all, there is no difference in tax treatment between bullion coins and proof coins. Moreover, traditional IRA distributions after age 59 ½ are taxed as ordinary income, regardless of the assets held in them. There is no legal way to reduce any tax liabilities you'd ultimately owe on your silver Eagles by doing a "switcheroo" to other coins or other assets inside your IRA.

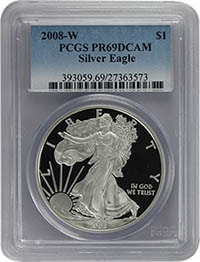

Silver Proof Eagles look beautiful,

but any value above normal bullion

Silver Eagle coins is questionable.

The transaction costs associated with selling conventional silver Eagles and buying so-called "proofs" would be far in excess of 2%. You have to pay a bid/ask spread twice, and it can be quite sizable on less-liquid, higher-premium proof coins.

At the end of the day, you'd end up with a lot fewer silver ounces than you started with and gain nothing except the faint hope of potentially being able to recover your transaction costs years down the road, if and only if proof buyback premiums rise at a significantly higher rate than silver spot prices. They could, but there's no good reason to think they will.

It so happens that proof Eagles are the only "collectible" coins that these numismatic coin dealers sell which actually qualify to be held in IRAs, so that's the realreason these coins are being recommended to you by this salesman.

The problem with these coins is the same as with the "rare" coins you see us exposing from time to time. Their premiums are extraordinarily high, the bid/ask spreads and liquidity of these coins are low, and they are generally promoted by high-pressure salesmen making huge commissions. Put your serious money into bullion coins, bars, and rounds that can be bought and sold at prices very close to global spot prices.

The sleazy tactics and arguments used by these numismatic coin dealers are wide ranging. Please visit here, here, and here on the Money Metals Exchange website to learn about all their various myths and deceptions.

Precious metals IRAs are great, but keep it safe and simple by holding bullion coins, bars, and rounds that can be obtained near the spot market price.

About the Author:

Clint Siegner is a Director at Money Metals Exchange, a precious metals dealer recently named "Best in the USA" by an independent global ratings group. A graduate of Linfield College in Oregon, Siegner puts his experience in business management along with his passion for personal liberty, limited government, and honest money into the development of Money Metals' brand and reach. This includes writing extensively on the bullion markets and their intersection with policy and world affairs.