Should You Own Silver as an investment?

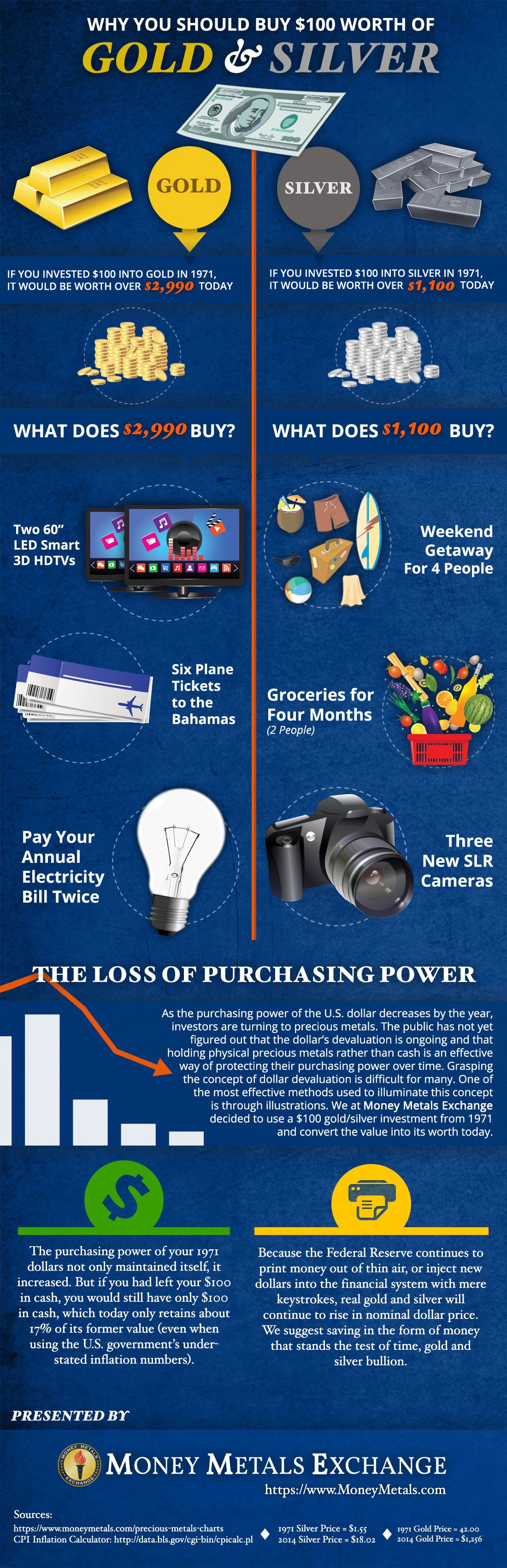

What Could You Buy With $100 Worth of Silver or Gold if You Invested 40 Years Ago?

As the purchasing power of the U.S. dollar decreases by the year, investors are turning to precious metals. The public has not yet figured out that the dollar’s devaluation is ongoing and that holding physical precious metals rather than cash is an effective way of protecting their purchasing power over time. Grasping the concept of dollar devaluation is difficult for many. One of the most effective methods used to illuminate this concept is through illustrations.

We at Money Metals Exchange decided to use a $100 gold/silver investment from 1971 and convert the value into its worth today. The infographic below was designed to help you decide if you should buy silver or gold today to protect your assets...

Is Silver a Good Investment?

Similar to gold, if you had purchased $100 in silver back in 1971, it would be worth over $1,100 in today’s dollars due to the silver Price per ounce succumbing to inflation. So, what would $1,100 buy? A weekend getaway for 4 people, groceries for 4 months (2 people), 2 wireless surround-sound systems, or 3 new digital SLR cameras.

Because the Federal Reserve continues to print money out of thin air, or inject new dollars into the financial system with mere keystrokes, real gold and silver will continue to rise in nominal dollar price. We suggest saving in the form of money that stands the test of time, gold and silver bullion.

A lot of folks took advantage of recently falling gold and silver prices to beef up their precious metals holdings.

Is it safe to invest in silver?

Silver can rightly be seen a safe-haven asset – albeit one that often exhibits extreme volatility in day to day trading. The longer your time horizon, the safer it is to hold silver. Unlike a corporation in which you might hold shares, physical silver can’t go bankrupt. Unlike a bond, physical silver can’t default.

As a scarce commodity with myriad uses, silver will never go to zero. And as a form of Constitutional money with a history of being used as money going back thousands of years, there will always be a liquid market for silver coins regardless of what dollar price they may command in the future.

Should I Buy Gold or Silver?

Those adding to their investment portfolios understood the old adage of buying low and selling high. Unfortunately, others wait until dollar values of gold and silver have zoomed before deciding to convert their paper money.

Still, most make buying decisions for their own good reasons. They either have the confidence of their convictions, or they have good questions still unanswered.

One of the frequent questions we get at Money Metals Exchange is a good one – How would I go about “spending” my gold and silver assets in a barter-type economy?

Readers and clients want to know if gold and silver would be accepted by a shop merchant or by a tradesman offering his talents. They ask how a seller would “make change” for gold and silver coins or bars. We feel those are perfectly valid questions.

The answer highlights the simple advantage an investment in gold and silver would give you in every financial transaction.

Every deal requires a seller making an offer and a buyer accepting that offer. Unless the buyer pays his money, there is no deal. The buyer always has the final option to seal the deal or walk away to find another seller who accepts metals..

If the time ever comes in your life or the lives of your children that a catastrophic financial collapse destroys the U.S. dollar or hyperinflation sends dollar prices soaring, your gold and silver assets will always hold value. Goods and services for barter would also have value, but there would be no meaningful, stable “dollar price.”

Is it better to invest in gold or silver?

It's best to invest in both gold and silver. Having two money metals gives you more versatility for barter and trade.

Being diversified into both gold and silver gives you exposure to two distinct forms of hard money that may also perform differently in different economic conditions. For example, gold tends to hold up better during a deflation or credit crisis. Silver, being more of an industrial metal, tends to outperform gold during inflationary upswings.

There are certainly times when one metal may be priced more attractively than another. When the gold:silver ratio trades near the high end of its normal range, silver may be the better buy. Lately, gold has been expensive relative to silver (with the gold:silver ratio trading near 80:1 during much of 2018). Value investors are thus finding silver to be the better buy – with some silver bugs eying a possible move in the ratio below 20:1 during the next big bull market phase for the white metal.

Is Buying Gold a Good Investment?

If you had purchased $100 in gold in 1971, it would be worth over $2,990 in today’s dollars. Let’s explore exactly how much your gold investment would be worth in terms of individual purchases. Today, $2,990 would buy you 2 60” LED Smart 3D HDTVs, 6 plane tickets to the Bahamas, a paid sports package for 30 years, or you could pay your annual electric bill not once, but twice.

The purchasing power of your 1971 dollars not only maintained itself, it increased. But if you had left your $100 in cash, you would still have only $100 in cash, which today only retains about 17% of its former value (even when using the U.S. government’s understated inflation numbers).

Precious Metals Become the Coin of the Realm in a Breakdown

Metals would be the primary form of currency most would need and gladly accept, followed by other forms of barter, including personal skills and talents.

In a financial collapse, the holder of gold and silver would be in charge of his metals transactions, not the fellow trying to sell goods or services. You need the goods, but he needs a reliable currency. If he's competing with others selling the same thing, then you're in charge, not him.

You'll recognize another way of saying it – He who has the gold makes the rules.

The question then is not whether the merchant will gladly allow you to spend your gold or silver coins. The only question is whether he has enough goods or services to get you to part with your monetary metals.

For example, you would decide if your silver coin, readily recognized as wealth for thousands of years, is a fair trade for a bushel of apples that will rot in a couple of weeks and not be marketable at all, or a fair trade for an hour of a workman's time and talent, lost if no one else hires him. You own the gold and silver. You decide its final value in the trade. You make the rules. You decide what “change” is due you, not the other way around.

Barter, trading one valuable for another, was the earliest form of money. Cows, coconuts, bullets, and bourbon have been bartered at one time or another. In one survivor's account of the brutal Kosovo War of the 1990s, he wrote the most valuable barter item he had was a case of 1,000 butane lighters.

One historic trade, admittedly shrouded in myth, was the 1626 purchase of the Island of Manhattan. Wealthy Dutch fur trader Peter Minuet thought he got a great deal for his 60 guilders in beads and blankets, later calculated at about $24. The tribal chief was just as happy. He purportedly later confessed his tribe didn't own Manhattan in the first place!

Beads and butane lighters might not work so well today. The most important characteristic of circulating currency is widely accepted confidence as a store of wealth. For that, it must be durable, it must have some historically intrinsic value, and it must be divisible for convenience and efficiency. Precious metals have best guaranteed that necessary confidence since antiquity.

America Was Hours Away from Financial Catastrophe on September 14, 2008

Don't let them claim these inflationary and economic crises can't happen, because they have happened.

History is littered with nations and societies destroyed by overprinting paper currency, exactly the situation we face today. Each time, without exception, gold and silver money flourished. The example of silver coins and bushels of apples is straight from The Great Depression of the 1930s.

More recently, the U.S. suffered bouts of debt-induced inflationary disasters in the 1970s and again in the 1980s. Gold and silver climbed to then-record highs in dollar values, as buyers lined up to trade their paper for precious metals.

There was another recent disastrous date in American history most cannot identify. It's not 9-11.

Just six years ago, on Sunday night, the 14th of September 2008, the U.S. came within a few hours of complete financial collapse, marked by the bankruptcy of financial giant Lehman Brothers and imminent disaster for its counterparties, and known now as the sub-prime housing mortgage crisis.

Years of disgraceful, mounting public and private debt viciously brought down banks like dominoes across the globe. Fortunes and futures were erased, putting tens of millions out of work and into impoverishment.

The U.S. government and Federal Reserve responded with an $800 billion bailout and by frantically printing trillions of paper dollars (more debt piled onto more debt) to temporarily “rescue” what was left of the global banking system, solving none of the problems that same debt created.

And just as gold and silver held value during the inflation of the 70's and 80's, gold has today settled 56% higher and silver 51% higher since that Sunday night in 2008 when the world came face to face with economic annihilation.

Investing in Gold and Silver

The dangers were not corrected, but only disguised with more paper debt. That makes a greater financial catastrophe possible, which could force transportation shutdowns, food shortages, lost jobs and other economic chaos, erasing that most important characteristic of money – confidence – in the dollar and other fiat currencies.

If so, new rules and values, varying from community to community, would emerge while governments scramble to regain or maintain authority. Someone will decide those new rules for their families and communities. Someone will set a new price for apples.

That someone will be he who has the gold.

Sources: