A few years ago, the wisdom of central bankers went virtually unchallenged. Citizens simply assumed anyone working for the central bank must be trustworthy, disciplined, and wise. After all, those leaders supposedly represent the best thinking in economics.

That sort of unquestioning reverence provided lots of latitude for them to operate, and to make profound mistakes as all central planners invariably do.

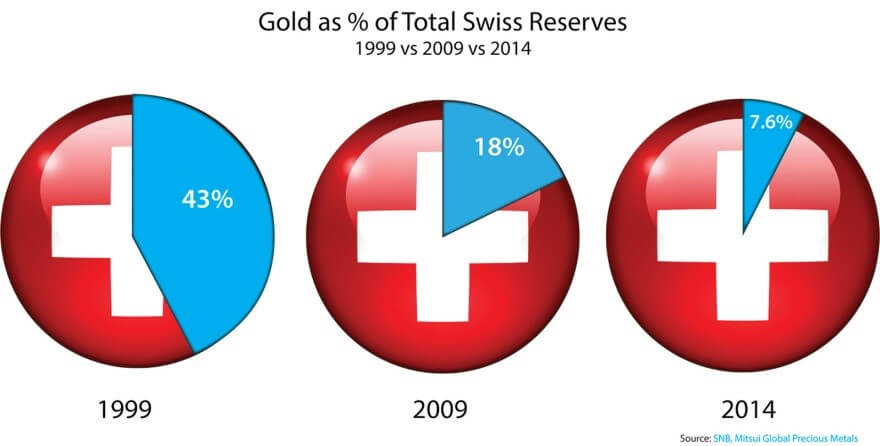

For example, Switzerland and England did not face public protests when they sold huge portions of their nation’s gold stockpiles at what turned out to be the worst possible time. They claimed that gold held no legitimate role in modern currency systems 10-15 years ago, and the public didn’t care.

|

Switzerland’s gold reserves dwindled from 43% to just 7.6% over the last 15 years.

The losses on central bank gold sales are staggering. At some point after the gold price went to multiples of their sell price, many of these central bankers decided gold had some important role to play after all and became net buyers -- replenishing some of the liquidated stockpiles.

Of course, blunders over the timing of gold sales are among a litany of recent failures -- including regulatory incompetence, bailouts for crony private banks, market manipulation, and a complete lack of accountability. The past few years have not been kind to the image of central banks.

Many Questions Arise About Unbacked Fiat Currencies, Switzerland Makes Vote

These days, people around the world are asking a few more questions. Is it wise to be reliant upon completely unbacked fiat currencies? Is it in our best interest for national gold to be held in vaults elsewhere? Venezuela and Germany recently decided the answer to the latter question was “no.”

The Swiss will vote on both of the above questions this coming Sunday.

Should the referendum pass, the Swiss National Bank will be required to hold 20% of its assets in gold. The Swiss will also repatriate 30% of their reserves currently held in England and Canada. And Switzerland will no longer sell any of the gold it accumulates.

|

The prospects for passage of the referendum dimmed slightly in the most recent polling with support at 38%, opposition at 47%, and 15% undecided.

As discussed in depth in last Friday’s Market Wrap podcast, the establishment, including leadership at the Swiss National Bank, is on a full-court-press campaign against the measure. If there is one thing central bankers hate, it’s any restriction on their ability to print and devalue.

Should the referendum beat the odds and pass, the Swiss will enter the gold markets as a buyer of around 1,500 tons of gold between now and 2019. At about half of the world’s annual production of gold, that represents a huge chunk of additional demand. It should be great news for gold (and silver) prices.

Regardless of what happens, we can at least see cracks in the facade of central bank infallibility widening. It may crumble entirely with the next crisis laid at their feet. But let’s hope the Swiss can start the ball rolling on reforms there and elsewhere around the globe before it comes to that.

About the Author:

Clint Siegner is a Director at Money Metals Exchange, a precious metals dealer recently named "Best in the USA" by an independent global ratings group. A graduate of Linfield College in Oregon, Siegner puts his experience in business management along with his passion for personal liberty, limited government, and honest money into the development of Money Metals' brand and reach. This includes writing extensively on the bullion markets and their intersection with policy and world affairs.