Why should you care?

- If you own gold or plan to buy gold, this information affects you. Other ideal times to buy gold were after the 9-11 disaster, during the stock market crash in October and November 2008, the December 2015 multi-year low in gold prices, and early 2017.

- If you own silver or plan to buy silver, you should know silver prices will rally higher and faster than gold prices, and crash harder. Regardless, the potential upside for silver is tremendous and we can help you determine the best way to buy silver.

- Gold prices will not move upward in isolation. The forces that will propel gold prices far higher will push prices for basic necessities upward. We need clothing, transportation, food, and energy. Expect those prices to increase, but owning gold and silver will help preserve your purchasing power as central banks further devalue the dollar.

- If you live on savings or a pension, the upcoming inflationary environment will reduce the purchasing power of your savings, pension, and social security.

- Save your gold, and buy more for protection from the inevitable devaluation of fiat currencies and their loss of purchasing power.

Why will gold prices increase?

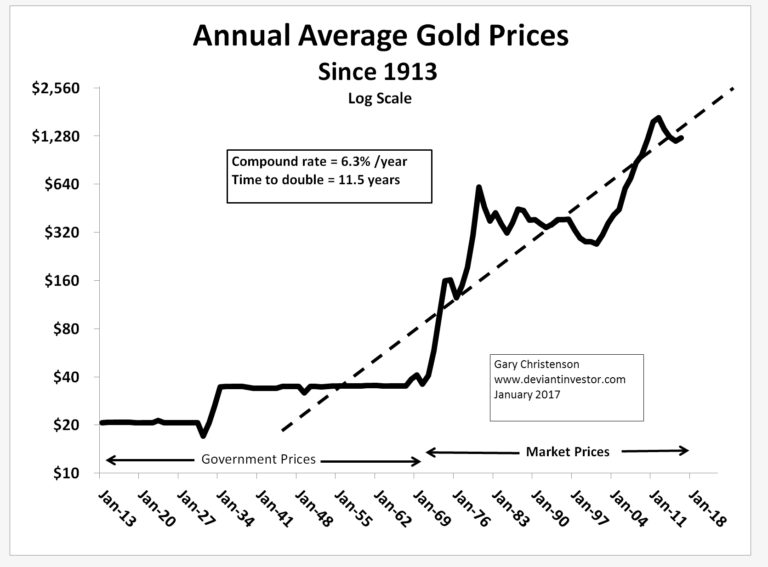

I base my analysis on 100 years of dollar devaluations, excessive government spending, accelerating debt accumulation, and the exponentially increasing quantity of currency in circulation.

We live in a time of increasing economic uncertainty. To counter that uncertainty and offer perspective, I prepared 44 graphs that support my conviction that gold prices will surge much higher. This study explains the logic for an eventual gold price of $10,000 through these easy-to-understand graphs, each of which illustrates a single idea. The graphs and accompanying analysis provide clarity about the consequences of exponentially growing debt and the resulting gold price increases.

Gold prices rose from $255 in 2001 to over $1,900 ten years later. The price of gold should rise to $10,000 during the next ten years, up from its January 2017 price of $1,200.

Examine the graphs and read my analysis for a detailed explanation of the logic behind a gold price rise to $10,000.

CONSIDERATIONS

- The timing and path to $10,000 are important! When and how will gold prices rise to that level?

- No one can guarantee gold will sell for $10,000, but that price is likely even without hyperinflation. Regardless, do your due diligence and make appropriate investment decisions.

- Gold might sell for an astronomical number and $10,000 could become the price for a cup of coffee. Hyperinflation of the U.S. dollar is possible but hopefully unlikely. Argentina has devalued its peso since 1945 by ten trillion to one against the U.S. dollar, and Venezuela is suffering from self-created hyperinflation.

- Other examples of hyperinflation have occurred since the Weimar inflation of the early 1920s in post-war Germany. Reserve currency status of the dollar creates a tremendous economic advantage, but the United States government is deeply in debt and mathematically incapable of repaying that debt without massive devaluation of the dollar. The U.S. government and the Federal Reserve may reduce the impact of overwhelming debt in the United States by rapidly devaluing U.S. dollars. The result could be hyperinflation.

Mr. Bernanke’s statement (11/21/2002) is worth repeating...

U.S. dollars have value only to the extent that they are strictly limited in supply.”

We know dollars have not been “strictly limited in supply” for over 100 years. Hence dollars have declined in value during the past century. More devaluation is coming.

About the Author:

Gary Christenson is the owner and writer for the popular and contrarian investment site Deviant Investor and the author of several books, including Fort Knox Down! and Gold Value and Gold Prices 1971 – 2021. He is a retired accountant and business manager with 30 years of experience studying markets, investing, and trading. He writes about investing, gold, silver, the economy, and central banking.