In a better world we might expect:

- Individuals, corporations, and governments spend no more than their income.

- “Honest” money is used by all, has intrinsic value, retains its purchasing power, and is not counterfeited by individuals or bankers.

- Governments and bankers support and encourage “honest” money.

Alas, we live in this world and must realize that:

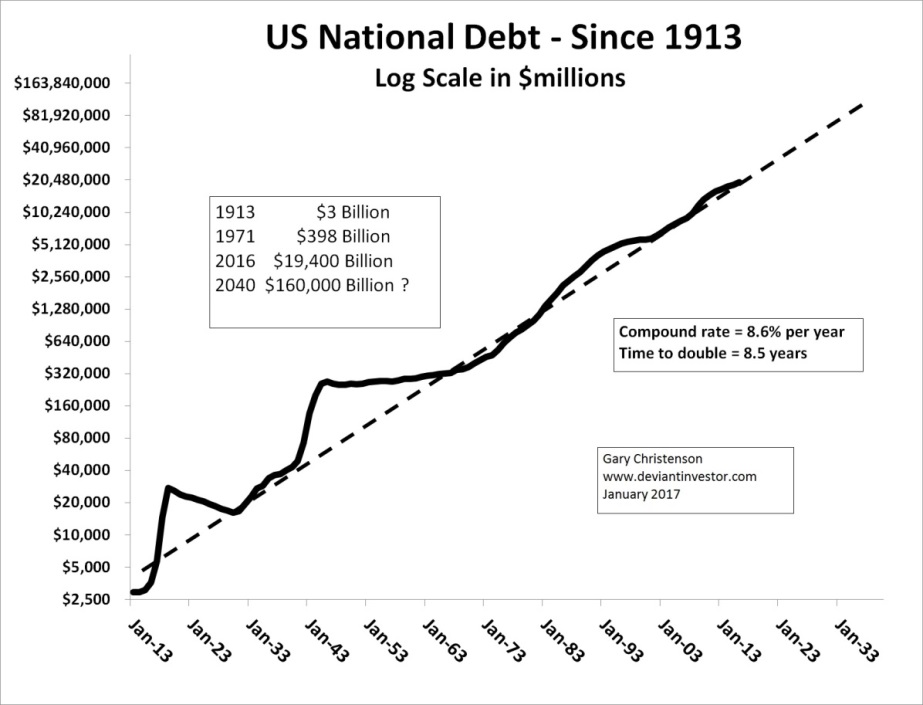

- Debt has increased rapidly for the past century. Example: U.S. national debt has expanded from roughly $3 billion to $20 trillion.

- Currencies are IOUs issued by central banks that promote ever-increasing currency in circulation, expanding debt, and continual devaluations in purchasing power.

- The “fiat-currency game” will continue until it implodes.

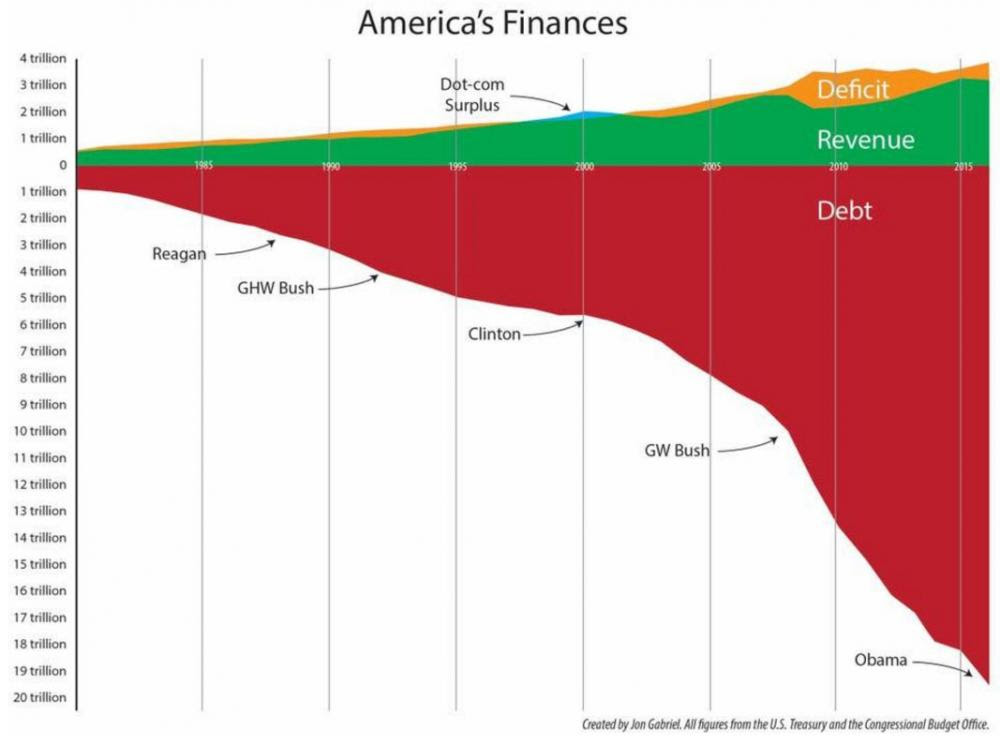

THE PROBLEM SHOWN IN ONE GRAPH:

Another Perspective on Official National Debt Increases Since 1913:

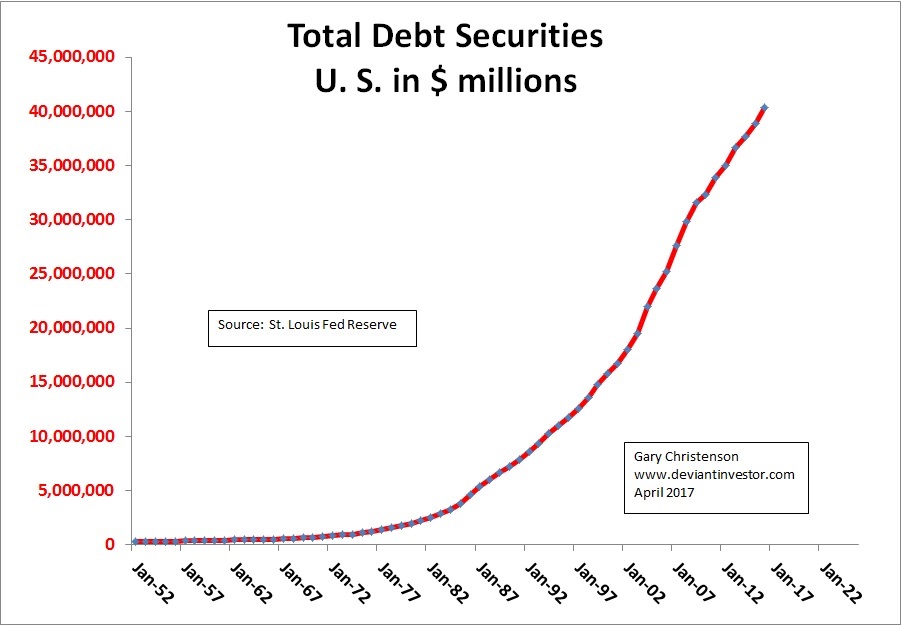

The economic world runs on debt and credit. Dollars are created as debt, so expect more debt, lots more debt. From the St. Louis Federal Reserve:

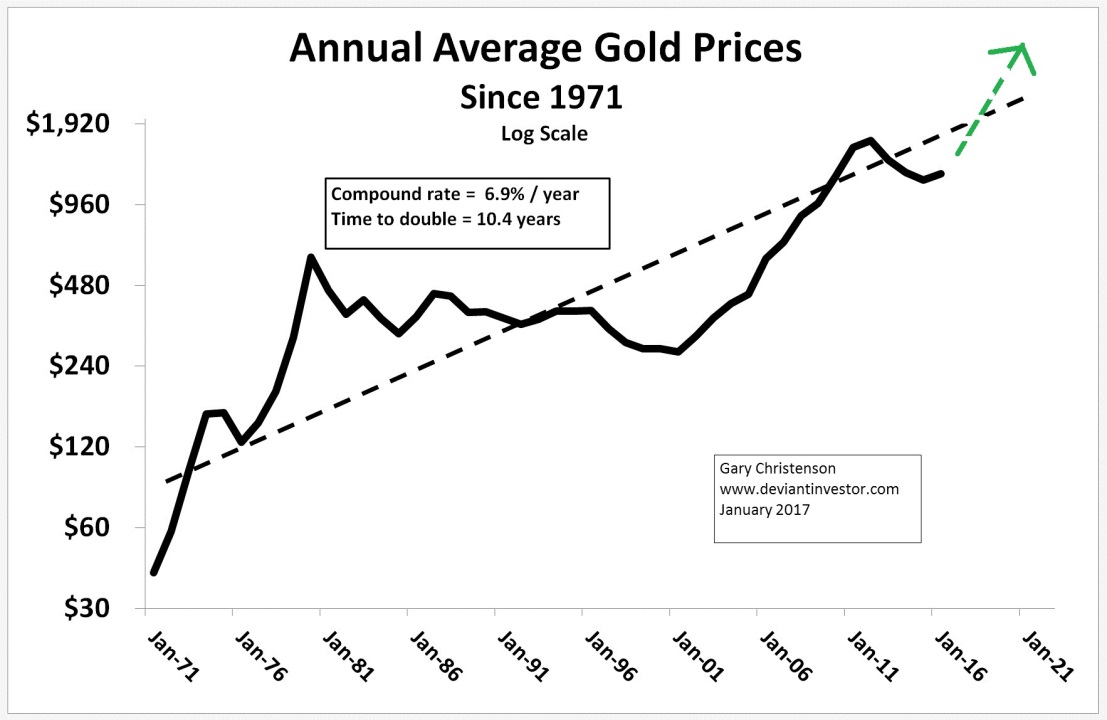

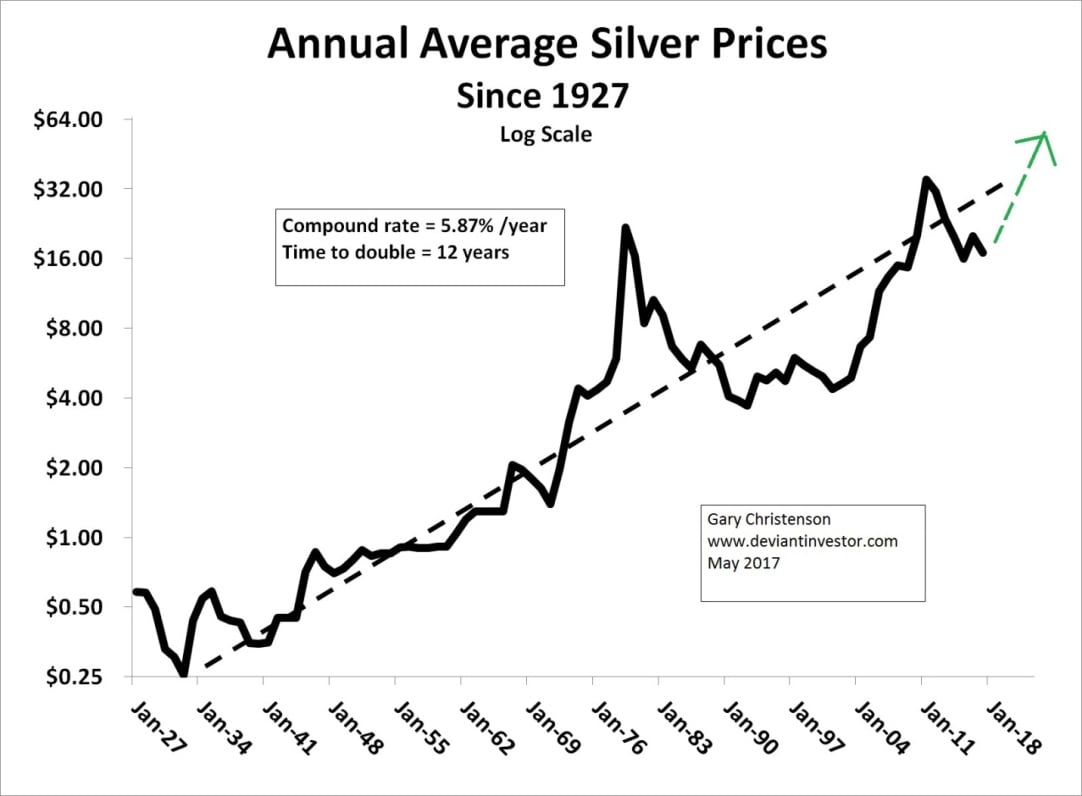

Gold & Silver Protect Purchasing Power

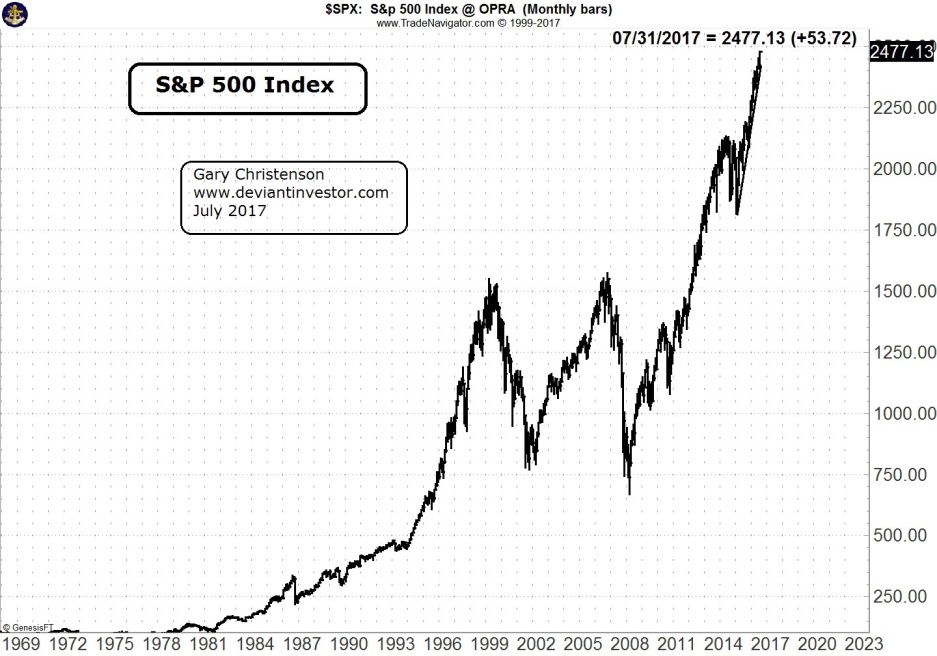

The Stock Market is Another Way to Protect Purchasing Power

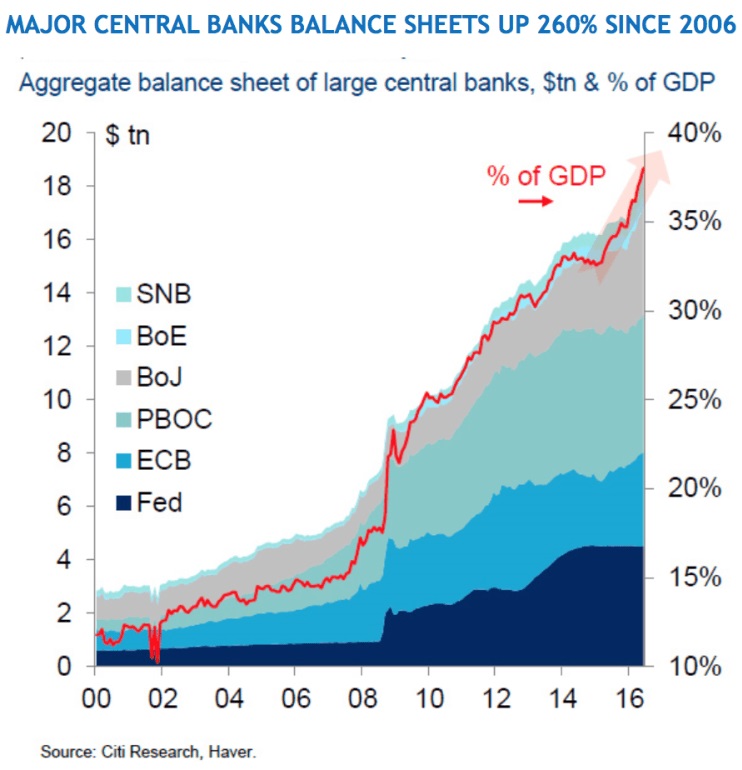

Central banks and commercial banks create more dollars, yen, euros, and pounds, thereby diluting the value of all existing fiat currencies. Consequently, consumers must protect their purchasing power.

The government and central banking “borrow and spend” business supports and benefits the financial and political elite, so it will continue. For perspective on the central bank “printing,” of their currencies from “thin air” consider this graph:

How do you protect your purchasing power? Stocks, bonds, real estate, silver, gold, and many others.

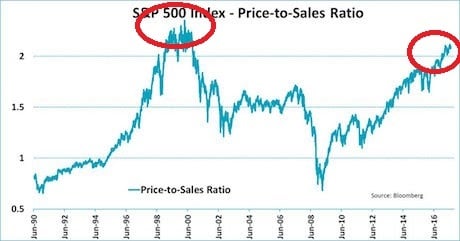

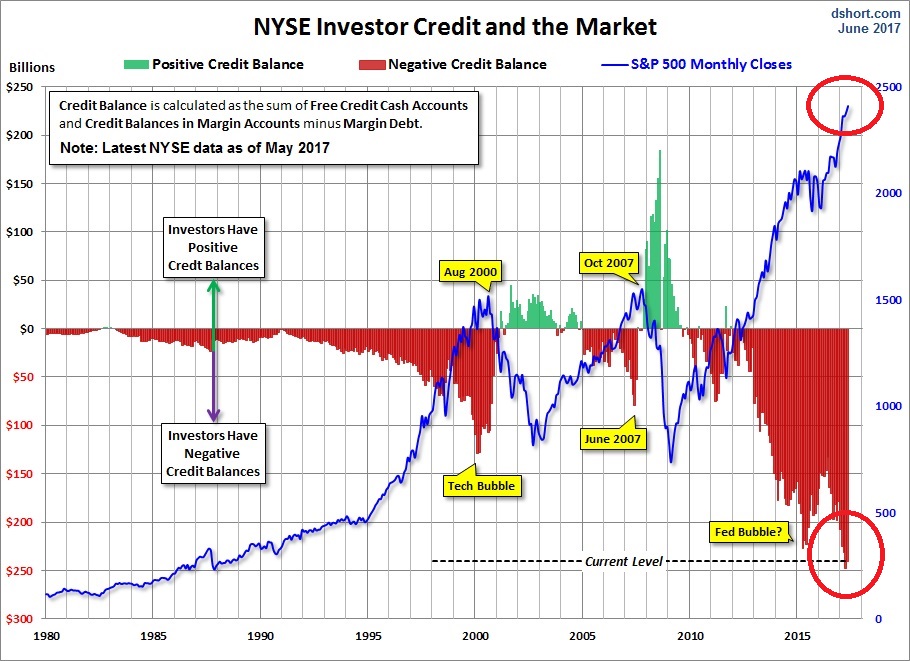

The problem with stocks – they are dangerously high.

From SovereignMan: “It’s Better to Turn Cautious Too Soon”

The problem with bonds: Bonds yield next to nothing and pay in currencies guaranteed to depreciate. Waiting for a friendly central banker to bail out your investment works for the elite, but not for most individuals.

The problems with gold and silver: They are mostly anonymous, safe, retain their value over centuries, are not simultaneously another party’s liability, and cannot be counterfeited by central banks or governments.

Some might see these characteristics as benefits, not problems!

Western central bankers believe gold and silver are threats to their fiat currencies. They want everyone locked into their unbacked debt-based fiat currency schemes that benefit the financial and political elite. Tough luck for the rest of us.

The rise of cryptocurrencies indicates, among other things, dissatisfaction with fiat currencies.

In summary, the global financial system, based on “dishonest” fiat currencies is dangerous and unstable. Potential wars with North Korea, Russia, and China will aggravate an already dangerous economic structure. Existing wars in Syria, Iraq, Afghanistan, and elsewhere have been costly in terms of soldier deaths, excessive expenses, and unpayable debt. Central banks and governments want more debt, more currency in circulation, and higher prices, so … expect more wars.

The consequence of massive and unpayable debt, out-of-control spending, and central bank “printing” of currencies is the inevitable destruction of the currencies.

The Western Central Bank's answer: Levitate stocks, boost bonds, near-zero interest rates, “war on cash,” and more debt. Note the current parallels with crashes in 2000 and 2007.

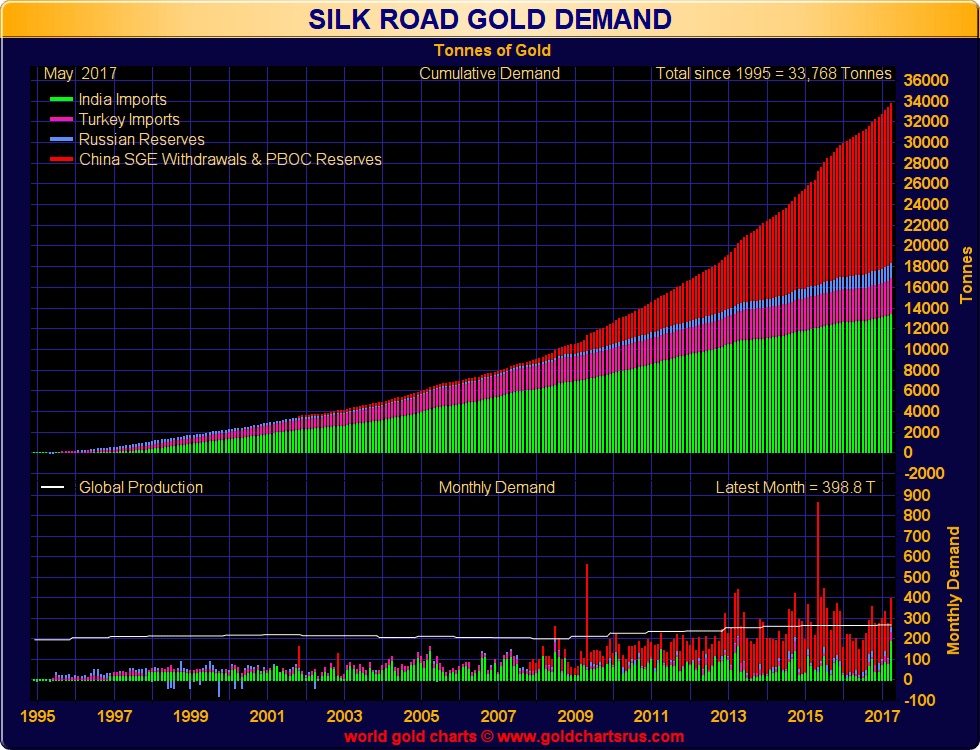

The Asian answer involves the acquisition of gold, lots of gold. Why have Western vaults shipped another 1,000 metric tons of gold bullion to Asia in 2015?

We have been warned!

About the Author:

Gary Christenson is the owner and writer for the popular and contrarian investment site Deviant Investor and the author of several books, including Fort Knox Down! and Gold Value and Gold Prices 1971 – 2021. He is a retired accountant and business manager with 30 years of experience studying markets, investing, and trading. He writes about investing, gold, silver, the economy, and central banking.