The gold industry has been built on the leveraging of debt and energy. The days of using human and animal labor to produce the precious yellow metal are long gone. While some gold is still mined the old fashion way, the overwhelming majority is produced by using colossal-sized mining equipment, massive amounts of capital, energy, and materials. Thus, the global gold supply comes from a very complex industry with a lot of moving parts. When one of these critical parts is in short supply or removed, then the entire gold supply system disintegrates.

An example of one of the newest complex gold mines in the world is the Pueblo Viejo Mine in the Dominican Republic, owned by Barrick (60%) and Goldcorp (40%), which cost a staggering $3.7 billion to build. The Pueblo Viejo Mine started production in 2013 and is now running a full capacity. Gold production at the Pueblo Viejo Mine is over one million ounces per year. According to Barrick, its cost of sales at Pueblo Viejo was $564 an ounce in 2016. However, the cost of sales does not include “all costs.” We must also factor in General and Administrative, Exploration-Evaluation, Mine Closure, and Income Tax expenses.

However, these additional expenses do not include the initial $3.7 billion cost to build the mine. According to data, the Pueblo Viejo Mine has approximately 15.5 million oz (Moz) of proven and probable gold reserves. Even though additional gold discoveries at the mine will be added in the future if we assume a 15-year initial payback period, the annualized capital cost would be an extra $250 per oz of gold produced.

Thus, the $564 cost of sales plus the $250 capital cost now equals $814 an ounce. But, this does not include the additional expenses which would push the actual total cost from the Pueblo Viejo Mine over $900 an ounce. This is just my simple calculation which shouldn’t be compared to the industry’s more complex accounting of Net Present Value. Even though the Pueblo Viejo Mine is Barrick’s lowest-cost gold mine in the company, Barrick’s total cost to produce gold last year was $1,125, based on the $1,251 spot price. Again, that is my simple “Net Income Break-Even Analysis.”

Regardless, the Pueblo Viejo Mine is a very advanced complex mine that processed 7.5 million tons of ore to produce the 1.1 Moz of gold last year. According to Barrick’s 2016 Sustainability Report, the Pueblo Viejo Mine consumed the following in 2016:

Pueblo Viejo Mine Materials & Energy Consumed:

- 4.9 billion gallons of water

- 3,100 metric tons of cyanide

- 338,000 metric tons of lime

- 18.7 million GigaJoules of Energy (3.1 million barrels of oil equivalent)

There are many other materials not included in that list above, but the ability to produce gold at the Pueblo Viejo Mine is only possible from a very complex supply chain. The majority of materials and energy consumed by the Pueblo Viejo Mine has to be transported to the Dominican Republic Island in the Caribbean.

For example, Barrick’s mining equipment fleet at the Pueblo Viejo Mine includes the following (info from OSIsoft Report):

- (34) CAT 789 Haul Trucks

- (2) Hitachi 3600 Shovels

- (3) CAT 994F Front Loaders

- (30) Support Equipment

The estimated maintenance budget for just the haul truck fleet is $18 million. And when one of the 34 trucks goes out of service, it cost one hell of a lot of money. The truck downtime cost is $700 per hour. The six tires the CAT 789 Haul truck uses cost approximately $30-40,000 a piece and last a little more than a year. The CAT 789 Haul truck gets about 0.3 miles per gallon.

(CAT 797F transported by Mercedes Semi-tractor)

Now, the featured picture (above) that I used for this article is not the CAT 789; it is the CAT 797. The CAT 797 weighs twice as much as the CAT 789, used at the Pueblo Viejo Mine. However, I just wanted to give an idea of just how big these haul trucks can get.

Furthermore, the mining, excavating, and hauling of ore out of the Pueblo Viejo Mine is controlled by high-tech computerized systems. The hauling of the ore by the large truck fleet is monitored by state-of-the-art technology that designs the most efficient method to remove the ore from the mine, so very little time is wasted. Again, time is money.

We must remember, the more technology that is used in a system, the more complex and fragile it becomes. Of course, technology is great at making large operations run more efficiently and faster, but the downside is that if one or more critical parts are removed, the complex mining system breaks down. What would happen to gold production at the Pueblo Viejo Mine if cyanide becomes in short supply? Without cyanide, the processing of gold ore grinds to a halt.

While I have provided one example of the enormous cost and massive amounts of capital needed to produce gold and one mine, let’s take a look at what is going on at the top 8 gold mining companies in the world.

Top 8 Gold Mining Companies Costs & CAPEX Spending Surge

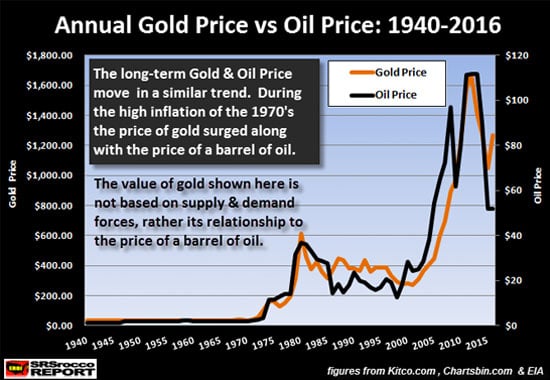

It is quite amazing how much more it costs to produce an ounce of gold today than it did at the beginning of the century. The huge rise in the total cost to produce gold is why the price is nearly five times higher. Unfortunately, many precious metals analysts suggest that the increase in the gold price is due to either market sentiment or increased demand. I have stated in several articles that the tremendous increase in the gold price was due to the rise in the price of oil:

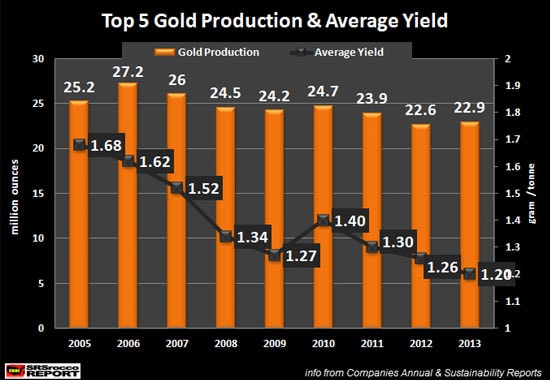

However, there are additional factors that also impact the cost to produce gold. For example, the gold mining industry now has to move a great deal more ore to produce the same amount of gold it did in 2000. The next chart shows the falling yield in the top gold mining industry from 2005 to 2013:

In just eight years, the top five gold miners experienced a nearly 30% decline in average gold yield from 1.68 g/t (grams per ton) to 1.2 g/t. If we went back five more years to 2000, I would imagine it would be closer to a 40% decline in average yield. Thus, it now takes the processing of 40% more ore to produce the same amount of gold today. This means, it now takes a hell of a lot more energy and materials to produce gold today than it did 16 years ago.

This next chart puts into perspective the increased cost to produce gold today versus 2000:

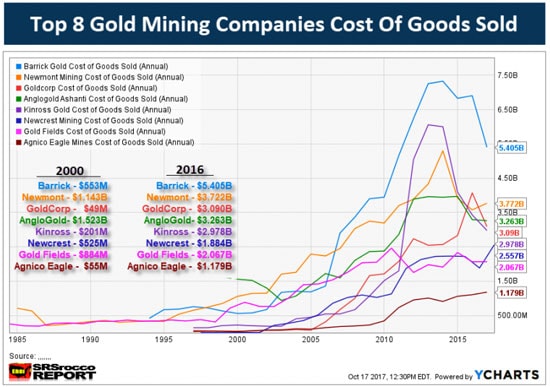

This graph shows the increase in the “Cost of Goods Sold” for producing gold at the top 8 gold mining companies in the world. Even though many of the companies have seen a decline in the Cost of Goods Sold since the peak in 2013, the overall figure is still much higher than it was in 2000. Some of the companies included in the chart above have seen their Cost of Goods Sold increase significantly because they increased their gold production substantially. However, Barrick did not have that excuse.

Barrick produced 5.9 Moz of gold with a $553 million cost compared to $5.4 billion in 2016 on 5.5 Moz of gold production. Here we can see that Barrick’s Cost of Goods Sold increased ten times while production is about the same.

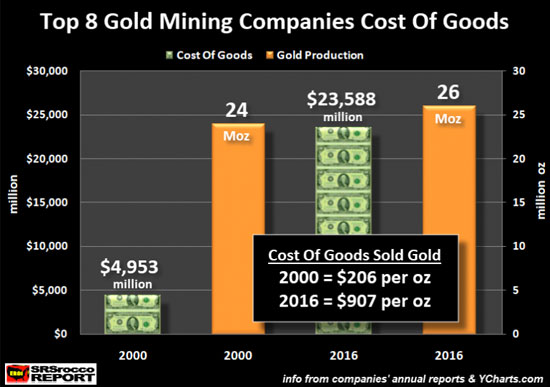

According to the data at YCharts.com and these companies’ annual reports, the total cost of Gold Sold in 2000, was $4.9 billion ($4,953 million) versus $23.6 billion ($23,588 million) in 2016:

Now, what is amazing about the figures in the chart above is that the Cost of Goods Sold figure has more than quadrupled while total gold production in the group only increased by 2 Moz. The top 8 gold miners' Cost Of Goods Sold increased from $206 per oz in 2000 to $907 last year. The huge increase in cost to produce gold is the very reason the price surged from $279 in 2000 to $1251 in 2016. Let’s look at the comparison:

Cost of Goods Sold vs. Gold Price:

2000 vs. 2016 Cost of Goods Sold = 4.4 times increase

2000 vs. 2016 Gold Price = 4.5 times increase

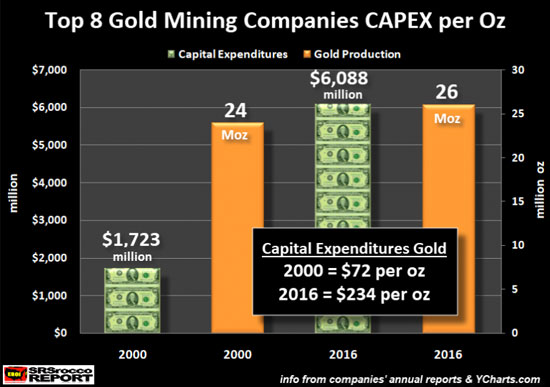

So, if we removed all SUPPLY & DEMAND forces from the equation, it is quite surprising that the gold price is up by the same amount as the cost to produce gold. However, we need to also look at the rise in capital expenditures. During the same period, the top 8 gold miners' total capital expenditures increased from $1.7 billion ($1,723 million) in 2000 to $6.1 billion ($6,088 million) in 2016:

Again, we can see that total capital expenditure (CAPEX) increased from $72 per ounce in 2000 to $234 an ounce in 2016, while overall production only increased by 2 Moz. The group’s CAPEX spending only increased 3.2 times versus the 4.4 times in the Cost of Goods Sold, but it shows that it cost a heck of a lot more money to sustain or replace production.

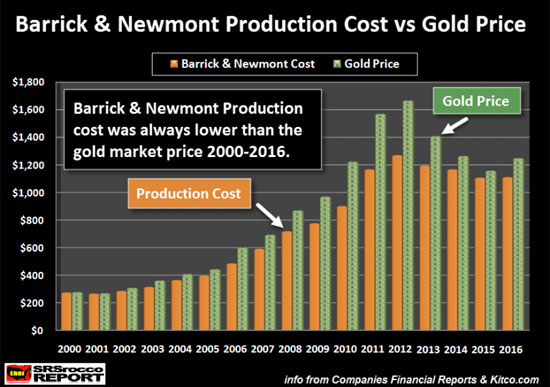

If we understand that the present value of gold is tied to its cost of production, then we would realize it has a PRICE FLOOR. Sure, the gold price could spike lower, but its average annual price has remained close to (or above) its cost of production for quite some time:

This chart represents my “Net Income Breakeven Analysis” for Barrick and Newmont, the two top largest gold companies in the world. As I also mentioned above, Barrick’s cost to produce gold in 2016 was $1,125 while the spot price was $1,251. Thus, the market has priced gold above its cost of production (in these two companies) since at least 2000.

Lastly, the gold mining industry needs a vast amount of materials, parts, and energy as well as a very complex supply chain system to produce the precious yellow metal. If one part of the supply chain breaks down, then it becomes extremely difficult or impossible to produce gold. While there are many fragile aspects of the modern high-tech gold industry, I believe ENERGY is the most crucial.

Once the world starts to experience a decline in global oil production, the vast supply chain system will begin to break down. This will impact the largest mines the most. I will be writing more about this subject matter and also why a declining global oil supply will push the price of gold up much higher.

About the Author:

Independent researcher Steve St. Angelo started to invest in precious metals in 2002. In 2008, he began researching areas of the gold and silver market that the majority of the precious metal analyst community has left unexplored. These areas include how energy and the falling EROI – Energy Returned On Invested – stand to impact the mining industry, precious metals, paper assets, and the overall economy.