Well, it looks as if a bit of life has come back into the silver market as US mint coins for sale, as the Silver Eagle sales jumped in August due to lower prices. While Silver Eagle sales have fallen over the past few years, if we exclude typical high January demand, sales so far in August are the highest in a year.

What is even more interesting is that Gold Eagle sales in August haven’t increased that much compared to Silver Eagles even though the gold price fell to the lowest level in more than a year-and-a-half. Gold Eagle sales this month are more than 50% less than they were last month. So, for whatever reason, Silver Eagle sales are responding more positively to the lower silver price than Gold Eagles.

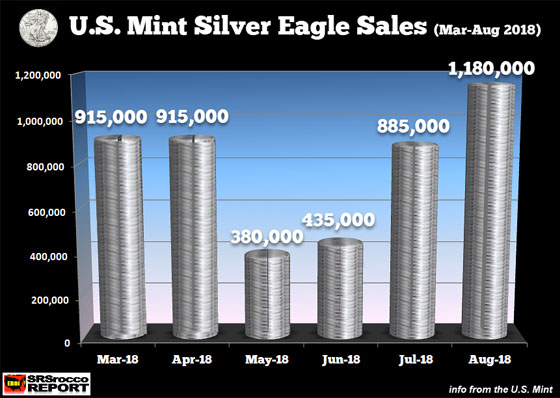

According to the most recently released data, the U.S. Mint sold 1,180,000 Silver Eagles in August, already up 33% versus last month, and we still have another week to go. Of course, this jump is nothing compared to the 3-4,000,000 sales per month we saw on average between 2010 and 2016, but it most certainly is a good sign.

As we can see in the chart above, Silver Eagle sales jumped off their lows in May of 380,000 to nearly 1.2 million in August. If we see another 200,000-300,000 in the last week of the month, that would be a good sign that “PRICES STILL MATTER” to some in the market.

Now, as Silver Eagle sales jumped in August, buying of Gold Eagles fell to 15,000 oz and is down by more than half compared to the 35,000 oz sold in July. My analysis suggests that Gold Eagle sales increased in July in response to the heated “Trade war rhetoric” between the U.S. and China. However, now that trade talks between the countries have resumed, it seems as if the demand for Gold Eagles has subsided.

Regardless, while precious metals sentiment and buying are still very low, Silver Eagle sales are down 70-75% from what they were two years ago, I believe we will see a huge increase in demand when these highly overleveraged markets begin to correct violently. Moreover, we may experience the largest physical gold and silver buying in history as the world's greatest bubbles pop.

Please check back for new updates on Gold & Silver Eagle sales.

About the Author:

Independent researcher Steve St. Angelo started to invest in precious metals in 2002. In 2008, he began researching areas of the gold and silver market that the majority of the precious metal analyst community has left unexplored. These areas include how energy and the falling EROI – Energy Returned On Invested – stand to impact the mining industry, precious metals, paper assets, and the overall economy.