Investors should prepare for crazy and turbulent markets in 2019. As the correction in the broader markets picks up speed and heads much lower, investor worry will start to turn into fear. At this point, the precious metals will likely disconnect from the markets and move higher as investors move into gold and silver to protect their wealth.

I discuss this in my newest video update: DOW, GOLD & SILVER: Markets Disconnect In 2019. In the video, I show how gold and silver rallied over the past month while the broader markets, copper, and energy sold off. I believe the precious metals will continue to disconnect even further from the markets in 2019 and 2020.

In the video, I also describe the image below and why the U.S. Shale Oil Industry continues to lose money:

This shows the typical slick water shale frac completion layout and the massive amount of equipment and energy it takes to produce shale oil and gas. The drilling rig has been removed, and the wellheads (in RED) receive an enormous amount of water, frac sand, and chemicals under high pressure from the 20 pressure pumping truck rigs.

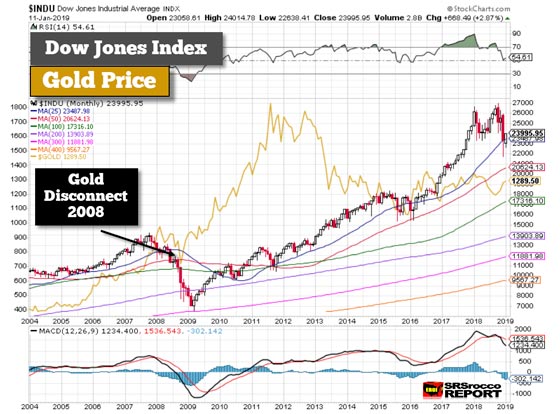

Furthermore, I explain the following chart and why the gold price will continue to disconnect from the Dow Jones Index in 2019:

While I explain more technical analysis in the video, the fundamentals will still play a leading role in guiding the economy and markets over the next several years. However, the technicals provide us with a crystal ball in how the prices will trade over this period.

About the Author:

Independent researcher Steve St. Angelo started to invest in precious metals in 2002. In 2008, he began researching areas of the gold and silver market that the majority of the precious metal analyst community has left unexplored. These areas include how energy and the falling EROI – Energy Returned On Invested – stand to impact the mining industry, precious metals, paper assets, and the overall economy.