Get ready for a new era of precious metals investors. That’s correct. Up until now, the primary buyer of gold and silver have been the older generation, 40-65+, but that will all change when the next financial crisis hits. The Millennials, or those in the 23-38 age group, have participated less in the stock market than previous generations. And, rightly so.

According to one study, Millennials preferred cash (30%) as their largest investment over stocks (23%). This should be no surprise as the older Millennials have experienced two market crashes, the dot-com NASDAQ crash and the 2008 market meltdown within a decade. Furthermore, the Millennials are likely very concerned and worried about the massive underlying debt and leverage in the system. Of course, it is probably true that most Millennials don’t understand the details of the financial markets, but have an excellent innate ability to recognize that SOMETHING IS SERIOUSLY WRONG.

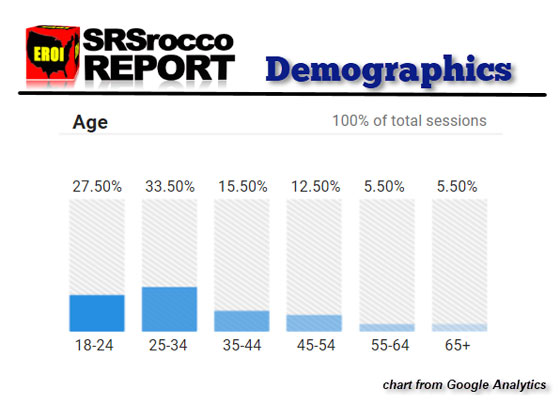

In my newest video update, New-Age Precious Metals Investor: Pension Fund Disaster, I discuss how surprised I was to learn that the largest age group that followed the SRSrocco Report website was the Millenials, not the older generation. Now if that wasn’t surprising enough, the next largest group of readers came from an even younger group, aged 18-24:

The chart comes from my Google Analytics dashboard so you can thank Google for that statistic. How on earth does Google know the demographics of my website, that is a subject matter for another day. Regardless, while the mainstream media suggests that the younger generation is less interested in finances and politics, I believe they are hungry for GOOD INFORMATION. Unfortunately, they will not find quality information in the mainstream press. This is precisely why many Millennials are quite concerned about the future and continue to question everything.

Because I now understand that the largest segment of my readership is coming from the younger age groups, I plan on putting out a series of articles on why it is essential to own and invest in precious metals. My newest video update starts with the upcoming U.S. State Pension Fund Disaster:

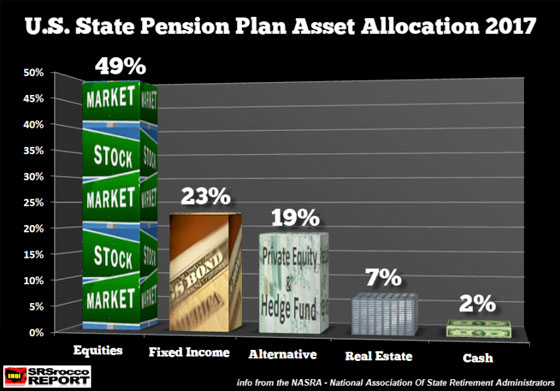

In the video, I discuss what the typical American investment portfolio looks like and how it compares to the U.S. State Pension Fund allocation. Normally, when Americans get ready to retire, their investment portfolio is very conservative. However, I was quite alarmed to find out just how risky the U.S. State Pension Fund assets have become.

According to NASRA, the National Association Of State Retirement Administrators, here is a breakdown of the U.S. State Pension Fund assets:

If you want to learn just how risky these assets are, especially the largest growth area in the U.S. State Pension Funds, “Alternatives,” I highly suggest that you watch the video above.

And it should be no surprise that financial planners or pension fund managers never recommend gold or silver as part of an investment portfolio. This will turn out to be a huge mistake.

Now, the main reason that I am a gold and silver investor has less to do with the dangerously high debt-leveraged financial system and more to do with the Falling EROI (Energy Returned On Investment). However, I wanted to start with the U.S. State Pension Fund system because it may be one of the first to go when the markets begin the collapse.

In future articles and videos, I will focus on how the Falling EROI will impact the value of the other major asset classes, STOCKS, BONDS, and REAL ESTATE. We must understand that without debt, the majority of these assets would lose most of their value. Furthermore, debt has only been able to grow as long as the U.S. and global oil supply rises. When global oil production finally peaks, we enter into a new ERA of the precious metals investor.

About the Author:

Independent researcher Steve St. Angelo started to invest in precious metals in 2002. In 2008, he began researching areas of the gold and silver market that the majority of the precious metal analyst community has left unexplored. These areas include how energy and the falling EROI – Energy Returned On Invested – stand to impact the mining industry, precious metals, paper assets, and the overall economy.